Pension scheme clearing exemption – latest updates

UK EMIR

Following its announcement on 28 March 2023, HM Treasury has laid before parliament a statutory instrument to (among other things) extend the exemption for UK pension scheme arrangements and EEA pension scheme arrangements from the clearing obligation for two years until 18 June 2025. The change will come into force on 12 June 2023.

As a reminder, the pension scheme arrangement clearing exemption provides that the clearing obligation, set out in article 4 of UK EMIR, does not apply “to OTC derivative contracts that are objectively measurable as reducing investment risks that directly relate to the financial solvency of pension scheme arrangements or EEA pension scheme arrangements, and to entities established to provide compensation to members of such arrangements in case of default”.

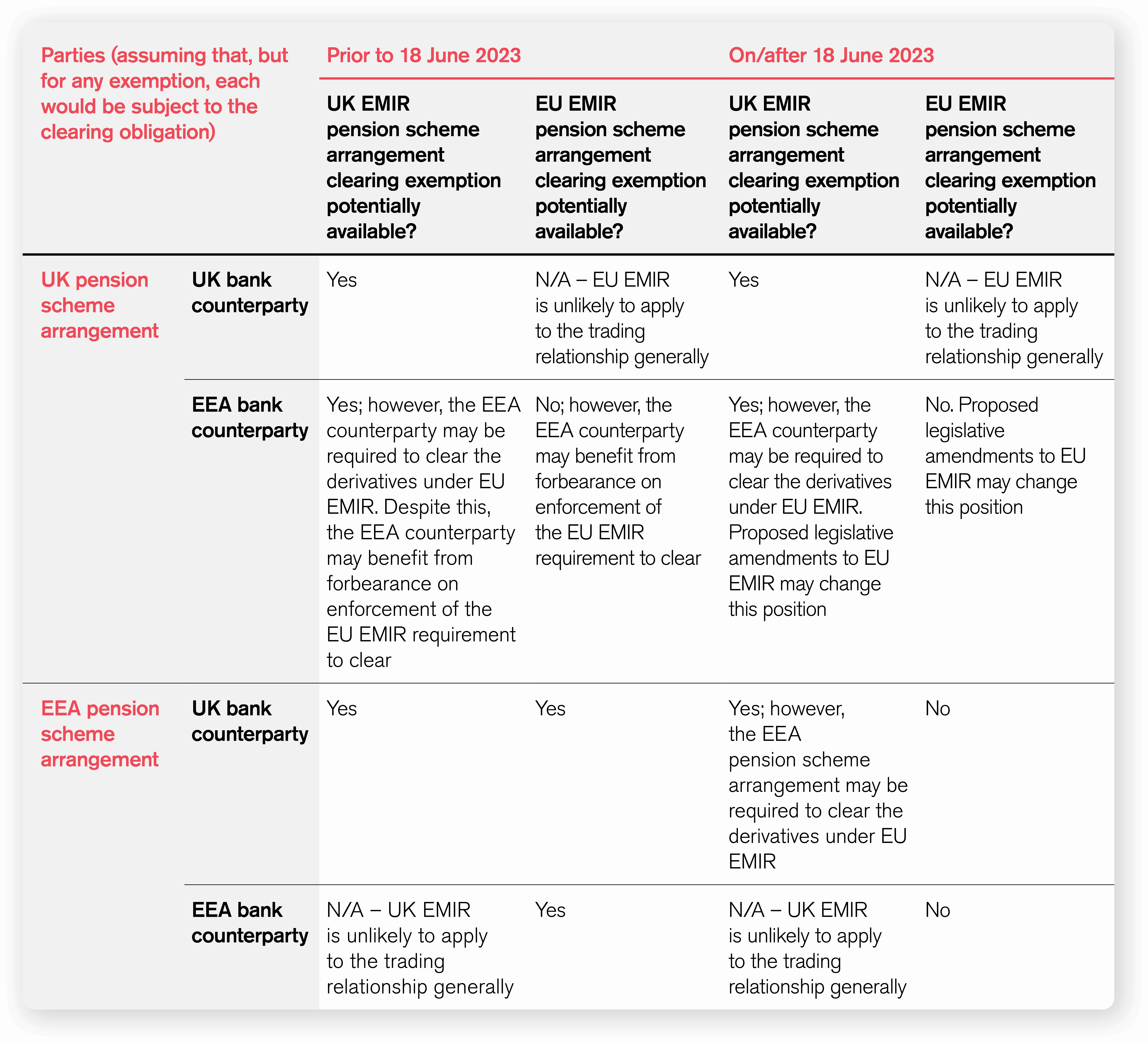

Whilst the UK EMIR exemption applies to both UK and EEA pension scheme arrangements (unlike the EU EMIR exemption), the practical use of this to EEA pension scheme arrangements following 18 June 2023 may be somewhat limited. This is because, as discussed below, the EU EMIR pension scheme arrangement clearing exemption is due to expire on 18 June 2023. This means that EEA pension scheme arrangements that are subject to the EU EMIR clearing obligation will be required (depending on their counterparty) to clear their mandatorily clearable derivatives pursuant to EU EMIR (regardless of any exemption which may be available under UK EMIR).

Similarly, in respect of UK pension scheme arrangements which trade with EEA entities that are subject to the EU EMIR clearing obligation, the extension of the UK EMIR pension scheme arrangement clearing exemption may also be of limited practical use. As previously noted, whilst UK pension scheme arrangements are currently not able to benefit from the temporary exemption under EU EMIR when transacting with EEA entities, certain national competent authorities have reportedly been taking pragmatic approaches to enforcement. However, when the EU EMIR pension scheme arrangement clearing exemption expires on 18 June 2023, as discussed below, it is likely that such forbearance measures will also cease meaning that, from 18 June 2023, in respect of UK pension scheme arrangements that are subject to the UK EMIR clearing obligation trading with EEA entities that are subject to the EU EMIR clearing obligation, any mandatorily clearable derivatives will need to be cleared.

In extending the pension scheme clearing exemption until 18 June 2025, HM Treasury concluded that no appropriate technical solution has been developed for the transfer by pension scheme arrangements and EEA pension scheme arrangements of cash and non-cash collateral as variation margins and that the adverse effect of centrally clearing derivative contracts on the retirement benefits of future pensioners remains. However, it is worth noting that the position remains subject to change and, in its initial announcement on 28 March, HM Treasury confirmed that it intends to conduct a review of the exemption ahead of its expiry in 2025, “allowing time for consideration and implementation of a longer-term approach”.

EU EMIR

In respect of EU EMIR, the pension scheme arrangement clearing exemption will expire on 18 June 2023 and, following the European Commission report from June 2022, it is not anticipated that it will be extended.

Assuming that the exemption is not extended, this would mean that, as noted above, EEA pension scheme arrangements that are subject to the EU EMIR clearing obligation will be required (depending on their counterparty) to clear their mandatorily clearable derivatives pursuant to EU EMIR. It also means, as noted above, that any forbearance currently exercised with respect to UK pension scheme arrangements trading with EEA entities will likely fall away, meaning that for UK pension scheme arrangements that are subject to the UK EMIR clearing obligation trading with EEA entities that are subject to the EU EMIR clearing obligation, mandatorily clearable derivatives will need to be cleared.

However, looking to the future, as part of proposed amendments to EU EMIR (so-called “EMIR 3.0”), the draft legislation introduces a new exemption to the clearing obligation. Under this proposed exemption, the clearing obligation would not apply where the transaction is between (i) an EEA financial counterparty or EEA non-financial counterparty, in each case that is subject to the clearing obligation, and (ii) a pension scheme arrangement established in a third country and operating on a national basis, provided that it is “authorised, supervised and recognised under national law and where its primary purpose is to provide retirement benefits and is exempted from the clearing obligation under its national law”. If this proposal forms part of the final legislation, UK pension scheme arrangements that benefit from the UK EMIR clearing exemption would also be exempt from the clearing obligation under EU EMIR.

Summary

Given the complexities of the pension scheme arrangement clearing exemptions, we summarise the potential availability of the exemptions, below:

Please speak to your usual Macfarlanes contact if you have any questions.