Real opportunities: how private capital can access real estate

Webinar |

Supporting Private Capital Managers

Tailored solutions for the private capital industry.

Spotlight case study

/Passle/5a1c2144b00e80131c20b495/MediaLibrary/Images/2025-10-03-11-18-50-250-68dfb11a8a133db117a65ab9.jpg)

10 minute read

For the most part in instances of borrower stress/distress private credit fund lenders often take a relationship-based approach to borrowers and their sponsors and will be open to granting waivers where breathing space is needed. However, where they cannot, for example where there is a liquidity need and the sponsor is not willing to provide that financial support to the borrower, the private credit fund lender may feel it has no choice but to take control, whether that be consensually or otherwise.

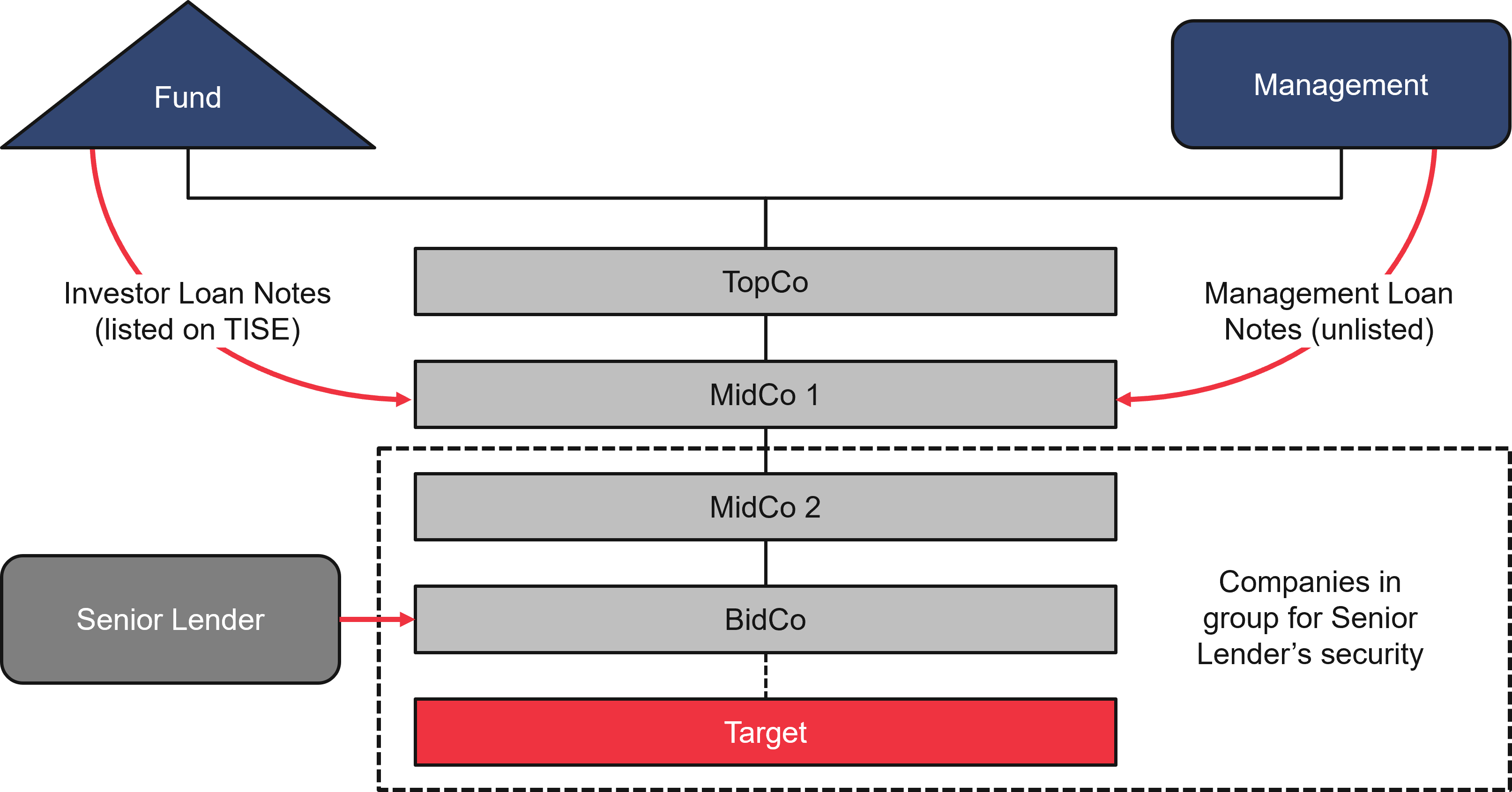

In this note we examine the primary issues for private credit fund lenders in a typical unitranche/super senior structure (i.e. those private credit funds acting as sole lender of a term facility alongside a super senior working capital facility) (see Figure 1) when they are considering taking the keys to a borrower. We discuss how a private credit fund lender might minimise disruption and create a stable platform from which to take control of equity, including the options available to them to push through a transaction if the borrower/sponsor is not cooperative, as well as associated tax, due diligence and deal term considerations.

Figure 1: A typical buyout structure

A key to the success of any change of control of a borrower is first ensuring sufficient stability and that, notwithstanding the impending removal of the sponsor, disruption is minimised and day-to-day operations are maintained. Private credit fund lenders ought to consider:

Whilst private credit fund lenders will be keen to ensure that they are not considered shadow directors (i.e. that they merely provide indications of the actions that would be necessary to maintain their support, subject to the independent judgment of the board), it is also important in any situation of stress/distress that the directors have access to comprehensive advice. For example a private credit fund lender might invite directors to hire a specialised Chief Restructuring Officer to help them navigate the various stakeholder management aspects of the process of which they might not otherwise have experience.

Of particular note, directors ought also to be mindful of wrongful trading, which occurs when a director continues to trade a company after they knew, or ought to have known, that there was no reasonable prospect of avoiding insolvent liquidation or administration. If found to have traded in this way directors would be personally liable for the worsening of the position of the company's creditors unless they have taken every step to minimise losses to those creditors.

Private credit fund lenders will be keen to ensure that the board has appropriate contingency plans in place, from ensuring an appropriate PR strategy has been developed in the event of information leaks, particularly where the business in question is one with name recognition, to implementing a strategy to keep employees and other creditors suitably incentivised and managed.

Early stage tax planning: collaborative engagement

Whilst there ought not be significant tax issues in a UK group in stress/distress (of the type described in Figure 1) in respect of its day-to-day corporation tax liabilities, where a private credit fund lender looks to take control of equity in that group that might have serious tax ramifications. Typically borrower side tax advisers, with ready access to company information, would hold the pen on tax planning. However early stage collaborative engagement and information sharing between the private credit fund lender and borrower teams is key to identifying and navigating potential tax impact.

Deemed release rule

A key issue to determine, and one which turns in part on the treatment by the private credit fund lender of the borrower’s debt, is whether “deemed release” rules are likely to apply to the overall transaction.

A private credit fund lender will typically want to keep the borrower’s debt as unimpaired as possible in order to retain its senior secured claim over the borrower group. However, it is likely that the private credit fund lender will at an appropriate time impair the borrower’s debt on the private credit fund lender’s own balance sheet in order to reflect the stress/distress in the borrower.

Deemed release of impaired debt occurs where a lender holds impaired debt and becomes connected with – has control over or is subject to the same common control as - a debtor company. In the event of such connection there is deemed to be a taxable credit in the debtor company (subject to the availability of certain exemptions/use of losses).

The deemed release rule that applies where lenders and borrowers become connected turns on how the lender entity(ies) accounted for the debt at the end of the accounting period immediately before the one in which the connection arose. Broadly, the rules apply if the lender had impaired the debt in the immediately preceding accounting period to the connection. Whether these rules already apply, or might in the future do so, can have a material impact on the timing imperatives of any restructuring transaction.

Due diligence

Taking control of shares in the borrower on a restructuring in the event of borrower stress/distress is clearly different from a typical M&A process as the private credit fund lender is already effectively “invested” in the company. However private credit fund lenders taking the keys will often want to ask some high-level tax diligence questions that aim to establish whether any serious instances of non-compliance have occurred or matters which pose a potential reputational issue, such as non-compliance or tax avoidance on the tax front exist.

Where a sponsor is uncooperative with a private credit fund lender in a restructuring scenario and is unwilling to hand over the equity on a consensual basis, the private credit fund lender can nonetheless effect a restructuring takeover by implementing a number of the other tools and processes at its disposal. However, preparation is key: the performance of a sufficient level of due diligence can help ensure that the private credit fund lender avoids any nasty surprises occurring as a result of the takeover transaction.

When considering any restructuring process it is important that private credit fund lenders perform an early analysis of the security package that they hold vis-à-vis the borrower in order to be aware of what action they might take, and in respect of which assets. As part of this security review the private credit fund lender will wish to ascertain whether there a single point of enforcement that allows the private credit fund lender to take control of the entire Borrower group in one go.

Where this option is either not available or is undesirable, enforcement will usually involve a more complex process of multiple enforcement proceedings over the business and assets of the borrower group: cherry picking which assets are to be subject to the proceedings and which are associated with liabilities that the private credit fund lender may wish to leave behind. Among other things the private credit fund lender will consider:

It will also be important for a private credit fund lender to plan for the impact that taking control of the borrower might have upon the business of the borrower.

Once the restructuring takeover is effected, the private credit fund lender holds the equity of the borrower and has taken control, what then?

Reworking the debt documents

It is a decision for the private credit fund lender as to whether the debt documents documenting the debt between the private credit fund lender and the borrower ought to be reworked following a restructuring takeover.

It would be unusual for the private credit fund lender to loosen the debt documents significantly. However, given that following the restructuring takeover the private credit fund lender will control the borrower, the private credit fund lender will need to waive any breach of, and update, change of control provisions and reschedule amortisation (if applicable). The private credit fund lender may also look to loosen financial covenants which, save for the liquidity covenant, are likely to have decreased in utility given that post the restructuring transaction the private credit fund lender owns the borrower, has direct access to borrower information and is likely privy to significant decisions of the board.

If not already available, it is not uncommon for the private credit fund lender to update the debt documents to include a short-form accordion facility mechanic to enable the provision of a further funding as the new management of the business find their feet.

Balance sheet restructuring

Typically, and in addition to a restructuring of equity, a group in distress will require a balance sheet/operational restructuring (often in conjunction with a reset of a management incentive plan). Whilst this restructuring might be effected by a comprehensive renegotiation of its key liabilities and contracts on a consensual basis, this approach would take a not insignificant amount of time and would come at considerable cost with no guarantee of success. Lenders could instead use a restructuring plan under Part 26A of the Companies Act 2006 to restructure a borrower’s balance sheet in a far more efficient manner alongside taking equity.

Restructuring plans can be used to implement a range of arrangements including to exit unprofitable leases, reduce rents, terminate unwanted contracts and write-off sums owed to HMRC. Notably, and unlike schemes of arrangement, restructuring plans can overcome significant opposition to a restructuring from creditors as the court has the power to sanction a restructuring plan even where an entire class of creditors or shareholders has voted against it.

The use of a restructuring plan requires a larger amount of work up front, but its use can effect a balance sheet restructuring without ongoing discussions, and once sanctioned can allow the borrower and its private credit fund lender owner to get on with the turnaround of the business. It is this comprehensive approach that we think will be attractive to private credit fund lenders looking to acquire control of borrower groups in the future.

| For more on restructuring plans see Restructuring plans - dos and don'ts and Restructuring plans - do's and don'ts (part 2): lessons from 2024. |

Stay up to date with our latest insights, events and updates – direct to your inbox.

Browse our people by name, team or area of focus to find the expert that you need.