Real opportunities: how private capital can access real estate

Webinar |

Supporting Private Capital Managers

Tailored solutions for the private capital industry.

Spotlight case study

/Passle/5a1c2144b00e80131c20b495/MediaLibrary/Images/2026-02-04-11-59-56-752-698334bc5f594bf3ef3431cf.jpg)

10 minute read

In this article, we dissect recent deal flow whilst analysing the structural and legal factors shaping investment and restructuring outcomes. We explore the interplay between lease-heavy and debt-laden balance sheets, the impact of business rates policy, brand resilience strategies, and the sector’s exposure to tariffs and supply chain disruption. The analysis highlights how these forces are accelerating insolvency risk, driving operators towards prepacks, CVAs, and restructuring plans - creating opportunities and pitfalls for investors seeking to navigate a rapidly evolving sector.

United States

The US market is defined by high-value sponsor-to-sponsor trades, platform roll-ups, and a steady stream of both growth and restructuring capital. Transactions such as Sizzling Platter and Carrols Restaurant Group (each c. $1bn) exemplify the scale and complexity of recent deal flow. The prevalence of private investment in public equity (PIPE) and venture rounds - Kitchen United, All Day Kitchens, Dig Inn - signals a sector in search of operational transformation. Private credit has been instrumental in enabling these deals, with significant financings for Weber-Stephen, Puttshack, and Main Event.[1] Aggressive add-on strategies and sponsor recaps are accelerating the pace at which distressed operators must address capital structure challenges, often culminating in prepackaged insolvency solutions or opportunistic M&A. For investors, the implications are clear: robust risk assessment, flexible capital deployment, and proactive restructuring strategies are now essential to preserve value and manage downside risk.

United Kingdom

The UK market, meanwhile, is characterised by public-to-private transactions, restructuring-led consolidation, and targeted growth capital for premium brands. However, outcomes across brands diverge quite starkly. Successful deals include L Catterton's investment in Dishoom (reportedly valued at £300m), Wingstop's sale to Sixth Street for £400m, and Five Guys' £185m refinancing to support rapid growth expansion, whilst distressed scenarios include Byron's multiple insolvency processes (facing its fourth restructuring) and TGI Friday's repeated prepack administrations just months after prior restructuring.[2]

The Apollo-led take-private of The Restaurant Group and carve-outs and add-ons - such as The Big Table Group’s acquisition of legacy brands - reflect a market in flux. UK-specific market drivers intensifying pressure include business rates on sites, minimum wage increases (rising from £10.42 to £12.21 per hour in recent years), higher employer national insurance contributions, and the reduction in availability of cheap labour post-Brexit.[3] This legal and economic environment is pushing many towards CVAs and prepacks, as balance sheet stress and shifting consumer demand expose the vulnerabilities of both debt-heavy and lease-heavy models.[4]

Property exposure is also becoming a critical factor, with investors increasingly funding acquisitions of freeholds to avoid operational leverage from short-term leases, as seen in strategies like Alchemy's investment in Heartwood Inns.[5] Owning freeholds can enable access to cheaper third-party debt through enhanced security, making properties attractive to mainstream bank lenders. For investors, the focus is on identifying transactions that anticipate distress, with particular attention to property exposure, capital structure flexibility, and contingency planning.

Spain and Portugal

The Iberian market is seeing robust growth in fast-casual and franchise platforms, with private equity and credit funds supporting the scale-up of branded concepts.[6] Transactions such as the Food Service Project and Grupo Dani García in Spain, and Cinven’s acquisition of Burger King restaurants in Portugal, illustrate the region’s momentum. However, operators face mounting exposure to supply chain tariffs and cross-border cost pressures, making real estate strategy and capital structure critical to resilience.[7] As in the UK, the balance between lease obligations and debt financing is shaping restructuring outcomes, with distressed assets frequently moving through accelerated M&A or insolvency processes. Strategic structuring around asset sales, creditor negotiations, and cross-border considerations is increasingly central to successful investment outcomes.

France, Nordics, DACH and Canada

Continental Europe and Canada are characterised by portfolio repositioning and international expansion. In France, trade sales and majority investments (Courtepaille, Big Mamma) reflect a focus on operational turnaround and brand revitalisation. The Nordics and DACH regions are seeing premium casual brands such as Sticks’n’Sushi and L’Osteria attract sponsor interest, while in Canada, roll-up strategies remain prevalent.[8] These markets are not immune to the pressures of rising input costs and shifting consumer demand. Restructuring frameworks - especially in cross-border contexts - are increasingly relevant, with investors and sponsors needing to navigate varying insolvency regimes and enforcement risks.

The sector’s transactional data underscores a market in transition, with deal activity and value concentrated in a handful of large transactions and a long tail of smaller, often undisclosed, deals. The US and UK dominate both volume and value, while Spain, Portugal, and Sweden also register significant activity. Private credit, though less visible in the data, has been crucial in enabling both growth and restructuring transactions, particularly in the US. The steady pace of deal activity, with notable peaks in 2021 and 2023, reflects both sustained investor appetite and the persistent need for capital solutions as operators adapt to evolving market pressures. This aligns with the broader macro trend of elevated insolvency rates in the UK and Europe, according to industry reports, where food service and hospitality remain among the most distressed sectors.[9] For investors, this consistency signals that opportunities for both growth and restructuring remain robust, but also that underlying distress is a constant feature of the landscape.

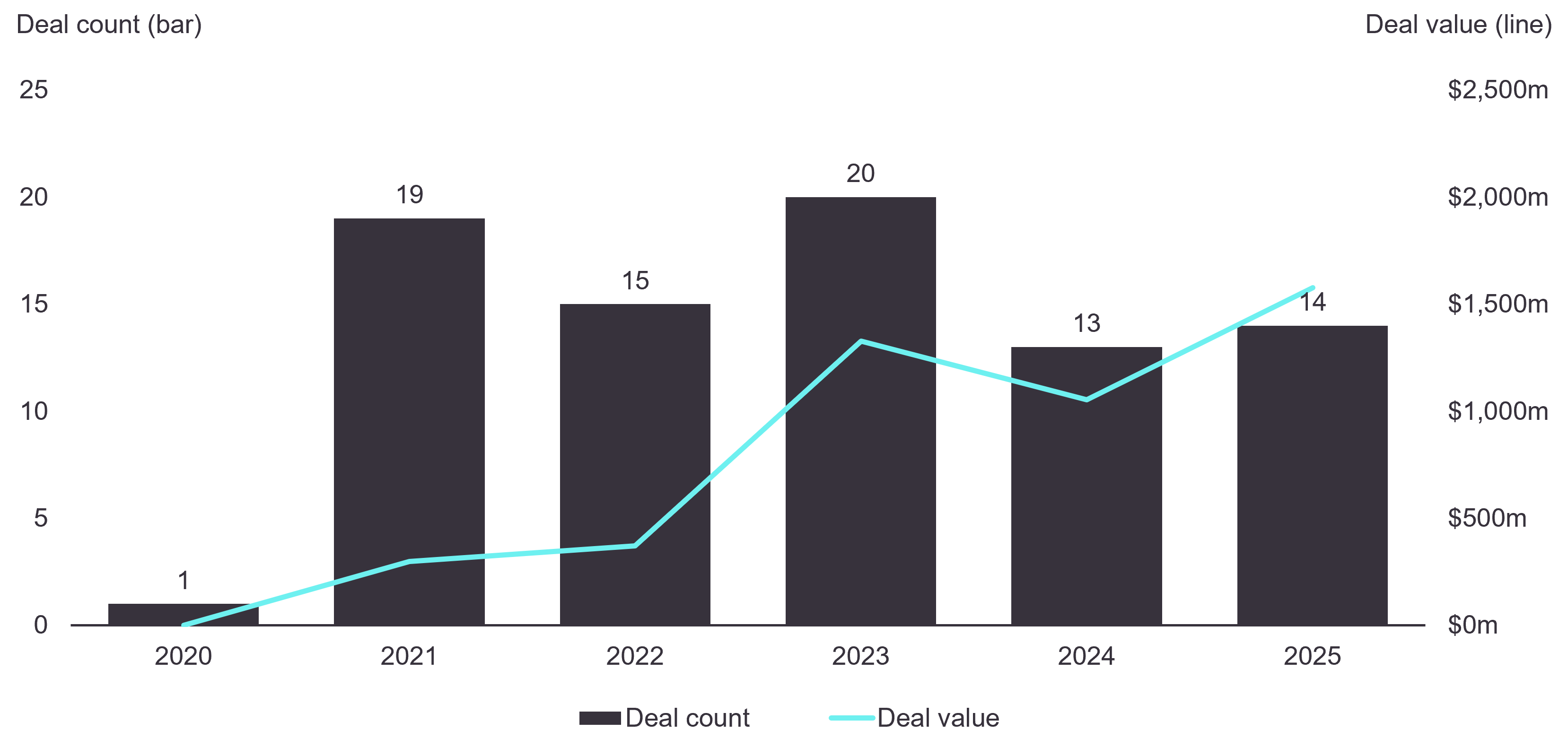

Figure 1: PE deal count and disclosed deal value (USD FX normalised) by year

Source: Macfarlanes analysis based on Preqin data on private credit and equity deal flow, 2020–2025.

As shown in Figure 1 above, aggregate deal value has surged in recent years, with 2023–2025 seeing a marked increase driven by a handful of mega-deals. This trend highlights a divided market: while some operators can attract significant capital and scale, many others face mounting challenges and limited access to funding. Elevated insolvency activity has persisted into 2025, with hundreds of thousands of UK businesses estimated to be in significant financial distress and hospitality remaining among the most affected sectors.[10] Investors should be alert to this divergence, as it creates both concentrated opportunities and heightened risk of fragmentation.

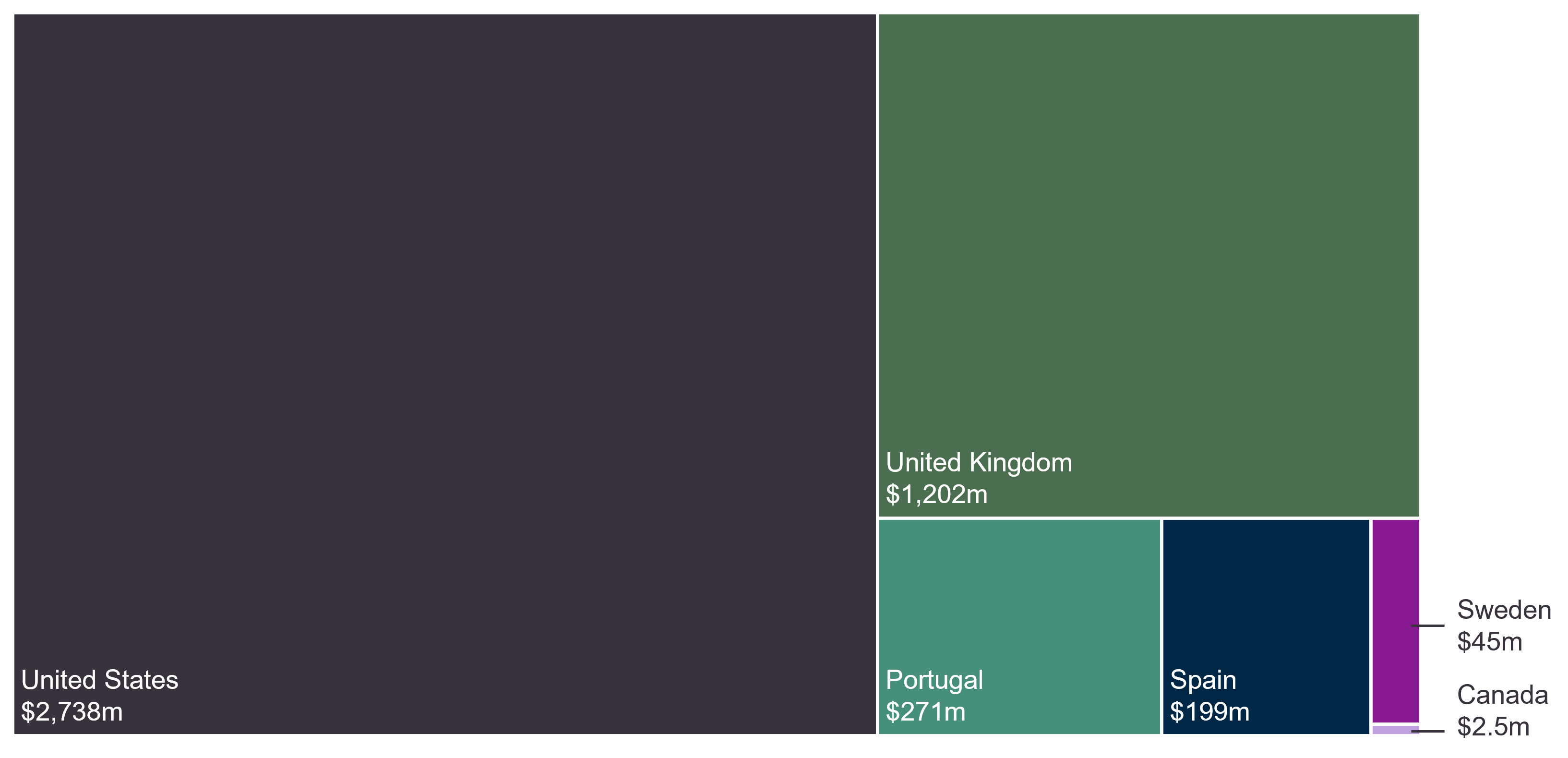

The United States and United Kingdom lead in disclosed deal value, as shown in Figure 2 below, reflecting their scale and the depth of restructuring activity. Spain and Portugal also show meaningful investment, while other regions remain less active or have less transparent deal flow. For investors, this geographic concentration underscores the importance of regional expertise and the need to tailor strategies to local market realities.

Figure 2: Disclosed aggregate value by geography: 2020-2025 (USD FX normalised)

Source: Macfarlanes analysis based on Preqin data on private credit and equity deal flow, 2020–2025.

Taken together, these figures highlight a market where capital is increasingly concentrated in a select group of high-profile transactions, while a long tail of smaller or undisclosed deals points to ongoing distress and fragmentation. For investors, this environment demands rigorous structuring and due diligence to navigate both visible and latent risks.

The trends above set the stage for a sector where scale, capital structure, and brand positioning are now critical to survival. Multi-brand platforms and franchise operators are using buyouts and add-ons to build resilience, while growth capital is targeting premium and tech-enabled concepts.[11] The complexity of these transactions is rising, with sponsors and investors facing not only traditional M&A risks but also the heightened threat of insolvency. Investment strategies are evolving, with greater emphasis on capital structure flexibility, risk mitigation, and restructuring triggers. The prevalence of prepacks and CVAs in the UK, and the use of Chapter 11 and 363 sales in the US, reflect a market where strategic structuring is as important as operational turnaround. Increasingly, deals are being structured where CVAs or restructuring plans are prepared by sellers as part of the sale process for buyers to inherit and implement, potentially maximising value on exit (the restructuring and insolvency equivalent of staple financing), as shown in transactions like the Poundland restructuring plan, albeit in retail.[12] For investors, anticipating distress and embedding flexibility into deal terms is now a core consideration.

Structural differentiators and restructuring drivers

These transactional patterns are underpinned by structural factors that shape both risk and opportunity. Lease-heavy operators are acutely exposed to business rates volatility and inflexible cost bases, while debt-laden groups face refinancing risk as interest rates rise. The divergence in brand resilience - Domino’s thriving, Pizza Hut collapsing - highlights the importance of operational agility and supply chain management. Sale-leaseback arrangements may provide short-term liquidity but often create long-term liabilities that complicate restructuring. Exposure to tariffs and cross-border supply chain disruption further amplifies risk, especially for operators with international sourcing.[13] These dynamics increasingly require investors to structure transactions and portfolios to anticipate and mitigate insolvency risk from the outset.

The current environment for restructuring and insolvency in the casual dining sector is shaped by both micro and macro trends. UK company insolvencies have remained elevated through 2025 at levels comparable to 30-year highs, with a sustained dominance of creditors’ voluntary liquidations and a noticeable uptick in compulsory liquidations, indicating firmer creditor enforcement. Hospitality continues to be among the most affected sectors, with significant seasonal volatility and cost pressures, and estimates suggest more than 666,000 UK businesses are in significant financial distress, up double-digits year-on-year and quarter-on-quarter.[14] This is consistent with the steady flow of restructuring transactions we’ve seen across the UK and Europe.[15]

The Corporate Insolvency and Governance Act (CIGA) modernised English insolvency law in a variety of ways, including the introduction of two new procedures – restructuring plans and statutory moratoria. A number of businesses in the sector have, since its introduction, utilised a restructuring plan to restructure their leasehold portfolios and reduce their base of expenditure. In an environment of continued cost pressures and high financing costs, we expect this trend to continue. The use of statutory moratoria is less common, and will likely require legislative variations to be made to the process before this changes, although the most high-profile use of the process so far (by the Corbin & King restaurant group), which allowed the group breathing space to effect a refinancing, demonstrates that in the right circumstances the tool can be used effectively as part of a rescue or turnaround.

Notwithstanding the introduction of these new tools, the use of a pre-packaged administration may still be the most appropriate restructuring tool available to business in the sector (see, for example, the recent use of a pre-pack by Pizza Hut UK). The ability to preserve value and jobs through a pre-pack, while controversial, can be a pragmatic solution in a distressed scenario, particularly when compared to outright liquidation. Across Spain, Portugal, the Nordics, and beyond, the interplay between lease obligations, debt maturities, and macroeconomic pressures is driving a surge in prepacks, CVAs, restructuring plans, and distressed M&A. The global nature of these trends means that investors must remain agile, leveraging cross-border insights and adapting strategies to local legal and market realities to unlock opportunities and mitigate downside. Early action and a willingness to use the full range of restructuring tools will be key to capturing value and managing risk as the sector continues to evolve.

For investors, the key takeaway is that the casual dining sector remains both challenging and opportunity-rich. Persistent distress, high insolvency rates, and the growing use of restructuring tools such as CVAs, prepacks, and restructuring plans mean that early, informed action is crucial. Increasingly, the potential use of CVA or restructuring plan processes to unlock value on exit should be considered as part of investment strategies. Investors who combine rigorous due diligence, regional expertise, and flexible capital strategies will be best placed to identify value, manage risk, and capitalise on the next phase of this sector’s transformation.

[1] Preqin data on private credit and equity deal flow, 2020–2025.

[2] The Caterer (2025), "Dishoom secures first private equity investment", August 2025; City AM (2024), "Wingstop UK bought in £400m sale by private equity giant", December 2024; The Caterer (2025), "Five Guys secures £185m to accelerate growth", 2025; Restaurant Online (2025), "Byron Burger future in doubt yet again", September 2025; The Caterer (2025), "TGI Fridays files for administration for the second time this month", December 2025.

[3] Boutiquehotelnews (2025), "2025 Budget: 'Permanently lower' business rates for hospitality", November 2025; House of Commons Library (2026), "Government support for the hospitality sector", January 2026.

[4] HCR Law, "UK insolvency and restructuring trends: sector pressures rise," October 2025. Financier Worldwide, "The Restaurant Group undertakes financial restructuring," August 2020.

[5] Macfaralanes (2023), Macfarlanes advises Heartwood collection on financing for growth of its pubs and restaurants business.

[6] Preqin data on private credit and equity deal flow, 2020–2025.

[7] Macfarlanes (2025), How private capital can thrive amidst tariff uncertainty, Macfarlanes Private Capital Solutions.

[8] Preqin data on private credit and equity deal flow, 2020–2025.

[9] HCRLaw (2025) "UK insolvency and restructuring trends: sector pressures rise,".

[10] HCRLaw (2025) "UK insolvency and restructuring trends: sector pressures rise,".

[11] Macfarlanes analysis based on Preqin data on private credit and equity deal flow, 2020–2025.

[12] Moreau, Emer and Masud, Faarea (2025), Poundland avoid administration as restructure approved, BBC News.

[13] Macfarlanes (2025), How private capital can thrive amidst tariff uncertainty, Macfarlanes Private Capital Solutions.

[14] HCRLaw (2025) "UK insolvency and restructuring trends: sector pressures rise,".

[15] Preqin data on private credit and equity deal flow, 2020–2025.

Stay up to date with our latest insights, events and updates – direct to your inbox.

Browse our people by name, team or area of focus to find the expert that you need.