Real opportunities: how private capital can access real estate

Webinar |

Supporting Private Capital Managers

Tailored solutions for the private capital industry.

Spotlight case study

/Passle/MediaLibrary/Images/2026-01-09-17-39-34-012-69613d56d42b6e4a58415609.jpg)

18 minute read

Despite an increase in investment concentration risk in US equities, in particular AI, and global geopolitical tensions, economies and financial markets proved more resilient than expected in 2025.

Entering 2026, the global economy is experiencing moderating inflation and gradual but uneven monetary easing amid widening policy divergence and elevated geopolitical and AI-related risks. Private markets have stabilised as M&A rebounded (particularly in the US), but weak distributions remain a key constraint, which has bolstered secondaries. Private credit demand remains solid, but intensifying competition is tightening terms as public–private market convergence and increased scrutiny reshape practice. Against this backdrop, capital is shifting to policy-backed, resilient and income-generating sectors - particularly digital and energy infrastructure, sports assets and real estate.

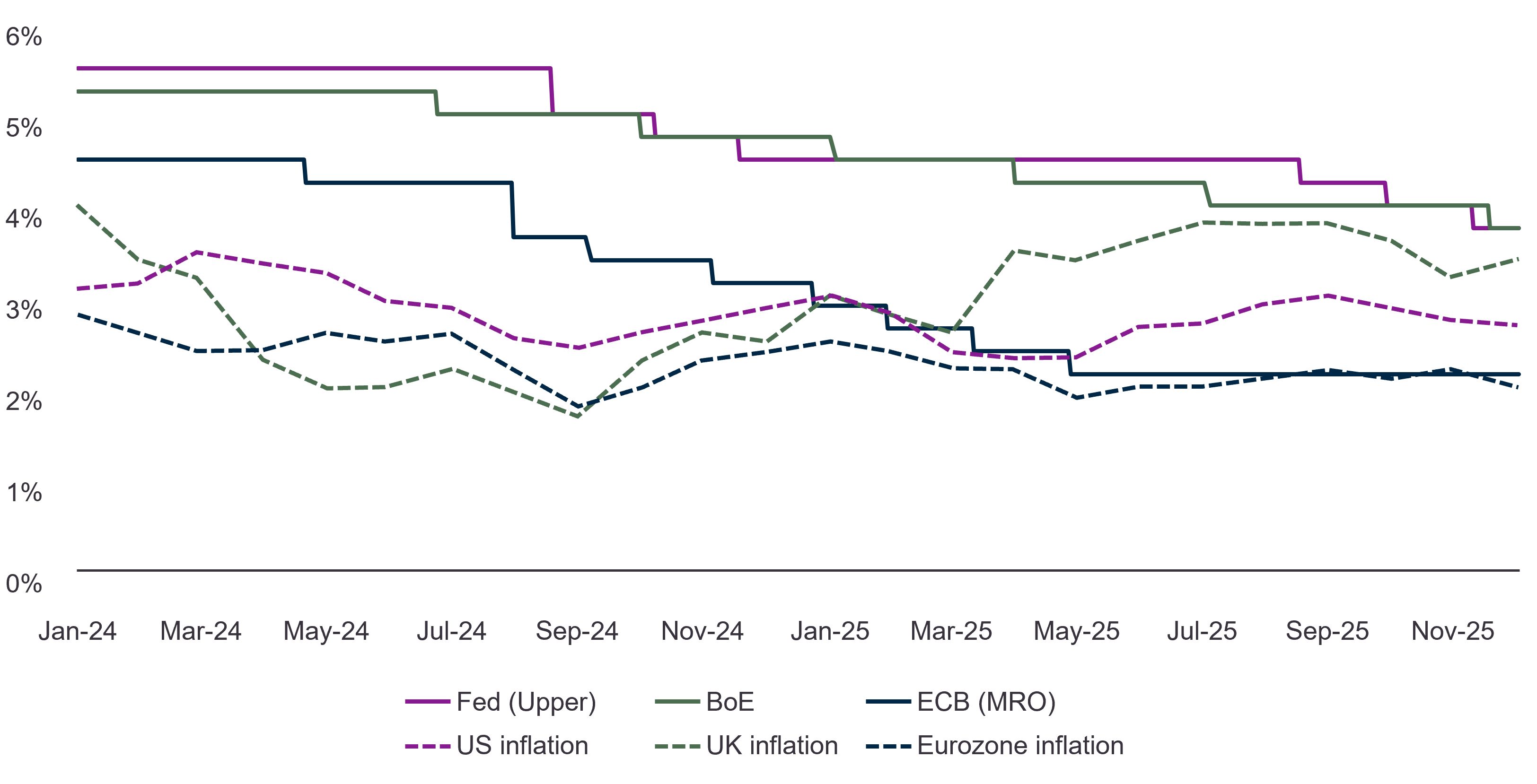

Inflation risks remain despite the easing of rates by central banks

Inflation is expected to moderate across major economies in 2026, including the US, UK and Eurozone. Policy rates are forecast to continue their decline, but the era of near-zero rates is unlikely to return. At its January meeting, the Federal Reserve (Fed) kept the federal funds rate at 3.50–3.75% following a 25 bps cut in December. Recent political pressure on the Fed chair risks undermining perceptions of central bank independence, adding uncertainty to the US interest rate outlook. This may prompt investors that seek safe-haven exposure to favour European government bonds over US Treasuries.[1] In the UK, the Bank of England (BoE) maintained Bank Rate at 3.75% in February, after a 25 bps cut in December, and has signalled gradual further easing as wage growth and services inflation slow. The European Central Bank (ECB) has kept the deposit rate at 2% in their most recent policy setting meeting, reiterating that inflation is expected to stabilise at its 2% target in the medium term.

Divergence in central-bank balance-sheet strategies and fiscal policy provide opportunities for proactive macroeconomic investment strategies. Interest rate decisions and term premia are increasingly determined by local conditions rather than the global economic cycle, in contrast to the more synchronised developments of the mid-2010s.

Discussions about inflation have shifted from whether it will fall, to what could re-ignite it. Ongoing geopolitical tensions, energy and commodity supply volatility and large investments in AI are frequently cited as potential drivers of inflation. Goldman Sachs baseline expectation is that disinflation will continue whilst policy rates decline in developed markets in 2026. They highlight tariff uncertainty as a driver of sticky US inflation and the recent slowdown in wage growth.[2] As the recent Greenland episode demonstrated, trade tensions persist between Europe and the US and these risk triggering inflation in both economies. Meanwhile, AI-related capital expenditures have grown significantly with expenditures on data centres forecast to reach $4tn by 2030. These AI-related costs could tighten semiconductor availability and strain power-grid capacity, increasing product and energy prices. In turn, this could make central banks pause rate cuts sooner than markets expect.[3]

Figure 1: policy rates (Fed/BoE/ECB) vs core inflation (Eurozone/UK/US)

Source: Bloomberg, 22 January 2026.

Fiscally supported but market-disciplined

The second key development we observe for 2026 is fiscal policy. In the US, the One Big Beautiful Bill may result in approximately $100bn of additional tax refunds in the first half of 2026, potentially providing a boost to household incomes and reinforcing the wealth effect from strong asset prices.[4]

In Europe, fiscal policy is becoming more expansionary. Germany is turning to higher defence and infrastructure spending, backed by rising real wages and lower rates, helping the euro area to recover. Germany’s shift is significant: the governing coalition has approved a €500bn infrastructure fund, and the 2026 budget includes a record allocation for investments of up to €58.3bn and significantly higher defence spending.[5][6] These actions are expected to reduce the economic growth gap to the US. This could, in turn, help investors diversify their portfolios and reduce concentration risk in US equities.

However, fiscal stimulus faces a clear constraint as bond markets are watching. Countries with significant debt levels, including the US, UK and France, remain exposed to “bond vigilantes”[7], leaving less room for deficit-funded expenditures.[8] Credibility can be repriced quickly when deficits increase or politics destabilise a country’s economic outlook, as highlighted by fears of a bond market backlash to UK Chancellor Rachel Reeves’ Autumn Budget.[9] In the UK, fiscal headroom remains limited with above-target inflation and pressured public finances, even as falling interest rates, real wage growth and healthy savings leave scope for growth.[10]

AI: an accelerator and stress test

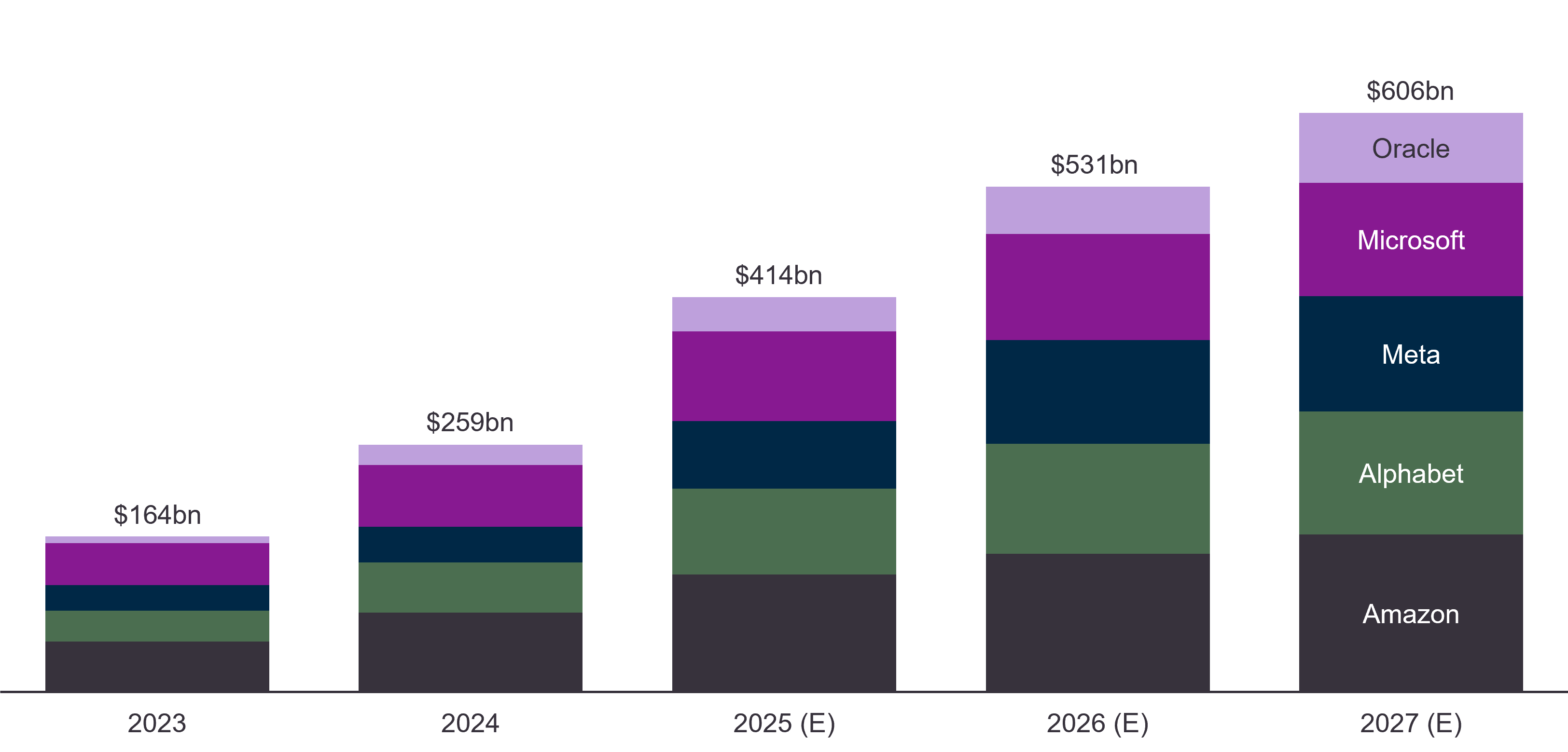

Although most of the productivity gain from AI is likely still several years away, the technology has already become a significant near-term driver of economic growth. This happens through both the AI-related investments in data centres, chips and electricity infrastructure, as well as the wealth effect from strong share price performance of companies that provide services or products in this space. Data-centre buildout is estimated to add roughly 10-20 basis points to US GDP growth in 2026[11], while total AI-related investment could exceed $500bn in 2026.[12] In recent years, equity market capitalisation growth has been highly concentrated: a small group of AI companies has accounted for more than half of S&P 500 returns and about one‑third of global equity gains as at October 2025.[13]

Figure 2: 2023 - 2027 hyperscalers capex ($bn)

Source: Bloomberg, Guinness Global Investors, 31 October 2025.

The debate amongst investors is now shifting from whether AI will have a real and lasting impact to whether it is priced correctly. With US AI firms commanding premium valuations and dominating index performance, large allocators are increasingly concerned about an AI bubble and show a growing preference towards non-US markets, smaller companies and overlooked sectors, reflecting wider concerns about concentration risk.[14] Investors have committed trillions of dollars to AI, making rallies more fragile. If returns fall short of expectations, particularly in a crowded market, investors may suddenly reduce exposure to this sector.[15]

AI investment also has macroeconomic consequences beyond growth. AI relies on scarce real-world inputs such as power, grid capacity, rare earth minerals and specialised computer hardware, and these constraints can keep specific cost pressures alive even as broader goods inflation cools. Electricity and high-end components are most exposed, and until supply catches up, more uncertainty will likely emerge around both growth and inflation.[16]

Although geopolitical fragmentation remains pronounced, private markets ended 2025 in better shape than many expected, giving rise to a more optimistic outlook for 2026. Interest rate volatility eased, financing costs increases slowed, and strategic buyers re-engaged, which matters because private capital ultimately relies on open exit routes and refinancing to deliver returns on investment (ROI). However, a key constraint remains cash returns to limited partners (LPs). Exit volumes recovered compared to 2024, yet the industry is still working through older assets and accumulated unrealised value. Additionally, liquidity solutions are now critical tools, bridging slower exits and the need for ROI.

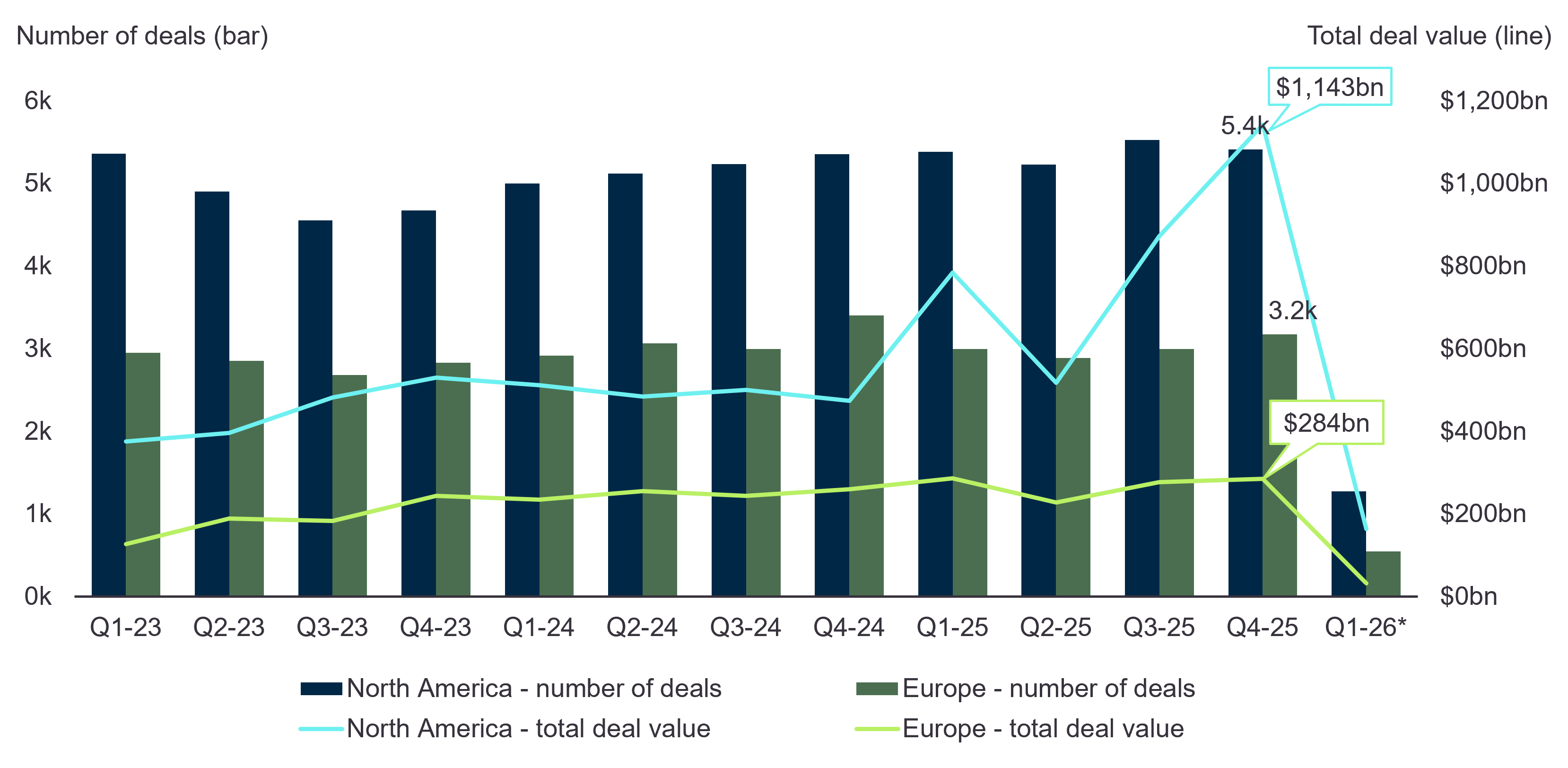

Deal activity and fundraising

Global M&A rebounded in 2025 to $4.4tn in transaction value, fuelled by a late-year shift towards larger deals and a renewed appetite for scale. 22 of the 70 global deals with a transaction value over $10bn were made in Q4[17]. North America saw an uptick in deal value to over $1.1tn in Q4 2025, while European M&A had similar momentum with a 25% increase in Q4 compared with Q2.[18] The 2026 pipeline looks encouraging, particularly if policy and antitrust uncertainty in the US continues to ease and debt markets remain open.[19] Beyond the growing confidence inspired by mega deals, the improving mid‑market appetite to transact in 2026 is encouraging private capital investment, as sponsors become less defensive on price and financing terms improve. According to a Citizens Financial survey of around 400 firms, 58% of executives at mid-market companies expect the volume of M&A to climb in 2026.[20]

Figure 3: North American and European M&A Activities

Source: Bloomberg, 22 January 2026.

Fundraising has also been affected by this increase in risk appetite. Overall capital raising remains constrained by weak distributions, but the largest managers are taking more - the 10 largest private equity (PE) funds captured around 46% of US PE fundraising in 2025, a 34.5% increase from 2024. In a tight liquidity environment, this is a rational response by LPs. However, some managers argue that prioritising larger platforms could come at the cost of higher returns, given the wider performance dispersion among small and mid-sized managers and their potential to outperform larger competitors.[21]

The investor base in private markets continues to broaden, with pension funds and high-net-worth individuals seeking more diversification through exposure to illiquid assets. The UK government’s reform agenda emphasises scale and consolidation - creating “mega funds” and “mega pools” - alongside an increase in private asset allocation. This is reinforced by the 2025 Mansion House Accord, under which certain Defined Contribution (DC) pension providers have committed to allocate 10% of default funds to private markets by 2030, including 5% to UK investments.[22]

Private equity: improving exits with changing liquidity playbook

Private equity in 2026 should see healthier exit conditions than over the last two years, driven by lower financing costs, more active corporate buyers and strong M&A momentum for both trade sales and sponsor-to-sponsor deals. Additionally, the valuation gap between public and private assets, which has impeded dealmaking in the past few years, is shrinking. According to EY’s latest global general partner survey, roughly two-thirds of respondents see greater confidence in meeting on price, citing resilient earning growth, creative deal structures and better financing condition as key drivers.[23]

Liquidity creation has evolved as traditional exits slowed. In 2025, continuation vehicles continued their journey from a niche tool to a material share of the exit market, accounting for approximately $107bn of transaction value and one-fifth of PE exits.[24] This exit model represents a pragmatic solution - LPs receive liquidity or an option to roll, while general partners (GPs) keep control of assets and increase their fee related earnings and carry paying money at work. However, GP-led secondary sales may, according to some, intrinsically elevate governance risk- when a buyer and seller sit under the same roof. Thus, transparent pricing, effective conflict management and robust process discipline are central to investor confidence. Secondaries are not just a liquidity valve but also a price-discovery tool. More LPs are turning to secondary markets as part of their regular portfolio management to generate liquidity. Stake sales typically happen at a discount, but this discount narrowed from 9% to 6% in 2025, signalling more confidence in private equity managers to exit their investments.[25]

Private credit: stronger demand, tighter terms and a converging market

Private credit entered 2026 with two clear strengths. First, structural demand remains strong as banks are still constrained, and sponsors continue to value speed and certainty from private lenders. Second, while “higher for longer” does not apply in many markets anymore, rates are still high enough to allow private credit to deliver meaningful ROI without having to stretch to excessive leverage. Asset yields on directly originated first‑lien are expected to bottom out and remain in the 8.0–8.5% range in 2026 - still attractive compared to historical averages.[26]

The challenge is less about demand and more about competition and standards. As more capital has entered the market, spreads have tightened and creditor protections have weakened in parts of the market. On the margins, some deals now include more borrower-friendly features, including more aggressive liability management and payment-in-kind (PIK) features. Going forward, returns are likely to depend less on broad market moves and more on principal protection and manager selection. Lenders with strong origination networks, credible restructuring capability and the discipline to walk away from crowded processes should be better placed than lenders who compete mainly on price.[27]

Another theme for 2026 is the convergence of public and private credit. When syndicated markets are volatile, borrowers value execution certainty; when they reopen, the strongest borrowers mix instruments - often adding private tranches alongside e.g. Public Term Loan B- to optimise price and other terms. Private lenders are moving into adjacent areas including asset based finance, investment grade credit and hybrid solutions. As these channels converge and links between funds, banks, and leveraged finance tighten, scrutiny of valuations, transparency and liquidity is also intensifying. In December 2025, the BoE launched its private markets system-wide exploratory scenario (SWES) exercise, engaging major private credit managers. The SWES exercise aims to stress test how shocks could propagate through private credit and whether bank–fund interactions could amplify stress.[28]

Infrastructure

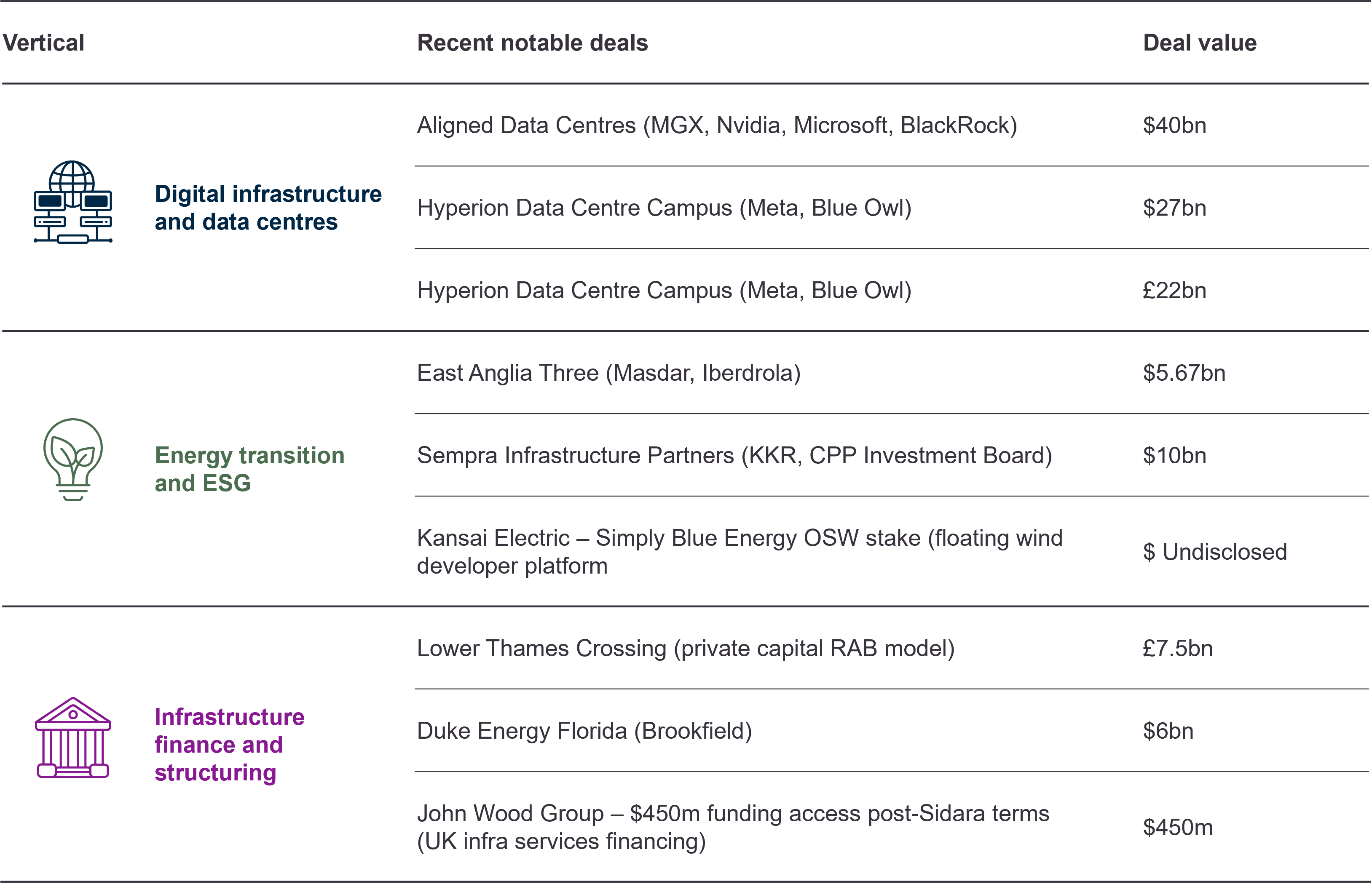

Despite global macroeconomic headwinds, infrastructure investment showed resilience throughout H2 2025. While institutional investors broadly adopted defensive positioning, the sector benefited from renewed policy clarity following NISTA's Infrastructure Pipeline launch in July 2025.[29] This strategic framework helped to boost market confidence, driving infrastructure investment volumes 59% higher year-on-year across the second half.[30] For H2 2025, we’ve focused on three key infrastructure verticals where we see growth in the market coming into 2026: digital infrastructure/data centres, energy/ESG, and infrastructure finance.

Figure 4: infrastructure deal activity (July 2025 - January 2026)

Source: Preqin Infrastructure deals database; Merger Market infrastructure database, January 2026.

The digital infrastructure segment, for instance, is growing rapidly, with global investment estimated to reach $19tn by 2040.[31] UK-specific commitments were shown in major programmes like Google’s £5bn initiative[32] and Microsoft’s £22bn AI infrastructure deployment.[33] These considerable capital commitments reflect not only growing data sovereignty requirements but also the complex regulatory frameworks that have emerged around critical national infrastructure designation, which create natural barriers that tend to favour established players with varied capabilities.

Meanwhile, energy transition infrastructure faces immediate funding pressures, with the Clean Power Action Plan investing £40bn annually, from 2024 until 2030, and driving substantial Q4 2025 transaction activity.[34] Renewable energy made up a significant proportion of deal volumes, exemplified by offshore wind projects like East Anglia Three ($5.67bn), which showed the capital intensity needed to implement large-scale developments and institutional appetite for long-term returns.[35] ESG credentials now often gatekeep access to mainstream capital, as institutions increasingly recognise sustainable infrastructure's portfolio diversification and attractive risk-adjusted returns that are often uncorrelated with traditional market cycles.[36]

Infrastructure financing, our last vertical, is experiencing a substantial change as private assets under management reached $1.3tn in 2024 - quadrupling over the past decade with 16% annual growth, outpacing the 13% from the broader private capital markets.[37] This growth reflects structural changes that go beyond traditional project finance, with core-plus funds attracting 58% of new capital in 2023 compared to just 11% five years earlier, signalling investor appetite for enhanced risk-return profiles.[38] The financing landscape is also growing in sophistication as digital infrastructure has commanded premium valuations as hyperscalers compete for capacity, while renewable energy projects now secure mainstream institutional backing rather than the niche climate allocations of the past.[39] Cross-asset strategies attracted 75% of infrastructure capital raised from H2 2023 through H1 2024, with major funds like Antin's €10.2bn Fund V and EQT's €21.5bn Infrastructure VI explicitly targeting convergence opportunities that blur traditional sector boundaries.[40] However, private investors face evolving headwinds - higher interest rates compressing returns, crowded auctions intensifying competition, and tightening controls on cross-border deals, all of which are causing investors to experiment with fresh value creation levers through operational improvements and commercial efficiencies.

Sports

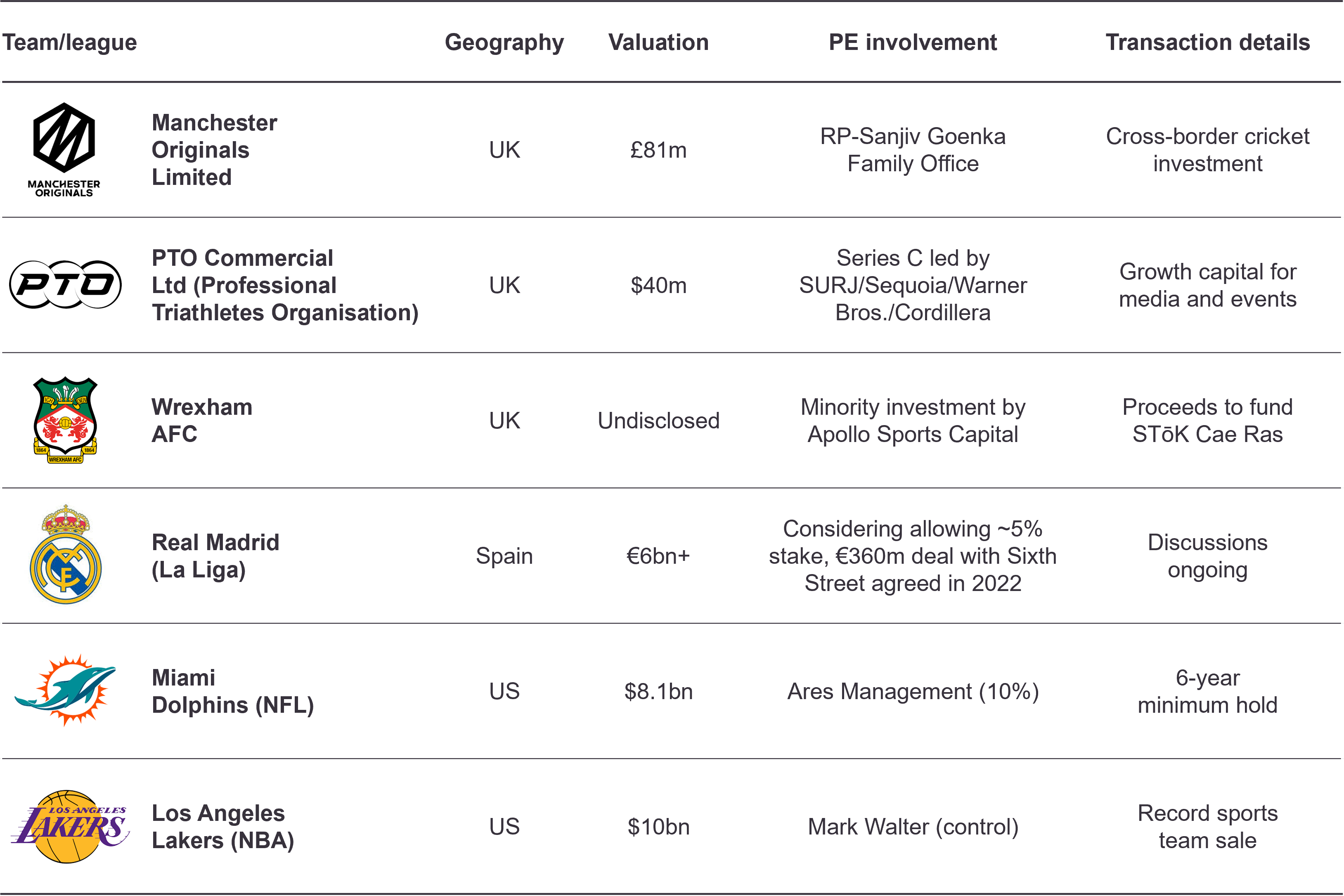

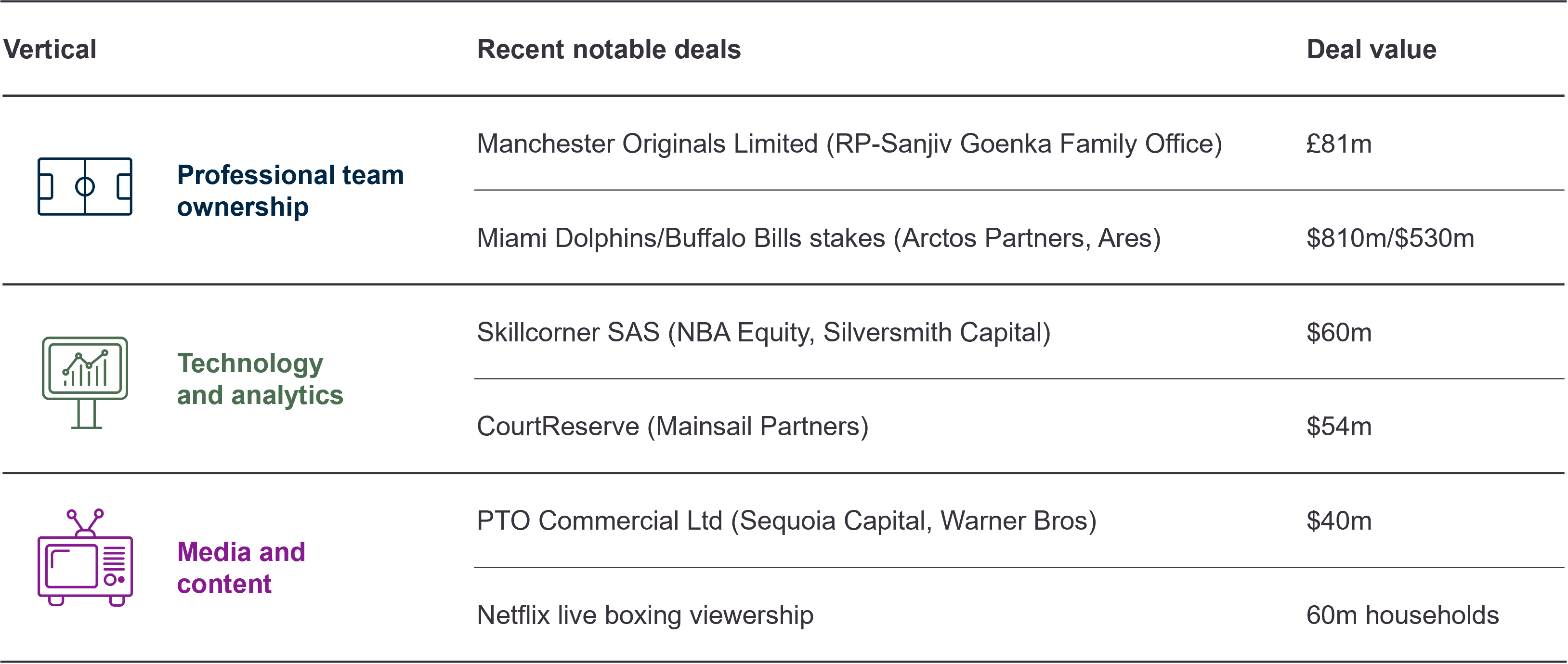

The sports sector grew significantly through H2 2025, with private equity investment reaching c.$6.3bn (disclosed) through Q3 2025 and momentum building into year-end[41], leading many investors to recognise the sector as an institutional asset class.[42] Several major deals underline this trend. In December 2025, Apollo took a minority stake in Wrexham AFC, alongside facility financing for the STōK Cae Ras redevelopment. In July 2025, RP-Sanjiv Goenka’s family office acquired 70% of The Hundred’s Manchester Originals for c.£81.2m. In September 2025, Sixth Street acquired an 8% minority in the New England Patriots, and a BellTower-led consortium acquired a minority in United Soccer Leagues.[43] Capital formation around adjacencies also accelerated: PTO Commercial (professional triathlon) raised $40m in a July 2025 Series C led by SRJ, Sequoia and others, while multiple software-enabled platforms in performance analytics, facilities, and youth participation secured growth rounds.[44]

Figure 5: major sports team valuations and private equity involvement (2025)

Sources: Preqin Sports Private Equity Deals Database; Merger Market Sports database; Sportico Valuations, January 2026; Private Equity Insights.

Following the NFL’s August 2024 approval of private equity investment into minority stakes, transaction activity broadened across H2 2025 as investors could now access an estimated $239bn addressable market across some of the largest, most profitable US leagues.[45] These reforms have also enabled sophisticated cross-team and cross-league strategies, with specialist funds using minority structures to create operational synergies while preserving club governance. Other major leagues (NBA, NHL, MLB and MLS) have permitted even larger third-party participation.[46]

Figure 6: sports deal activity

Sources: Preqin Sports Private Equity Deals Database; Netflix viewership data, January 2026.

UK fan-base data is consistent with this deal pattern. Engagement remains broad based, with 88% of UK adults engaging with sport between 2024 and 2025 and strong growth among younger cohorts in dynamic formats such as basketball and boxing. The quality of coverage and exciting highlights were the biggest draw for fans, while women’s sport continues to deliver double-digit revenue growth expectations and rising participation.[47] These demand-side signals reinforce the investment case for capability-rich minority stakes, roll-ups across services and technology layers, and targeted growth equity where unit economics may benefit from digitisation and participation tailwinds.

Media rights monetisation remains the core value driver in sports but this may require recalibrated underwriting. Industry surveys and executive commentary caution against linear extrapolation of traditional TV rights given younger audiences' increasing reluctance to pay for content and an increasing fragmentation of distribution channels, even as premium rights retain pricing power.[48] This shift is opening space for direct-to-consumer and hybrid models, with live-event streaming drawing large audiences, alongside continued innovation in sponsorship and commerce. Transaction data from H2 2025 shows mid-market depth (as measured by median ticket sizes in the tens of millions) and Anglo-American concentration across both professional ownership and technology platforms.[49]

Real estate: sector to watch

The UK real estate market has shown recovery momentum in H2 2025, with commercial investment volumes tracking toward a projected 15-20% increase through 2026, as institutional and cross-border capital continues re-entering the market.[50] This recovery has been accompanied by interest in Northern England (for example), which has created investment opportunities that extend beyond traditional London-centric strategies. The geographic realignment is evidenced by Manchester’s 2.2% economic growth rate that outpaces national averages of 1.9%, whilst Birmingham’s rental value projections show 22.2% growth through 2028.[51]

Build-to-Rent has performed strongly with Q3 2025 investment volumes of £581.2m and £3.8bn currently under offer (disclosed), indicating momentum in institutional residential investment strategies.[52] Cross-border investment has also rebounded to 51% of total BTR investment in 2024, with North American capital deploying over £1bn (out of a £5bn total) in Q4 alone, supporting sustained international appetite for UK residential assets.[53]

This convergence of recovering transaction volumes, diversifying capital sources, and strengthening regional fundamentals is positioning UK real estate as an increasingly attractive allocation for institutional investors seeking defensive, income-generating assets, amid broader market uncertainty.

[2] Goldman Sachs, The Global Economy Is Forecast to Post ‘Sturdy’ Growth of 2.8% in 2026 | Goldman Sachs

[4] Goldman Sachs, The Global Economy Is Forecast to Post ‘Sturdy’ Growth of 2.8% in 2026 | Goldman Sachs

[7] "Bond vigilantes" are investors who sell off government bonds to protest fiscal policies they deem irresponsible, like excessive spending or inflation risks, thereby raising borrowing costs for governments and forcing policy changes. ECB, Who are the “bond vigilantes” on sovereign debt markets?

[8] The Guardian, Five charts that explain the global economic outlook for 2026 | Global economy | The Guardian

[9] The Guardian, Bond market power: why Rachel Reeves is keen to keep the £2.7tn ‘beast’ onside | Budget 2025 | The Guardian

[10] Invesco, 2026 Annual Investment Outlook

[11] Reuters, J.P.Morgan forecasts spending on data centers could boost US GDP by 20 basis points in 2025-26 | Reuters

[13] Invesco, 2026 Annual Investment Outlook

[14] Invesco, 2026 Annual Investment Outlook

[15] BlackRock, A 2026 global macro outlook: Patience

[17] Reuters, More mega deals coming as chase for scale fuels near record-breaking year for M&A | Reuters

[18] Bloomberg, As at 22 January 2026

[20] Reuters, Private equity firms expected to unleash middle market M&A deals, survey says | Reuters

[22] Macfarlanes, Mega funds, mega pools and mega changes – the impact of the UK Government’s pension reforms on private capital

[23] Morgan Stanley, Alts In Focus: 2026 Outlook | Private Equity

[26] Morgan Stanley, Alts In Focus: 2026 Outlook | Private Credit

[27] J.P Morgan Asset Management, alternative-outlook.pdf

[29] National Infrastructure and Service Transformation Authority, Infrastructure Pipeline kicks off new era of infrastructure delivery, July 2025.

[30] Macfarlanes analysis. Preqin infrastructure deals database; Merger market infrastructure deals, January 2026

[31] Green, Alastair, Nangia Ishaan, Sandri, Nicola (2025),The infrastructure moment, McKinsey, September 2025

[32] Islam, Faisal, Google owner reveals £5bn AI investment in UK ahead of Trump visit, BBC News, September 2025

[33] Wall, Matt, Microsoft AI Tour London: Turning aspiration into action, Microsoft, October 2025

[34] Transaction data: Preqin infrastructure deals database; Merger market infrastructure deals, January 2026

[35] Green, Alastair, Nangia Ishaan, Sandri, Nicola (2025),The infrastructure moment, McKinsey, September 2025

[36] Khandekar, Aryan, The Effect of ESG (Environmental, Social, and Governance) Criteria on Investment Strategies: An Analysis of Financial Returns and Company Performance., January 2025

[38] Ibid, 2025

[39] Green, Alastair, Nangia Ishaan, Sandri, Nicola (2025),The infrastructure moment, McKinsey, September 2025

[40] IJInvestor, Funds and Investors Report, H1 2024; Emily Lai, "Antin Infrastructure secures €10B for latest flagship fund," PitchBook, December, 2024

[41]Macfarlanes analysis. Preqin sports deals database; Merger market infrastructure deals, January 2026

[42] S&P Global Market Intelligence, Eyeing a private equity reckoning; growing appetite for sports investment, Oct 2025

[43] MergerMarket, Apollo Sports Capital acquires minority stake in Wrexham AFC (Dec 2025); Preqin, Manchester Originals 70% stake by RP-Sanjiv Goenka Family Office, July 2025; Preqin, Sixth Street acquires 8% minority stake in New England Patriots, September 2025; Preqin, BellTower Partners minority investment in United Soccer Leagues, September 2025

[44] Preqin, PTO Commercial Ltd $40m Series C led by SRJ/Sequoia et al, July 2025; Preqin Sports transactions dataset - median/Anglo-American concentration, July 2025 - January 2026

[45] Ozanian, Michael, Cowboys now worth a record $12.5B –10 other NFL teams valued at more than $8B, CNBC; One Year in, Private Equity Boosts NFL Values on Handful of Deals, Sportico, August 2025

[46] Akin, 2025 Perspectives in Private Equity: Sports; PwC, Global Sports Survey (8th Edition), institutional investment expectation, July 2024

[47] EY-Parthenon, UK Sports Engagement Index 2025, December 2025; PwC, Global Sports Survey (8th Edition): divergence between premium and non-premium rights; new commercial models; women’s sport outlook, July 2024.

[48] S&P Global Market Intelligence, Eyeing a private equity reckoning; growing appetite for sports investment, October 2025; EY-Parthenon, UK Sports Engagement Index 2025, December 2025

[49] Macfarlanes analysis. Preqin Sports transactions dataset median/Anglo-American concentration, July 2025 - January 2026

[50] Macfarlanes analysis. Preqin real estate PE deals database, January 2026; CNBC, Here’s what to expect for commercial real estate in 2026, December 2025

[51] Select Property, UK Real Estate Investor Trends to Watch in 2025, July 2025,

[52] Macfarlanes analysis. Preqin real estate PE deals database, January 2026

[53] Savills, UK Build to Rent Market Update—Q4 2024, 2025

Stay up to date with our latest insights, events and updates – direct to your inbox.

Browse our people by name, team or area of focus to find the expert that you need.