Tax issues on stake sales and investment into managers: structuring, pitfalls and steps to take now

Supporting Private Capital Managers

Tailored solutions for the private capital industry.

Spotlight case study

/Passle/5a1c2144b00e80131c20b495/MediaLibrary/Images/2025-09-04-12-58-34-038-68b98cfabb695430b1bc5a13.png)

5 minute read

The Treasury has confirmed final rules which impact both authorised and unauthorised firms making financial promotions in reliance on exemptions for high net worth individuals (HNWI) and self-certified sophisticated investors.

These changes form part of the Government's broader investor protection work and the continued tightening of regulation of financial promotions. In particular, recent changes made earlier this year mean that authorised firms are now subject to stricter rules when promoting certain high-risk investments1 and must also apply for an additional permission to approve financial promotions for unauthorised firms.

A financial promotion is a communication made in the course of business that contains an invitation or inducement to engage in investment activity. Generally, firms which are not authorised under the Financial Services and Markets Act 2000 (FSMA) cannot make financial promotions unless:

This is known as the "Financial Promotion Restriction" and it is a criminal offence to breach it.

Authorised firms are also restricted from issuing financial promotions where the promotion is in respect of unregulated collective investment schemes unless the promotion is made in accordance with certain FCA rules or an exemption under the FSMA (Promotion of Collective Investment Schemes) (Exemptions) Order 2001 is available (the CIS Order).

The exemptions in the FPO and the CIS Order relating to HNWI and self-certified sophisticated investors are available for promotions relating to investments in unlisted companies. These exemptions have not been substantively updated since 2005. They were originally implemented to enable small and medium sized enterprises to raise finance from HNWI, sophisticated private investors or "business angels" without the costs of having to comply with the financial promotions regime.

Firms are able to rely on these exemptions for financial promotions directed to individuals whom the firm believes on reasonable grounds to be HNWI or self-certified sophisticated investors. Although these exemptions will remain broadly in place, they are now being reformed. The Treasury has explained that the changes are necessary to reflect current circumstances and to address the risk of the exemptions being misused and causing investor detriment when inappropriate products are marketed to ordinary retail investors.

The key changes include:

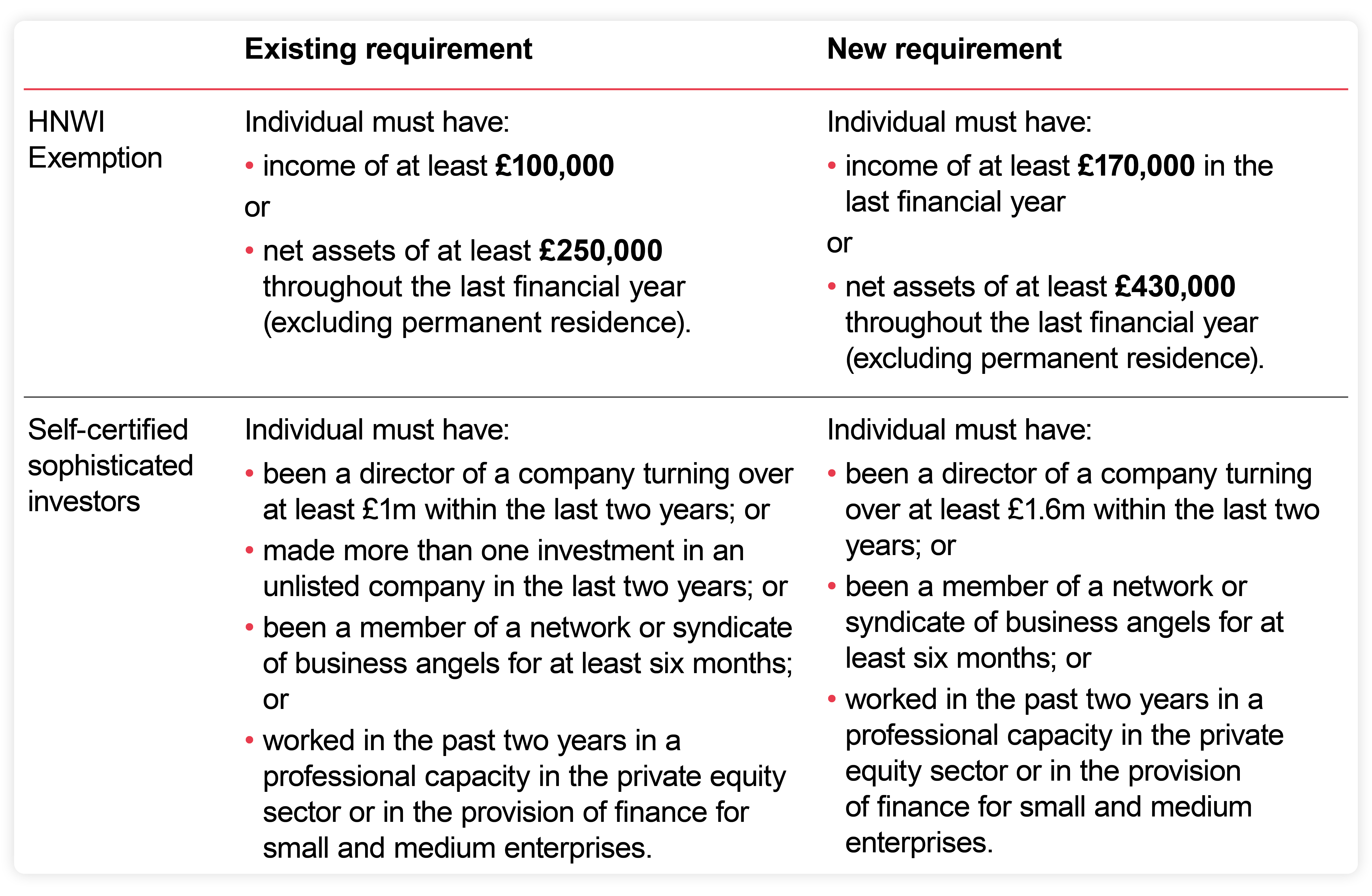

The table below sets out a summary of the changes to the financial/qualifying criteria for the exemptions.

Subject to the parliamentary process, it is the Government's intention for these changes to be implemented on 31 January 2024. Given the criminal consequences of breaching the Financial Promotion Restriction, firms seeking to rely on these exemptions should act now to ensure that any financial promotions made after 31 January 2024 are compliant with the new criteria. In particular, firms should:

The Treasury has confirmed that where financial promotions have been made in compliance with the existing regime prior to 31 January 2024, the follow up communications provisions in the FPO and CIS Order will remain available.3 This means that any follow up financial promotions relating to the same investment made within 12 months of the first communication will not require updated investor statements provided that the other relevant requirements of those provisions are met.

1 These rules are set out in COBS 4.12A and COBS 4.12B and came into effect in February 2023

2 From 6 November 2023 authorised firms are able to submit applications for permission to approve financial promotions. The initial application period will close on 6 February 2024. On 7 February 2024, amendments to Section 21 FSMA will come fully into force and authorised firms that have not applied to the FCA for permission as a financial promotion approver will no longer be able to approve financial promotions (subject to certain exemptions).

3 Article 14 FPO and article 11 CIS Order.

Stay up to date with our latest insights, events and updates – direct to your inbox.

Browse our people by name, team or area of focus to find the expert that you need.