ESG and remuneration – how do your practices measure up?

29 April 2021Environmental, social and governance (ESG) factors are increasingly present as a feature of good corporate governance and as a key issue of interest for investors.

It is not surprising that more companies than ever are using ESG metrics as an important cog in the broader machinery of their reward arrangements: as the Financial Times recently reported, the latest data from ISS ESG suggests that the number of companies that include ESG metrics in their remuneration determinations has doubled since 2018.

This, in tandem with increased investor interest in ESG, forms something of a virtuous circle; the more companies embed it in their remuneration arrangements, the more it becomes a feature which investors will expect to see, and so on.

The opportunities associated with engaging with investors on this topic are significant. In its report on “How ESG engagement creates value for investors and companies”, the UN PRI1 identifies several such opportunities, some examples of which include the opportunity for a company to:

- clarify its investors’ expectations surrounding ESG topics;

- rectify misrepresentations and manage investors’ views of the company; and

- anticipate upcoming trends and issues and develop broader knowledge and understanding of ESG issues.

Whether or not you choose to proactively engage with them, there is likely to be increasing pressure from investors who will want answers as to how you approach ESG, including whether and how you link ESG to pay (and if not, why not).

This uptake in the inclusion and importance of ESG metrics has also prompted developments of disclosure frameworks and reporting standards against which to measure progress. Disclosure obligations are likely to become increasingly mandatory (as the TCFD2 recommendations have in a limited sense become – as to which see below), so it is important to start thinking about ESG and how it fits in with your remuneration policies and plans. If you are not already doing this, now is the time to take action. If you are already doing it, you will want to make sure you are getting the most out of your efforts.

In this briefing, we want to share with you the result of our survey of the remuneration reports of the FTSE 100 companies looking at what companies are doing in relation to ESG and remuneration. The survey reveals some interesting features and a snapshot of what the UK leading companies are doing in this space. Later in the briefing, we also consider in more detail how companies that have not yet considered ESG in connection with remuneration may go about doing so.

We are doing a lot of work in this space at the moment and would be very interested in hearing from you about your experiences and goals where ESG is concerned. We would also be delighted to speak to you about what we are seeing in the market and the direction of travel so please do get in touch.

FTSE 100 survey

Last year, the Macfarlanes Reward team completed a “FTSE100 - ESG and Pay Survey” which gave us an invaluable insight into the current state of affairs when it comes to actively taking steps to linking ESG to remuneration. Not only that, the survey also gave us an insight into the way in which companies are using their remuneration arrangement as a means of achieving their ESG objectives.

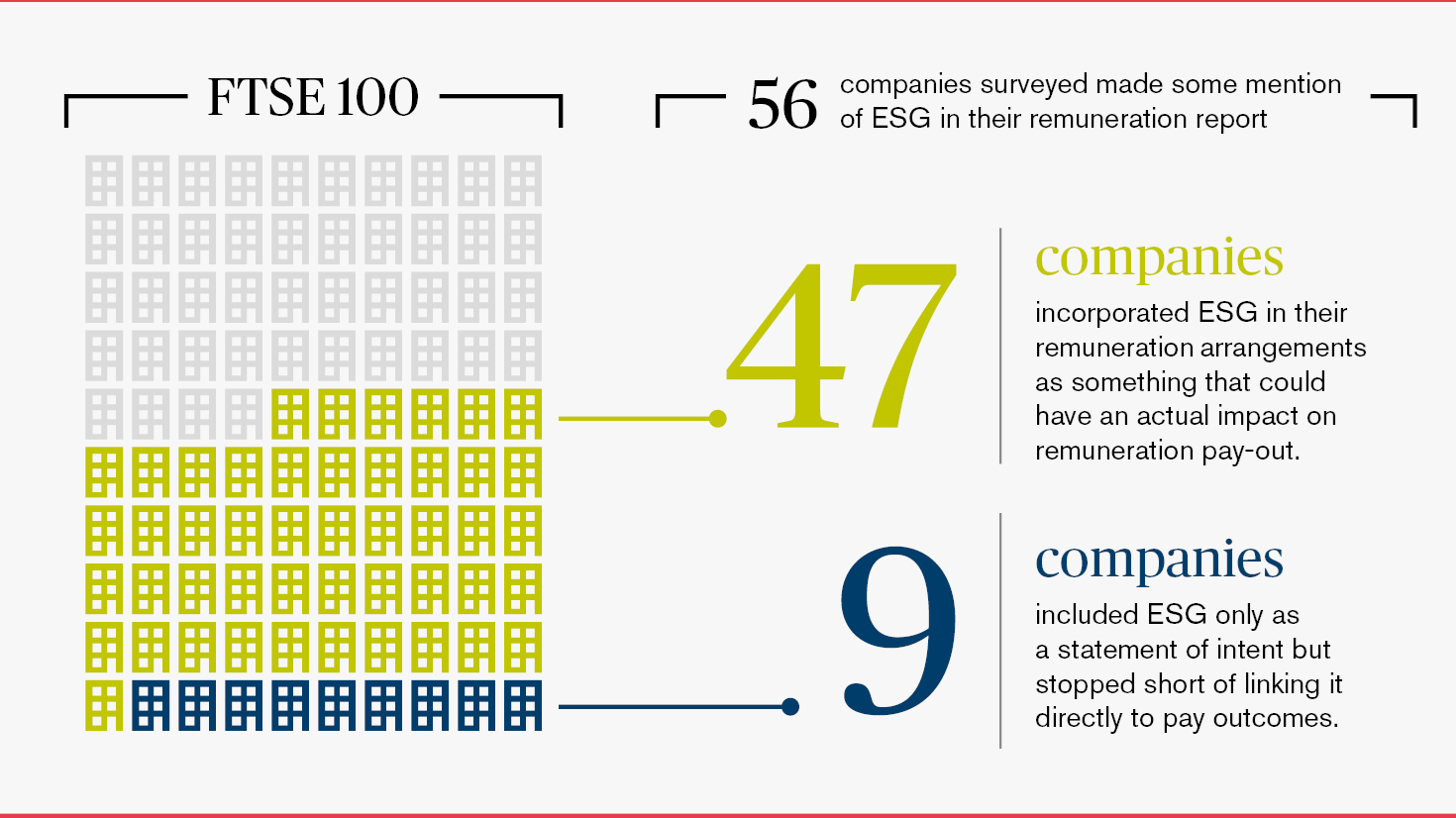

For example, the survey showed that that over half of the FTSE 100 heavyweights talk about ESG in their remuneration reports. Secondly, over two thirds of companies that mention it have incorporated it as something that has a tangible impact on the outcome of their remuneration arrangements.

While 56 of the FTSE 100 companies surveyed made some mention of ESG in their remuneration reports, this did not consistently translate into ESG featuring tangibly in their remuneration arrangements. The survey showed that 9 of those companies included ESG only as a statement of intent but stopped short of linking it directly to pay outcomes. By contrast, the remaining 47 companies went further and incorporated ESG in their remuneration arrangements as something that could have an actual impact on remuneration pay-out.

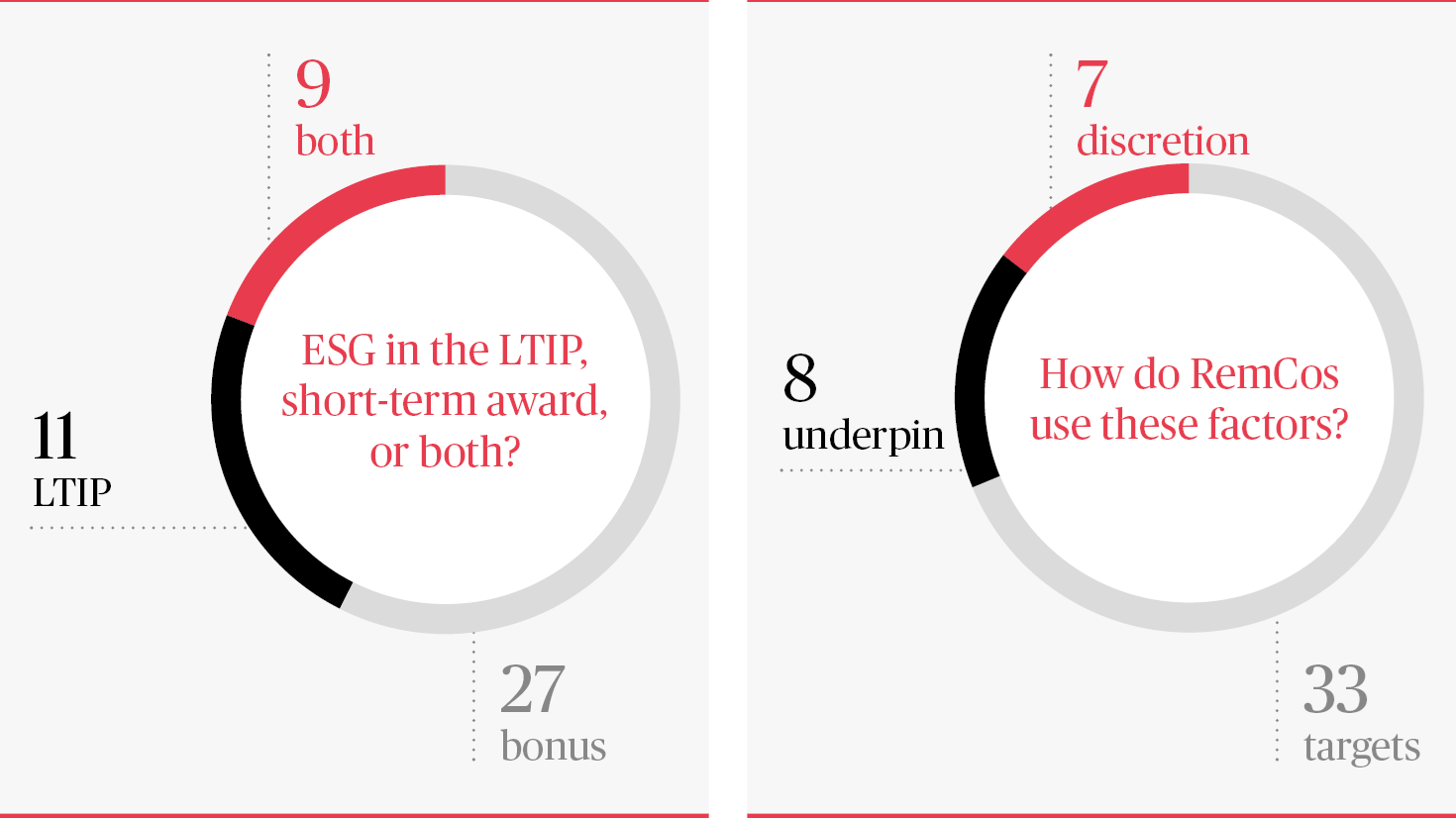

Digging a little further into this, the next question we looked at was how these factors had been incorporated into bonus and LTIP plans. At the time of review, 27 companies included one or more specific ESG targets in their short-term bonus arrangements, while 11 companies included them in their LTIP plans. A further 9 companies had ESG metrics or discretions featuring in both their bonus and LTIP plans.

The next thing we looked at was how ESG was used in relation to the relevant plans, i.e. how remuneration committees would apply ESG in determining outcomes. The key distinction we saw here was between having specific ESG targets (i.e. which if hit would trigger a payment) and having a general discretion and underpin related to ESG such that if financial and personal targets had been made, remuneration committees could exercise discretion to reduce any pay-outs if ESG metrics were not deemed to have been satisfied. Our findings are set out below and we would be happy to share more of the detail of the survey with you.

ESG and pay – how do you do it?

If you are considering building ESG into your remuneration framework but want to get a better sense of the process, we have set out some information and guidance below which we hope will be useful and practical.

There are of course various mechanisms available for the inclusion of ESG metrics in your remuneration plans. Typically, where companies have adopted a link between pay and ESG performance, they have done so in their long- or short-term incentive plans for executives and senior personnel (although we have encountered one company that has linked their all-employee plan to ESG metrics).

This can be done in the following ways.

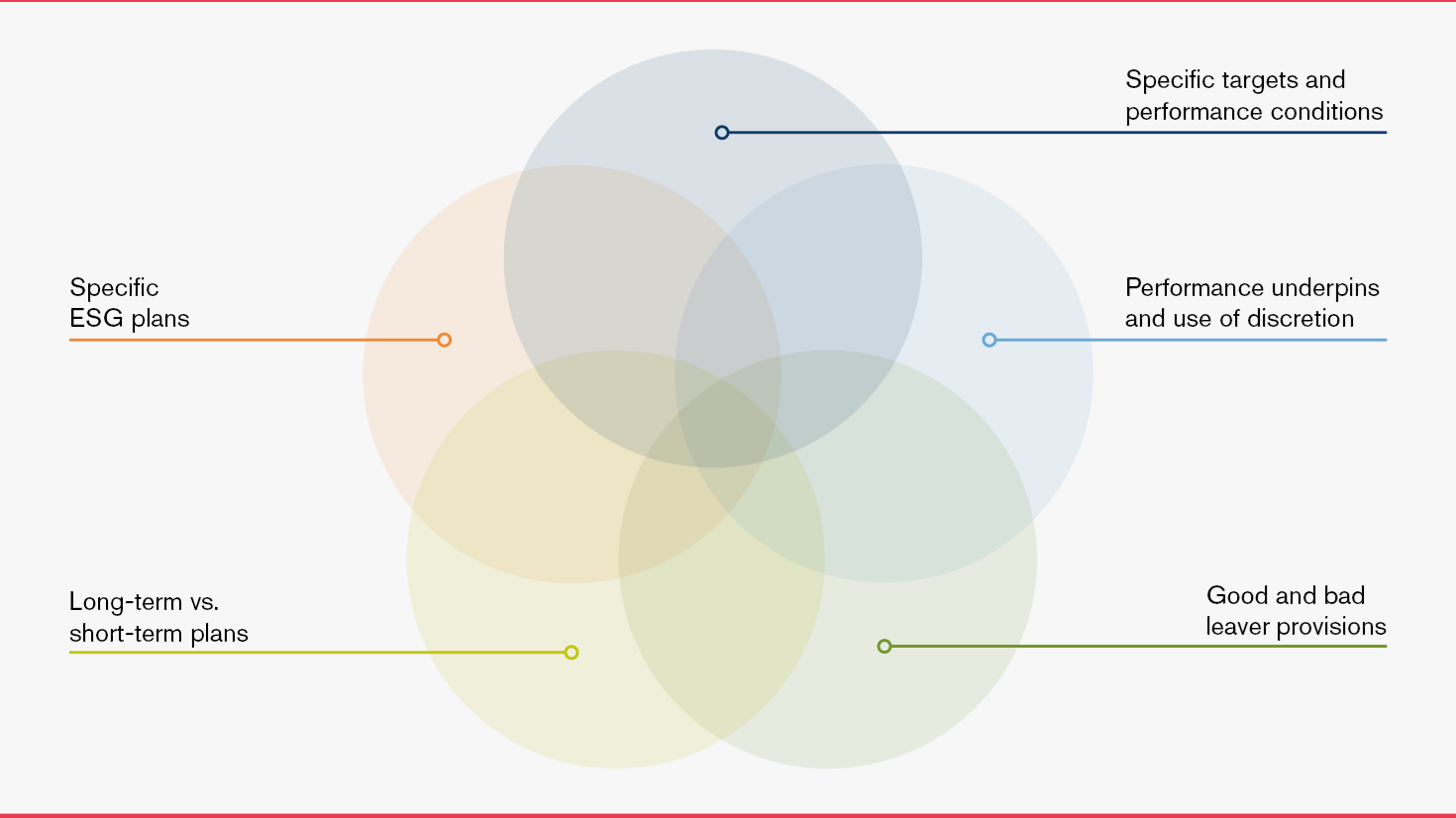

- Targets – the ESG metric is included as a specific performance target which, if not achieved, results in the lapse of a proportion of the award or award potential. Our ongoing review of the remuneration reports of the FTSE 100 reveals that this is currently the most popular method of integrating ESG in pay.

- Discretion – ESG performance is included as a standalone independent factor in the discretion of the remuneration committee as to the quantum of entitlement to an overall award, or portion of an award. This is the second most popular method according to our FTSE 100 review.

- Overlay/underpin – where a financial target is met, the remuneration committee is given discretion to adjust that award up or down based on performance in relation to separately measured ESG metrics.

There is no reason these metrics cannot be more widely or more creatively implemented to delivery ESG objectives specific to your company, for example:

- including ESG metrics in good and bad leaver provisions in incentive plans; and

- expanding ESG metrics to all-employee plans.

We can advise on the most appropriate plan provisions in which to incorporate the metrics that you want to use to incentivise your people.

Selecting appropriate metrics

One of the biggest decisions in linking ESG factors to pay is choosing which metrics to use. How do you measure and quantify success against ostensibly qualitative measures like diversity, environmental impact or customer satisfaction?

There are an increasing number of frameworks available which set out recommended ESG indicators and metrics. The short answer is that there are no “right” metrics to use. The metrics which are most appropriate to include are those which make sense for your business, taking into account the context in which it operates and your ESG appetite.

Working out your ESG objectives

The first stage, therefore, is taking a step back and working out what your ESG targets and ambitions as a company are. To do this you will need to look at your business and the environment in which it operates. ESG is closely linked to your overall mission and culture as a company. Once you have articulated those, the ESG objectives start to become clearer.

We would be interested in hearing your thoughts on this. If ESG appetite is something that you are still considering, we would also be happy to discuss the relevant considerations with you and introduce you to our board engagement questionnaire to assist you in identifying your ESG position.

Turning them into measurable metrics

Once you have established your company’s ESG appetite, you can then more easily identify concrete objectives and metrics which are appropriate for inclusion in your pay practices.

Some ESG metrics have settled into the remuneration context very easily. Occupational health and safety measures, for instance, often offer a set of measurable, quantifiable metrics which are ripe for inclusion in a remuneration plan. However, there is no reason why you cannot look further than these historically more established metrics to cultivate a set of performance indicators which respond to your business’s specific needs, ambitions and opportunities.

You will also need to consider the prominence and weight that you will give to these metrics. As noted further above, the nature of the metrics and the importance ascribed to them often determine the way in which they are linked to remuneration.

We have reviewed a wide variety of ESG indicators from a range of sources and are able to offer assistance in selecting a suite of metrics tailored to your ESG appetite and the context in which your business operates. If this is something you have already considered or are considering, we would be interested in hearing about your thoughts and experiences with selecting appropriate metrics.

Reporting on your efforts

Selecting which ESG metrics you will use in your remuneration plans is not the end of the process. There is an increasing focus on transparency and disclosure in respect of ESG – this momentum is reflected in the development of various disclosure frameworks and reporting standards, both legislative and voluntary.

One example of this is the introduction by the FCA of a new listing rule requiring commercial companies with a UK premium listing to state in their annual reports the extent to which the disclosures therein are consistent with the recommendations of the Taskforce for Climate-related Financial Disclosures (for more detail on this, see our blog post published at the time).

Similarly, the Sustainable Finance Disclosure Regulation (SFDR), which has been in force since 10 March 2021, requires investment and asset managers which provide services in countries within the European Union to ensure that their remuneration policies promote effective management of sustainability risks.

Developments like these are of interest not only to those companies that fall directly within their scope, but also more broadly; they are indicative of likely future developments in the area, and also reflect (and impact on) investors’ expectations.

The most appropriate place to disclose your ESG remuneration arrangements will be the remuneration report. This is the key forum to meaningfully explain the way you have incorporated ESG into pay, as well as disclosing the way performance is measured against the targets set (and indeed, whether these have been met). Disclosure in the remuneration report is therefore a company’s opportunity to showcase its ESG credentials and functions as a clear signal to investors and other stakeholders that the relevant issues are a priority and are taken seriously.

We can help you to identify the relevant disclosure requirements which your company is subject to – both mandatory and voluntary - and advise you on the appropriate wording and approach to disclosure.

1 The UN PRI refers to the Principles for Responsible Investment: a United Nations-supported international network of investors working together to implement its six aspirational principles guiding investor behaviour

2 The TCFD is the “Taskforce for Climate-Related Financial Disclosures”, set up by the Financial Stability Board to develop recommendations for more effective climate-related disclosures to promote more informed investment

Get in touch

Related content

See all related content