Q&A: Implementation of the Sustainable Finance Disclosure Regulation

10 March 2021Confusion regarding SFDR compliance is rife in the industry and is compounded by lack of regulatory guidance and differing views on interpretation from law firms across the EU.

We set out below our views on some of the key interpretation questions raised most frequently by our clients.

The lack of clarity is frustrating, but market practice will evolve and further regulatory guidance will inevitably be published in the future. In the meantime, our view is that it is paramount to ensure your firm’s approach is defensible and well-reasoned, in order to withstand regulatory scrutiny. You must also only make ESG related disclosures you are confident you can back up with verifiable evidence.

This is the beginning of the ESG conversation, not the end, and it is commonplace for clients to risk accept certain elements of non-compliance at this juncture pending the further development of their own internal ESG related policies and procedures over the coming months.

Glossary

Non-EU firms

Means UK firms as well as all other third country firms; for example, US, Cayman, Hong Kong, Singapore and Channel Islands firms.

Product

Means an AIF and/or a UCITS, as the context requires.

RTS

Means the “Final Report on draft Regulatory Technical Standards with regard to the content, methodologies and presentation of disclosures pursuant to Articles 2a(3), Article 4(6) and (7), Article 8(3), Article 9(5), Article 10(2) and Article 11 (4) of Regulation (EU) 2019/2088”, the provisions of which remain in draft form.

SDFR

Means regulation (EU) 2019/2088 on sustainability-related disclosures in the financial services sector.

Firm level disclosure FAQs

There are both legal and commercial reasons why non-EU firms may need to comply with SFDR.

The legal obligation to comply with SFDR is triggered to the extent there is an “EU nexus” associated with the firm or product. For instance:

- If marketing a product in the EU from 10 March 2021, the product must comply with the article 6 product disclosures, and with the article 8 or article 9 disclosures if those are relevant.

It is irrelevant whether the product itself is an EU or non-EU product – the critical point is whether the product is marketed to EU investors.

There is no requirement for non-EU firms to comply with the firm level requirements.

- If the non-EU firm has products it is no longer marketing to EU investors, but which it has classified as article 8 or 9 products, then compliance with the article 8 and 9 website and reporting disclosure requirements may be required – see question "What disclosures need to be made in respect of article 8 and 9 products that are no longer being marketed?".

(Non-EU firms should also remember that, if they structure products using an EU management company – e.g. an EU AIFM or ManCo– then that EU management entity must comply with the firm level requirements.)

Even if the non-EU firm is not legally obliged to comply with SFDR, there might be compelling commercial or reputational reasons for it to comply with the rules. For instance, a firm that is marketing products both inside and outside the EU might choose to apply the SFDR requirements to all of its products for the purposes of operational ease; alternatively, a firm may wish to be “best in class” from an ESG disclosure perspective, or may be receiving investor pressure to comply.

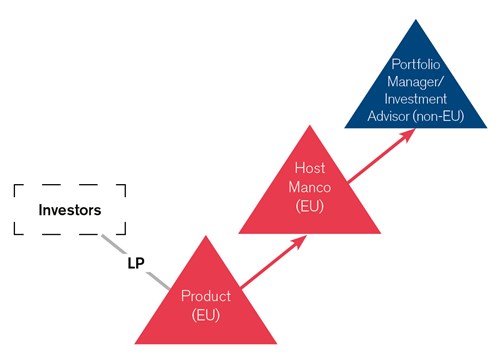

It is the responsibility of the EU host ManCo (e.g. host AIFM or UCITS management company) to make the necessary SFDR disclosures as they are within scope of SFDR from 10 March 2021.

It is important to assess which entities within a product structure need to comply with SFDR. In the scenario illustrated in the structure chart above:

- the EU host ManCo must comply with the firm-level disclosures by 10 March 2021;

- if the product is being marketed in the EU, it will need to make product-level disclosures;

- if the product is no longer being marketed in the EU and is an article 8 or 9 product, it may need to comply with certain product-level disclosures – see question "What disclosures need to be made in respect of article 8 and 9 products that are no longer being marketed?"; and

- any non-EU portfolio managers or investment advisers in the structure will not need to comply with SFDR. However, they will need to help the EU host ManCo comply with its firm-level and product-level disclosures by providing it with the relevant data to meet its obligations.

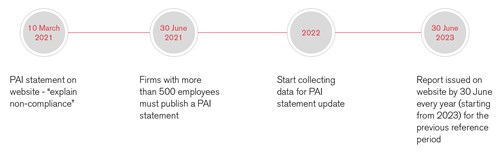

No, only firms with more than 500 employees must consider PAIs from 30 June 2021. However, any firms can choose to comply if they wish to do so.

The data collection required and reporting on such data under the RTS is onerous so firms opting to comply need to be comfortable they are able to do so. A firm cannot cherry pick which PAIs to report on – it should fully comply with the mandatory PAIs and choose those voluntary PAIs which are appropriate for it, not just those which flatter the firm.

The SFDR requires firms to use “best efforts” to gather the data required to report on PAIs through direct engagement with investee companies. Information must be gathered from all investee companies, including for instance minority holdings in investee companies as well stakes held by products no longer being marketed.

If after engaging with investee companies, firms do not have the required data for their reporting purposes, they can:

- use third party data providers to assist, although firms must consider the reliability, accuracy and robustness of the data offered by providers;

- conduct additional research; and

- make reasonable assumptions.

Where a firm makes reasonable assumptions, these should be clearly highlighted in the PAI report.

Where information cannot be obtained, firms should detail the best efforts that they have undertaken to try to gather the information.

Yes, SFDR does not differentiate between sub-threshold AIFMs and fully authorised AIFMs.

It is possible, but we have yet to see the direction of travel on this.

Managers of EU fund of funds will need to comply with SFDR. An EU fund of funds may struggle to obtain the data it needs for its own compliance if an underlying manager is not complying with SFDR itself. It is conceivable that EU funds may divest if the lack of information from the underlying non-EU fund is not forthcoming and it substantially skews the reliability of its own disclosures. Non-EU firms that manage funds into which EU fund of funds are invested should engage with those EU fund of funds sooner rather than later to understand what they require from an SFDR perspective.

It is worth noting this issue may arise in respect of other EU investors which are directly in scope of SFDR, such as pension funds and insurers.

No, if a firm is not legally required to have a remuneration policy, then SFDR does not require it to adopt one.

SFDR requires firms to consider and disclose on their website how their remuneration policy is consistent with their integration of sustainability risks. There is no obligation to publish an internal remuneration policy in full.

Whilst a firm might not have a remuneration policy in place, it may have informal remuneration policies (e.g. employment contracts, bonus schemes) that it will need to ensure are consistent with its sustainability risk integration.

Product level disclosure FAQs

This is a hot topic in the industry and ESMA has written to the European Commission to request clarification on this issue.

Article 6

All products that are in scope of SFDR must comply with the article 6 disclosures. This means article 6 products will comprise a very diverse range of products from those with no consideration of ESG characteristics at all, to those that do consider them to some extent, but not to such an extent as to be considered article 8 products.

Article 8: products that promote an environmental or social characteristic, and whose investee companies follow good governance practices

Categorisation as an article 8 product ultimately comes down to: how is the specific product being promoted in order to encourage investors to choose that product over another? In common with a number of industry associations, we do not consider that, just because a firm has firmwide ESG policies and exclusions, all of that firm’s products should by default qualify as article 8 products.

Managers will need to identify the environmental or social characteristic being promoted in relation to the product in order to be able to report against that characteristic.

If the firm promotes a product as having a sustainability focus or applies exclusions that are specific to that product (and which form a key feature of that product), then it is likely an article 8 product (assuming the environmental or social characteristic being promoted can be identified). Managers of these products consider sustainability factors as part of their investment decision making, over and above a firm’s baseline environmental or social safeguards. In other words, the fund manager must “bear in mind” the sustainability characteristic when managing this product over other (perhaps similar) products, given the sustainability characteristic which the product specifically promotes.

Article 9: products with an environmental or social objective, that “do no significant harm”, and whose investee companies follow good governance practices

If the product has a “sustainable investment” objective – i.e. those that pursue an environmental or social objective alongside a financial return, sometimes called “impact funds” – then it is likely to be an article 9 product. These products often have an index aligned to its objective in order to benchmark the product’s progress in achieving its stated objectives. For example, a fund aimed at reducing carbon emissions which, following the Low Carbon Benchmark Regulation, may align with one of the EU Climate Transition and Paris-Aligned benchmarks.

In our view, no.

There is no reference to requiring a “binding” environmental or social characteristic in SFDR. An environmental or social characteristic may not be incorporated in the core legal documents but may still have been used to induce an investor to invest in the product. If the product is “promoted” with an environmental or social characteristic, then it is likely in scope of article 8 in any event.

The RTS do refer to “binding” criteria, but this is in a different context (i.e. firms can only disclose their investment selection criteria if they are “binding”). In our opinion, this is to address the risk of misleading investors by disclosing investment selection criteria that can be disapplied, waived or overridden at the firm’s discretion. But a product can still be an article 8 product, even if there are no such binding criteria. It comes down to how the product is promoted to investors and what may have induced them to invest.

No, the categorisation of products under SFDR is not consistent across jurisdictions.

There are differences of opinion across the EU and the UK amongst market participants, service providers and lawyers as to what type of products fall within scope of article 8 or 9. This is driven by several factors, including but not limited to:

- attempting to align local rules with SFDR categorisations – a product may be deemed “an ESG positive product” under local rules but not an article 8 or 9 or vice versa; and

- pressure from EU distributors/investors to have an article 8 or 9 product available to market.

There may be benefits from a distribution perspective of categorising a product as article 8 or 9, but firms must consider the regulatory and reputational risks of miscategorising a product for marketing purposes: if the categorisation cannot be justified, firms will be exposed to the risk of being accused of greenwashing.

SFDR may apply to other managed products and services in the same way as it applies to collective investment schemes.

The scope of products to which SFDR applies is very broad and, for example, includes portfolios managed in accordance with MiFID II. If there is an EU nexus to the managed account or segregated mandate, such as an EU-based client, firms should check whether the account meets the definition of a “financial product” which is in scope of SFDR. It may be that SFDR disclosures and reporting are required in respect of the mandate.

No, compliance with the SFDR product level disclosures is only triggered when that product is actively marketed in the EU.

Article 6 product level disclosure FAQs

Depending on the type of product, the SFDR dictates where the disclosure should appear. For example:

- for AIFs, the pre-contractual disclosure should be made in the same document as the AIFMD article 23 disclosure, whether that is a private placement memorandum (PPM), due diligence questionnaire (DDQ) or a standalone document; and

- for UCITS, the disclosure should be made in the prospectus.

The SFDR does not prescribe a form or template for the pre-contractual disclosures. However, the disclosures must be consistent with the language in article 6. Firms should also be careful to avoid any suggestions of greenwashing and ensure that the disclosures are “fair, clear and not misleading”.

Potentially – if the updated article 23 disclosures are deemed a “material change” to information previously shared then they will need to be filed with local regulators and notice given to existing investors.

Notice to regulators

If relying on an AIFMD passport to market the AIF, firms are required to notify their local regulator of any material changes to the information previously disclosed to the regulator as part of the passport application. Firms will therefore need to assess whether a material change has occurred as a result of the updated SFDR disclosures. If so, the regulator should be notified one month in advance of changes being made to the disclosures. If not, firms should still consider filing an updated copy with the regulator for information purposes and in the interests of being fully transparent.

If marketing a product via a national private placement regime, the requirements vary depending on the regulator in question. Firms should check with local counsel.

Notice to existing investors

For an article 6 product, SFDR only requires pre-contractual disclosures to be made. As a result, there is no obligation to give notice to existing investors that have already entered into the investment contract as the “pre-contract” period has expired.

However, if the AIFM is subject to AIFMD, AIFMD requires investors to be notified of any material changes to the previously disclosed article 23 information. This could potentially be done in the annual reports.

Even if a firm is not required to update existing investors, it may nevertheless decide to do so from an investor relations perspective or to ensure fair treatment of investors. Firms should also consider whether they are subject to any contractual obligations (e.g. contained in side letters) that require disclosure of updated documents to investors.

None.

Article 6, which applies to all products, requires only pre-contractual disclosures. Pre-contractual disclosures can only be made prior to investors having contractually committed to make an investment.

For article 8 and 9 products that are no longer being marketed – see question "What disclosures need to be made in respect of article 8 and 9 products that are no longer being marketed?".

Article 8 and 9 product level disclosure FAQs

No, you do not need to comply with the RTS until they are adopted and then become effective.

Until the RTS are adopted and become effective, firms are only required to comply with the SFDR Level 1 legislation and its level of detail. The RTS are anticipated to become effective on 1 January 2022.

We are seeing different approaches in the market: some firms are deciding to comply with the draft RTS now in the expectation that the final rules will not be subject to significant changes, while others have decided to wait until the RTS are adopted and then revisit their disclosures.

The European Commission stated that firms should take a principles-based approach to complying with the disclosures from 10 March 2021, including the suggestion that firms could refer to international ESG and sustainable investment standards to comply with the rules. However, the view of the ESAs (as part of their joint supervisory statement in February 2021)……” and then where it refers to 10 March, we should say “10 March 2021.

When deciding whether to adopt the RTS now or wait, firms should be careful of selective compliance. They should not pick only those RTS disclosures which flatter the firm and/or product to avoid greenwashing.

To avoid breaching local marketing rules, firms may need to limit public access to the website on which the disclosures appear.

The SFDR requires disclosure on a “public website” and the legislation does not differentiate between private and public products. However, the RTS does recognise that website disclosure should respect EU and national rules on the confidentiality of information.

Firms should assess whether the information that they intend to disclose on a public website could breach either local marketing rules or contractual confidentiality arrangements with investors. Disclosure on a public website could also hinder firms’ ability to rely on reverse solicitation. There is potentially significant risk to a firm and the successful fundraise of a product if marketing rules are breached.

If the information might breach those requirements, firms could consider the following alternative options:

- put the disclosure in a data room. The disclosure must be available for the life of a product. Therefore, the data room must be kept open for the life of the fund or an alternative website provided once product marketing has ended and the data room closed; or

- put the disclosure on an investor portal or locked website page.

There is no clear consensus on this yet. We anticipate that a general industry standard will eventually develop. Until then, our view of the current position is as follows.

Pre-contractual disclosures – no disclosures required

Pre-contractual disclosures should not apply to products which are no longer being marketed because those disclosures are intended for investors’ consideration before contractually committing to make an investment.

Website disclosures and ongoing reporting – disclosures required

SFDR applies for the life of a product – it does not distinguish between products currently being marketed and those no longer being marketed. Therefore, a straight reading of SFDR requires a firm to make ongoing website and reporting disclosures article 8 and 9 products regardless of whether they are still being marketed.

N.B. Compliance with the SFDR would only be required if the article 8 or 9 product in question had been actively marketed to the EU investors admitted to the product (i.e. they did not invest following a reverse solicitation).

The periodic reporting requirement for article 8 and 9 products comes into effect on 1 January 2022. This means that firms will need to compile information from 10 March 2021 to a date which falls shortly before the first report which is published after 1 January 2022 (e.g. the annual report for AIFs), in order to include information relating to that reference period within the report, and then annually thereafter. Firms should clarify in the periodic reporting what reference period the data covers.

By contrast, the first reference period for PAI reporting (for those firms considering PAIs from 10 March 2021) is 1 January 2022 to 31 December 2022 in order to publish a PAI statement including data on adverse sustainability indicators by 30 June 2023 – see question "What is the timeframe for disclosing PAIs?".

The UK position

HM Treasury’s recent consultation on its “Review of the UK Funds Regime” notes that the UK Government is considering whether to implement SFDR in the UK.

The FCA’s Director of Strategy Richard Monks has said in a speech that the regulator is working closely with UK Government to implement the ambitions of the EU’s Sustainable Finance Action Plan – recognising the benefits of an internationally aligned approach – but taking a more principles-and outcomes-based approach. The FCA’s immediate areas of focus are implementing the ambitions of SFDR and Taxonomy Regulation.

We do expect some divergence between the UK’s approach and SFDR but there is limited visibility at present on the degree of such divergence.

The FCA will consult on any changes they propose before introducing any new rules. This will give UK firms enough time to prepare to make any regulatory ESG disclosures in the UK.

Get in touch

Related content

See all related content