Asset holding company regime: the ownership condition

09 March 2022The qualifying asset holding company (QAHC) regime, which takes effect from 1 April 2022, should allow UK companies to be used as under the fund asset holding vehicles.

One of the main conditions for entry into the regime is that the QAHC meets the ownership condition, which states that the relevant interests in the company held by non-category A investors must not exceed 30%. The most common route to satisfying the ownership condition will be if a qualifying fund holds a sufficient relevant interest. However, the rules are complex in determining the relevant interests, quantifying them and applying them to fairly standard structures found in practice.

Following several years of stakeholder engagement and consultation, the new UK asset holding company regime is ready to launch. From 1 April 2022, qualifying asset holding companies (QAHCs) will be able to elect into a new bespoke tax regime, offering investment funds the opportunity to base their under the fund investment holding structures in the UK, rather than in locations such as Luxembourg or Ireland.

The reasons for the introduction and the benefits on offer under the regime are well rehearsed (see ‘The UK asset holding company regime: a quacking idea!’ (James McCredie), Tax Journal, 2 September 2021). Instead, this article concentrates on the ownership condition which will in effect determine whether a QAHC can be used. The legislation is contained in Sch 2 of Finance (No. 2) Bill 2022 which is approaching royal assent. The legislation is effectively in final form, at least for this legislative cycle.

Ownership condition and relevant interests

One of the main conditions for entry into the regime is that the QAHC meets the ownership condition under para 3(1). This states that the relevant interests in the company held by non-category A (i.e. bad) investors must not exceed 30%. The 30% limit is applied to the class of securities where the QAHC has issued securities (which are not fixed rate preference shares or normal commercial loans), tracking particular profits or assets (para 3(1)(b)). It is therefore necessary to avoid issuing tracking securities where there is a risk that they might become more than 30% owned by a non-category A investor, as that would exclude the whole company from the regime. We will come back to the definition of category A investor later in the article; first, though, it is necessary to identify who owns the relevant interests in the company.

A holder of relevant interests is a person who either directly or, in limited circumstances, indirectly is beneficially entitled to either:

- part of the profits or assets of the QAHC that would be distributed to equity holders of the QAHC; or

- part of the voting power in the QAHC attaching to an interest in the profits or assets of the QAHC.

(An equity holder for these purposes is a person who holds ordinary shares in the QAHC or is a loan creditor in respect of a non-normal commercial loan.)

Save where:

- it is necessary to trace through a shareholder as a result of either (a) one of the indirect scenarios applying or (b) the shareholder being a partnership or trust which is not a qualifying fund; or

- where non-shareholders hold profit participating debt in the QAHC, the holders of relevant interests in a QAHC will be its direct shareholders.

Tracing indirect interests

There are only limited circumstances where indirect interests can be relevant interests.

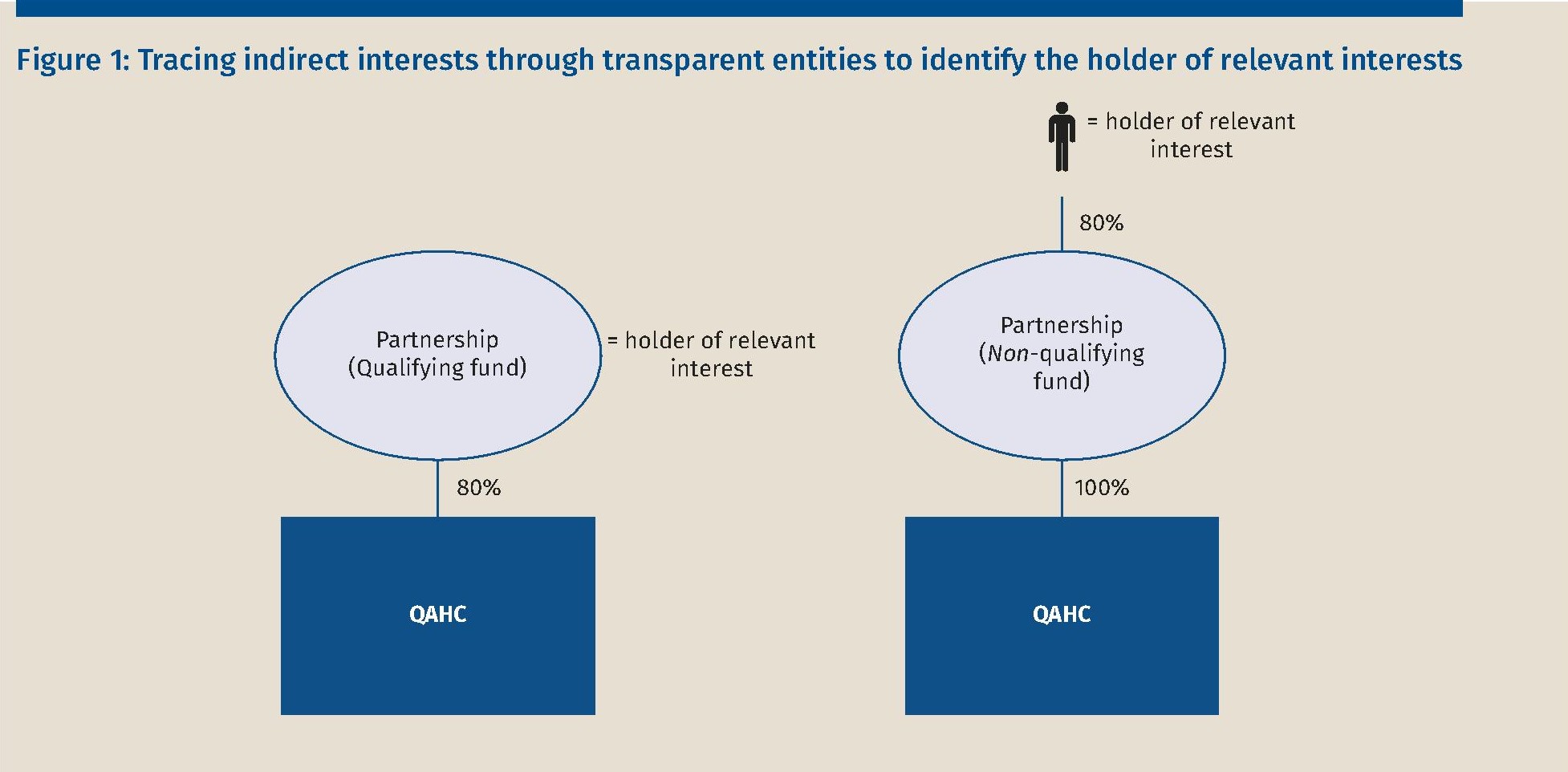

First, unless it is a partnership which is a qualifying fund, it is necessary to trace through partnerships and bare trusts to identify the relevant interests in the QAHC (see figure 1). While the general rule is that you do not trace through a qualifying fund, an interest held via a qualifying fund can still be a relevant interest for the purposes of the ‘directly or indirectly’ rule which we come onto to discuss below. This means that carried interest arrangements within a qualifying fund should not be relevant interests provided the holders are not also direct interest holders in the QAHC (when the ‘directly and indirectly’ rule will be triggered). To avoid having to measure such interests, it is therefore preferable to avoid carried interest holders in a fund also being a direct shareholder in an QAHC.

Where a partnership or bare trust is looked through in order to identify holders of indirect interests, any management fee priority profit share in that arrangement is ignored (para 6(5)) and voting rights attached to securities held by the partnership/trust are deemed held by participants in line with their entitlement to the related economics of those securities.

An indirect interest only otherwise counts as a relevant interest where it is held either: (i) solely through one or more QAHC (the QAHC tier scenario) or (ii) where it is held indirectly otherwise than through one or more QAHC and the person also holds an interest directly in

the QAHC or through a connected company which is not a QAHC and which has a direct economic interest in the QAHC (the ‘directly or indirectly’ scenario).

The application of the "directly and indirectly" scenario is supplemented by para 4(3) which treats indirect (otherwise than via a QAHC) economic interests held by a person (who is neither a company nor a category A investor) who is connected to another person as an indirect interest held by that person for the purposes of the "directly and indirectly" scenario if those interests would not otherwise be counted as relevant interests in the QAHC.

For the purposes of determining relevant interests, two persons are connected with each other if they are for the purposes of CTA 2010 ss 1122 and 1123. This is a very broad rule which includes treating all partners in a partnership as connected with each other with and that connection is only ignored if the partnership in question is a qualifying fund.

Where a person has a relevant interest in more than one of the profits, assets and/or votes of the QAHC, the highest of those percentages is taken as their relevant interest with the result that the aggregate relevant interests in a QAHC can add up to more than 100%.

The "directly and indirectly" scenario is an anti-fragmentation rule which seeks to prevent a direct non-category A investor bifurcating their interest and holding part of it through (for example) a qualifying fund such that it would not otherwise count as a bad interest. The indirect interest is then effectively added to the person’s direct interest.

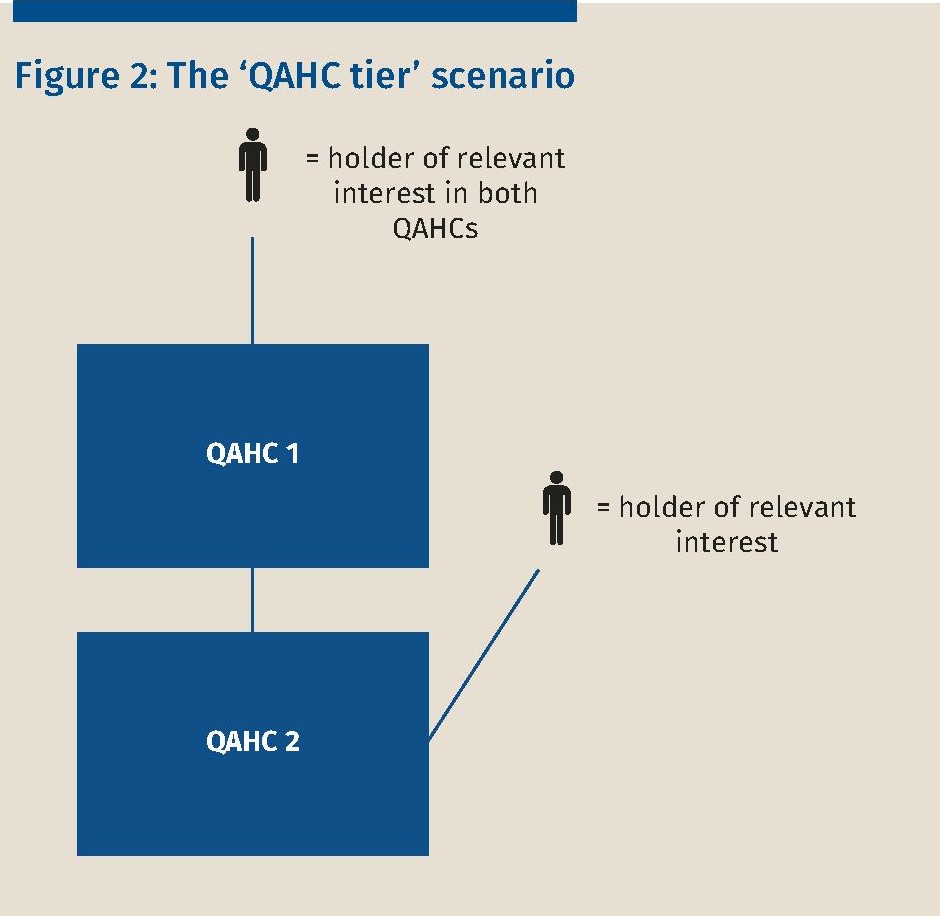

While the rules do allow for a stack of intermediate companies to qualify, the ‘QAHC tier’ scenario (figure 2) is designed to stop a group having more than 30% ‘bad investors’ in a QAHC by splitting across more than one tier of QAHC.

Quantifying relevant interests

Having identified the holders of relevant interests, it is necessary to quantify their interests and determine if non-category A investors hold more than 30% or not.

CTA 2010 ss 165, 166 and 169–178 apply for measuring economic rights constituting relevant interests. This is the amount that the person would be beneficially entitled to on a distribution to the equity holders of the QAHC of its total profits for the relevant accounting period or its net assets on a winding up.

Where a person has a beneficial entitlement to profits as a result of carried interest arrangements which carry a variable entitlement to profits it is necessary to use the maximum entitlement over the life of the arrangements not the actual proportion at any one time. Where the carried interest is within a qualifying fund, this rule will be irrelevant unless the "directly and indirectly" scenario applies.

In relation to measuring votes, this is by reference to the ability to vote on a standard resolution at a company’s general meeting or equivalent.

Category A investors: what makes an investor good?

The ownership condition requires that persons other than category A investors must not exceed 30%. The list of category A investors is set out in para 8 and essentially comprises five groups, which includes:

- qualifying funds;

- QAHCs;

- certain other intermediate companies;

- qualifying investors that include UK or overseas pension schemes, authorised life insurance companies, entities benefiting from sovereign immunity, and charities unconnected to the individuals managing the QAHC; and

- UK public authorities.

Qualifying funds

The most common route to satisfying the ownership condition will be if a qualifying fund holds a sufficient relevant interest. A qualifying fund is defined by the following three tests:

- a collective investment scheme (CIS, as defined in FSMA 2000 s 235) that meets the genuine diversity of ownership condition (GDO);

- a CIS or an alternative investment fund (AIF, as defined in AIFM 2013 reg 3) that is not closely held; or

- a CIS or an AIF that is held as to at least 70% by category A investors.

We consider each of these in turn below.

1. CIS and GDO test

Under the QAHC rules, it is only possible for a CIS to satisfy the GDO condition (which are borrowed from the Offshore Funds (Tax) Regulations, SI 2009/3001). A significant advantage of a fund satisfying the GDO condition is that it need not undertake a potentially complex and/or uncertain close company or 70% ownership test analysis, nor (in practice where the fund is closed-ended) need to continually monitor its status in this regard. Furthermore, it may allow widely marketed but narrowly held funds to qualify as a qualifying fund. However, a closed-ended corporate fund is not a CIS and so cannot rely on the GDO condition.

The rules broadly contain three conditions (set out in the break-out box below) and HMRC’s existing guidance in relation to the application to the offshore fund rules is a helpful resource in understanding how the rules will apply.

There is some uncertainty as to how to apply the GDO test where there is a master-feeder structure. While the GDO rules within the offshore fund rules can allow the marketing of a feeder fund to qualify a master fund, that rule requires the feeder fund to be an offshore fund, which a partnership feeder will not be. We have asked HMRC to confirm in guidance that a master fund can satisfy GDO by reference to the activities of its partnership feeders where they operate as a single fund.

2. Non-close test

If it is not possible to qualify the fund under the CIS and GDO category, then there are two alternatives. The first is the non-close test which allows both CISs and AIFs to be a qualifying fund if it can be determined that it is not held closely i.e., whether it is under the control of five or fewer participators.

Control for these purposes is defined as a person who:

- exercises, or is able to exercise or entitled to acquire direct or indirect control over the company’s affairs; or has possession or entitlement to acquire:

- the majority of the voting power of the company;

- issued share capital carrying the right to the majority of the income distributable to participators; or

- the right to the majority of assets of the company were they to be distributed amongst participators.

There is another test of control which similarly looks to the possession or the right to acquire the right to the majority of assets on distribution to participators on a winding up (either including or excluding rights held as a loan creditor).

While under the general close company test a participator includes both a shareholder and other interest holders in the income or capital of a company including a loan creditor (other than a bank lending in the ordinary course of its business). For the purposes of the QAHC rules the right a person has as a creditor in respect of a normal commercial loan is ignored in determining these economic tests. In a fund, participators are therefore likely to only include shareholders/partners and holders of profit participating debt.

There are various special rules that apply on top of the normal close company test. These are:

- a vehicle cannot be close just because of the control of a manager/general partner of the fund;

- any management fee priority profit share is ignored in determining the rights of participators; any carried interest is treated as a fixed percentage (being the maximum overall profit share) throughout the life of the fund; and votes held by a feeder partnership are treated as held by the participants in line with their economics; and

- while partnerships feeding into a fund should be traced through for these purposes, it is not possible to trace through a corporate feeder.

While there are various attribution rules that can operate to effectively increase a person’s stake size (for example, by treating them as also holding an associate’s interest, interests of a company controlled by the person, or interests they have the right to acquire in the future), the normal attribution rules which apply to persons in partnership with each other are switched off leaving attribution rules which should not apply very often in practice. The exclusion of connection via partnership is obviously an essential amendment in this context given the prevalence of partnerships in the funds world.

In summary, the QAHC non-close test requires you to look at the fund vehicle being tested, identify the investors in it by tracing through partnerships but not companies, exclude the voting and GPS/management fee interests held by the manager, treat the carried interest held by those in connection with the provision of investment management services as a constant percentage and ask whether the largest five interest holders add up to more than 50% by economics or vote. Most funds which are widely held should be non-close on this basis.

While some may observe that the non-close test in theory needs to be constantly monitored and it may be difficult to get perfect information for the purposes of the assessment, the reality is that a manager is not going to use this provision to seek to qualify as a QAHC if the situation is in any way close to the line and as such the operation should be manageable in practice.

3. 70% category A investor test

If it is not possible for the fund to qualify under the previous two tests, there is a third route for funds to qualify as a category A investor. The third test looks at whether the fund is controlled by at least 70% category A investors.

Under the 70% category A investor qualifying fund test, a fund (again defined as a CIS or AIF) is 70% controlled by category A investors if one or more of them directly or indirectly possesses:

- 70% or more of the voting power in the fund;

- so much of the fund as would, on the assumption that the whole of the income of the fund were distributed among persons with interests in the fund, entitle that investor or those investors to receive 70% or more of the amount so distributed; and

- such rights as would entitle that investor or those investors, in the event of the winding up of the fund or in any other circumstances, to receive 70% or more of the assets of the fund which would then be available for distribution among persons with interests in it. These tests are the same as the close company tests with the following differences and points to note.

- While the question of whether investors have voting power is not critical to the close test, it is necessary to conclude that they do for the purposes of the 70% test and then to determine how to measure voting power. A fund will usually be controlled by a manager/general partner, so investors will usually be given voting rights on certain matters and HMRC regard that as both sufficient and the voting power to be measured in this context.

- While for the close test there is no tracing through corporates, for the 70% test is it possible to trace through any number of body corporates (although the rules do not tell you how to do so where the body corporates have more complex ownership structures).

- While for the close test, you trace through all partnerships, for the 70% test you do not trace through a transparent CIS that meets the GDO condition.

- Like the close company test, in determining economic rights, it is necessary to ignore any interest any person has as a creditor of the fund in respect of a normal commercial loan.

As the 70% category A test includes carried interest entitlements (who will not be held by category A investors), it is really a 90% test where there is a 20% carry. As such, it is likely to be limited to funds of one (or maybe a few) or, for example, where a master fund does not qualify under GDO but where it is owned by feeder funds which do satisfy the GDO test.

Examples to watch out for in practice

With any new set of rules there will clearly be anomalies. A couple we have identified and alerted HMRC about involve the application to parallel funds and intermediate holding companies, which we hope will be fixed in subsequent updates to the legislation.

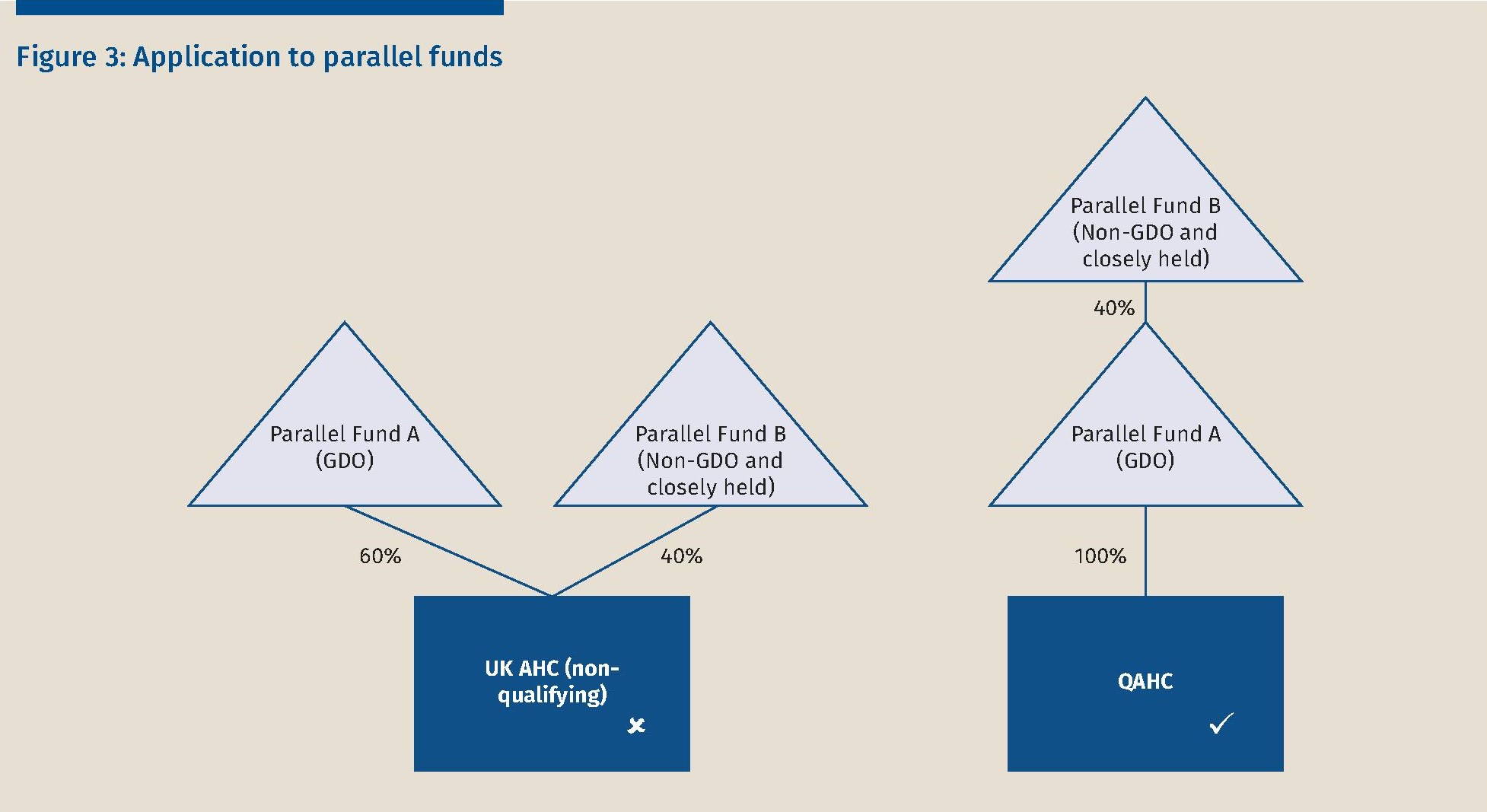

Taking parallel funds first, the issue is that they would not seem to be looked at as one entity even if they are effectively one fund. In figure 3, the structure on the left ostensibly does not qualify as the AHC is only held 60% by a qualifying fund. Perversely, if the non-qualifying fund becomes a feeder into the qualifying fund (structure on the right in figure 3) then it would be possible to qualify as the qualifying GDO fund effectively cleanses the feeder fund. We see no reason why parallel partnerships should not be treated as a single fund where they are operated as a single fund and it is possible, at least in relation to the GDO test, that HMRC might provide something helpful on this point in guidance. Failing that, it has said it will revisit this point in the future.

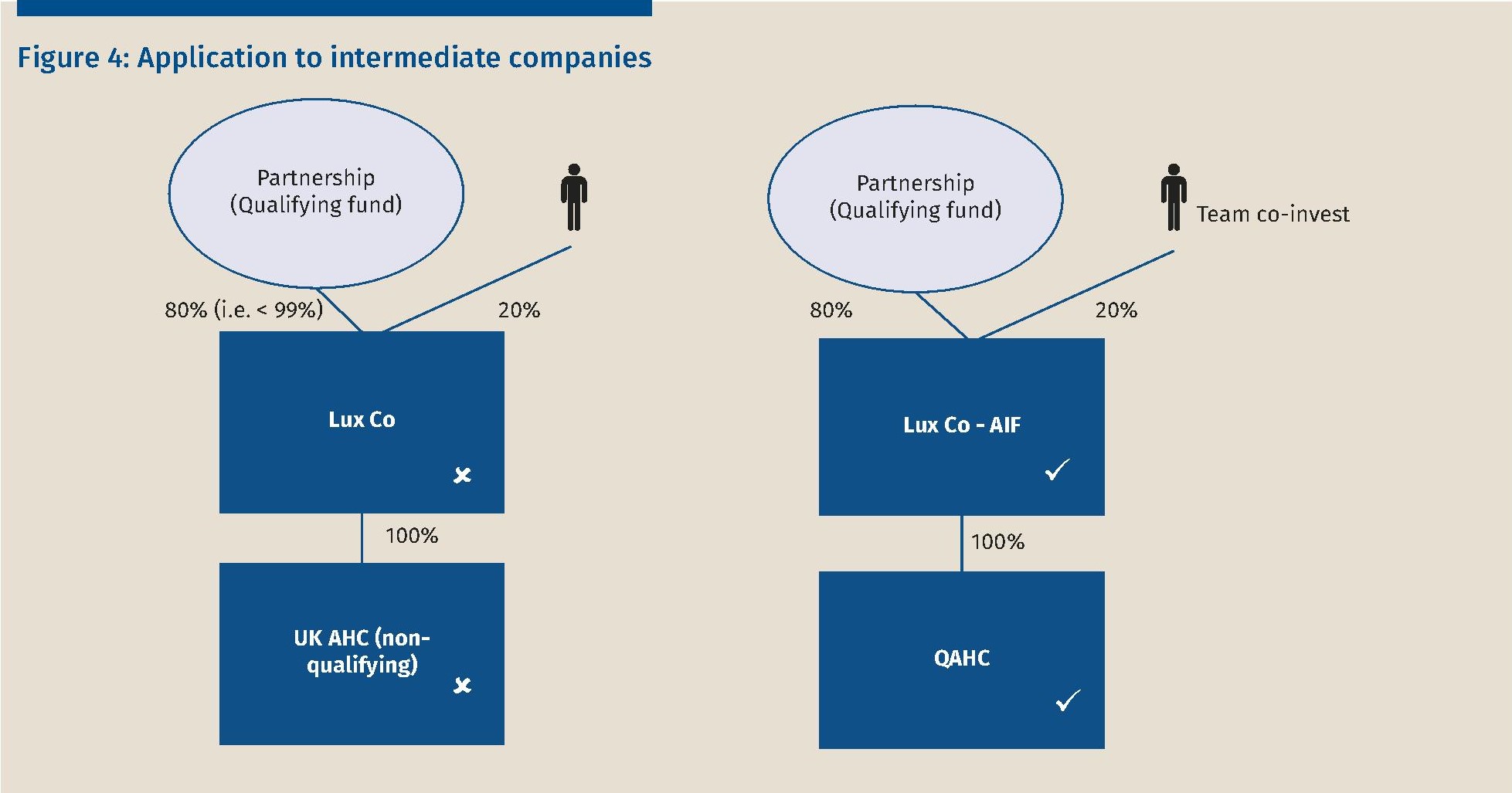

As set out above, generally there is no way to trace through a (non-QAHC) company owning a QAHC to reach a category A investor. The exception to this is to provision for an intermediate company to be a category A investor. However, an intermediate company (for example, a Luxembourg AHC between the fund and the UK AHC) must be 99% owned by category A investors (under para 11(2)). This sets a strict test which would not allow any meaningful co-investment by non-category A investors in the Luxembourg AHC. This will in practice likely limit the use of the intermediate company limb to where the Luxembourg intermediate AHC is wholly owned by one or more category A investor. The exception to this would be where the Lux AHC is an AIF (for example, a RAIF (reserved alternative investment fund)) in which case it could be a qualifying fund in its own right if it is held non-closely or it meets the 70% category A investor test.

In the example in figure 4 the Lux AHC is held by more than 70% category A investors so would be a qualifying fund enabling the UK AHC to qualify for the QAHC regime.

It is hoped that the 99% requirement will be relaxed in the future as there does not seem to be a good policy reason for the higher requirement provided the look through ownership of the QAHC by category A investors does not drop below 70%.

Final thoughts

Clearly the ownership condition is not for the faint hearted. Obligingly, the rules do allow for situations where the ownership condition is not met initially, but is ultimately met, and so a company may elect into the QAHC regime where it reasonably expects the conditions to be met within a two-year time period, for example where negotiations are ongoing with certain category A investors. Similarly, if the ownership condition is failed during the life of the QAHC there are provisions allowing the breach to be cured. However, welcome as these provisions are, we struggle to see a situation where a structure would be set up if you thought you would need to rely on these provisions.

The ownership test is overly complicated, but it should allow the vast majority of fund structures to use a UK AHC. This should allow the regime to get off the ground, and the hope is that the regime will be made more accessible in the future as HMRC get more comfortable with the risks it represents. The silver lining of the complexity of the ownership condition (other than the work it represents for advisers!) is that it should mean that the regime is seen as not open to abuse and therefore not vulnerable to future removal on a change of government.

Get in touch