QAHC changes

21 July 2022The QAHC regime has been in force since 1 April 2022. As we have pointed out in the past, the ownership test had a number of gaps in coverage on launch and the government has made some improvements to the rules as part of the proposed Finance Bill 2023 legislation released on L-day yesterday (20 July). The government also took the opportunity to close down a potential loophole.

By way of recap, to enter the QAHC regime you need to ensure your proposed QAHC is at least 70% owned by one or more Category A investor, typically a qualifying fund. A qualifying fund is a CIS or AIF which is either non-close, at least 70% owned by qualifying investors or (if a CIS) satisfies the (prescriptive) widely marketed (GDO) test.

Being a qualifying fund by reason of GDO is helpful for various reasons including (i) in a closed ended fund it is pretty much a once and for all test without the fiddliness and ongoing compliance of the non-close test; (ii) it operates well with the 70% test in that it is not necessary to trace through a GDO qualifying fund for that purpose, whereas it is necessary to trace through a fund that is otherwise qualifying. Not tracing through a qualifying fund for the purposes of the 70% test allows you to ignore non-Category A investors at the level of a GDO feeder fund.

There were a number of issues with the original GDO rules.

- Only a CIS could satisfy GDO with the definition of CIS taking the FSMA definition. This excludes a body corporate (other than an OEIC or a UK LLP) and therefore excludes partnerships which are body corporates under their local law. While not beyond doubt, there is a concern that a Delaware limited partnership is a body corporate and so could not satisfy GDO. The proposed change (taking effect from the inception of the rules) seeks to deal with that issue by providing that an entity is a CIS if the only reason it would not be is that it is a body corporate. While that clearly deals with the Delaware LP issue, it goes further and would appear to bring corporate funds more generally into the CIS definition, and also potentially asset holding companies. That final implication could have the effect of making the intermediate company provisions (which are narrowly cast) somewhat obsolete and that is probably not intended. It may be that, as part of the legislative process, this change is “clarified” so that it just addresses the Delaware LP type situation (i.e. partnerships which are body corporates) and perhaps the corporate fund situation but not wider possibilities.

- The original rules did not work well where a fund was structured as a series of parallel partnerships where one satisfied GDO but the other (representing more than 30% of the fund, and so the QAHC) was not a qualifying fund. If the non-qualifying parallel were structured as a feeder into the GDO fund, the entire fund would be treated as a GDO fund (as it is not necessary to trace through a qualifying fund). We had suggested the government fix this by adopting the associated investment scheme definition in the IBCI rules however HMRC regarded that as too broad and the proposed definition of a parallel fund (which is treated as satisfying the diversity of ownership condition if it is parallel to a GDO fund) is very tightly defined and includes seven (!) conditions. This proposed change will take effect from a date to be set but not later than Royal Assent of Finance Bill 2023. It is currently too narrow to allow for differences which should not offend HMRC (for example, different sharing ratios due to the operation of excuse rights, FX movements or defaulting investors). It also does not help the situation where the qualifying fund qualifies on the basis of non-close. The provision also does not deem the parallel fund to satisfy GDO (just the general diversity of ownership condition) and so it would be necessary to trace through it for the purposes of the 70% ownership test (a fact that feels like the wrong answer and that we will be suggesting is changed). Nevertheless, with the other broadening of GDO discussed below, it is a welcome change, especially if we can get some (what we would regard as sensible) changes to the conditions.

- HMRC’s view is that marketing of a feeder fund did not qualify as marketing by a master fund for the purposes of qualifying the master fund as a GDO qualifying fund. While the GDO rules have provisions which allow feeder fund marketing to qualify a master fund, these are narrowly cast and do not apply to partnership feeders. HMRC has sought to address this issue by providing that where all of the interest holders in a master fund satisfy GDO (or are treated as doing so as a result of the parallel partnership change referred to above), the master fund is treated as satisfying GDO. This amendment is too narrow as in that situation the master fund would be a qualifying fund anyway (100% owned by qualifying funds) and, for example, it would not apply where a carried interest is taken out at the master fund level or house or team co-investment is made at that level. Again, we hope to be able to improve this change before it is finalised. This change will take effect from the same date as the main parallel fund changes.

The changes shine a light on an issue which continues to dog the regime. The ownership condition is so complicated and prescribed that it cannot possibly pick up all of the variations that exist in fund structures. They work in the example the draftsperson had in mind when drafting the rules, but small differences from that situation (which inevitably arise in the fluid world of alternative investment management) disqualify a structure. These changes represent progress and we are sure they will be further improved during the legislative process to minimise the situations where commercially equivalent structures end up on different sides of the eligibility divide without an obviously good reason.

Finally, the government has taken the opportunity to tidy up an anomaly in the rules which can be seen from the below example. The point can best be understood in the context of seeking to qualify a QAHC where there is below the fund team co-investment. Assume, in that situation, a fund wanted to make an investment through a QAHC (which would be established to solely hold a particular investment), with the team-co-investors and a third party co-investor also participating in that QAHC.

The fund partnership in this instance is a qualifying fund, and the third-party co-investor is not a Category A investor.

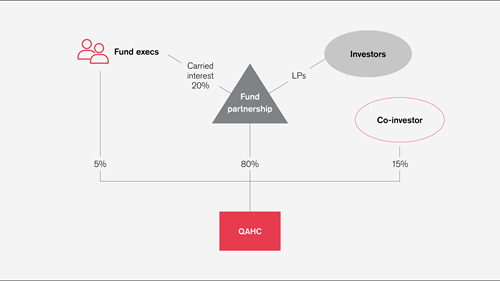

Single QAHC structure

The initial structure proposed was as follows:

The relevant interests held in the QAHC shown above would be as follows:

- the fund, as a Category A investor, will hold 80%;

- the third party co-investor will hold 15%; and

- the fund executives will together be treated as holding (i) 5% in respect of their direct stakes in the QAHC; and (ii) 16% (being 20% x 80%) in respect of their indirect holdings by virtue of receiving carried interest from the fund partnership (by application of the rule at para 4(1)(b)(ii)).

Therefore, the total percentage of relevant interests in the QAHC held by non-Category A investors is 36%, meaning that the ownership condition would not be met.

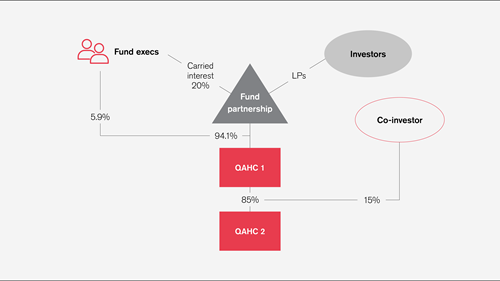

Double QAHC structure

Alternatively, a double stack QAHC structure could have been implemented which achieves the same economic effect:

The relevant interests in QAHC 1 shown above will be as follows:

- the fund, as a Category A investor, will hold 94.1%; and

- the fund executives will together be treated as holding (i) 5.9% in respect of their direct stakes in QAHC 1; and (ii) 16% (being 20% x 94.1% x 85%) in respect of their indirect holdings by virtue of receiving carried interest from the fund partnership (by application of the rule at para 4(1)(b)(ii)).

The ownership condition should therefore be met in respect of QAHC 1 as its relevant interests are less than 30% held by investors that are not Category A investors.

The relevant interests in QAHC 2 shown above will be as follows:

- QAHC 1, as a category A investor, will hold 85%;

- the third party co-investor will hold 15%; and

- the fund executives will together be treated as holding 5% as a result of their stake in QAHC 1 (by application of the rule at para 4(1)(c), which does not require indirect holdings in QAHC 1 to be considered).

The ownership condition should therefore be met in respect of QAHC 2 as its relevant interests are less than 30% held by investors that are not Category A investors. This anomaly has been closed down by a new provision (effective from 20 July but not impacting existing structures) that treats the fund executives as direct shareholders of QAHC 2 so that their indirect interests are also brought into account, as with the single tier structure.

A reader might ask what is the solution in that situation – and the answer is to set up a CIS below the main fund in which the main fund partnership and team co-investors (and perhaps even the co-investor) participate in the deal. That should be capable of being a qualifying fund (by virtue of being owned as to at least 70% by a qualifying fund – the main fund) such that the QAHC is more than 70% owned by Category A investors with the team co-investment no longer being a direct holding which triggers the directly and indirectly rule. Avoiding the directly or indirectly rule is generally to be advised as, with its broad connection test including partners in non-qualifying partnerships, it is somewhat a can of worms.

Get in touch