Unpacking Pillar Two: Administration

18 July 2022Chapter 8 of the Pillar Two model rules deals with administrative aspects of the GloBE Rules. Much of the detail of these provisions remains to be determined, but the rules, commentary, and consultation provide an indication of the direction of travel.

It is hard to make administration sound exciting, but taking up only a few pages of the rules, it is nonetheless an important chapter for MNE groups to become familiar with as it governs how they will need to incorporate Pillar 2 into their annual tax compliance process. This article sets out, in a nutshell, what the administrative provisions do, and identifies certain areas that will bear further consideration depending on the circumstances of the particular group and the outcome of the OECD’s recent public consultation on these provisions.

GloBE Information Returns

Who is required to file a GloBE Information Return (a Return)?

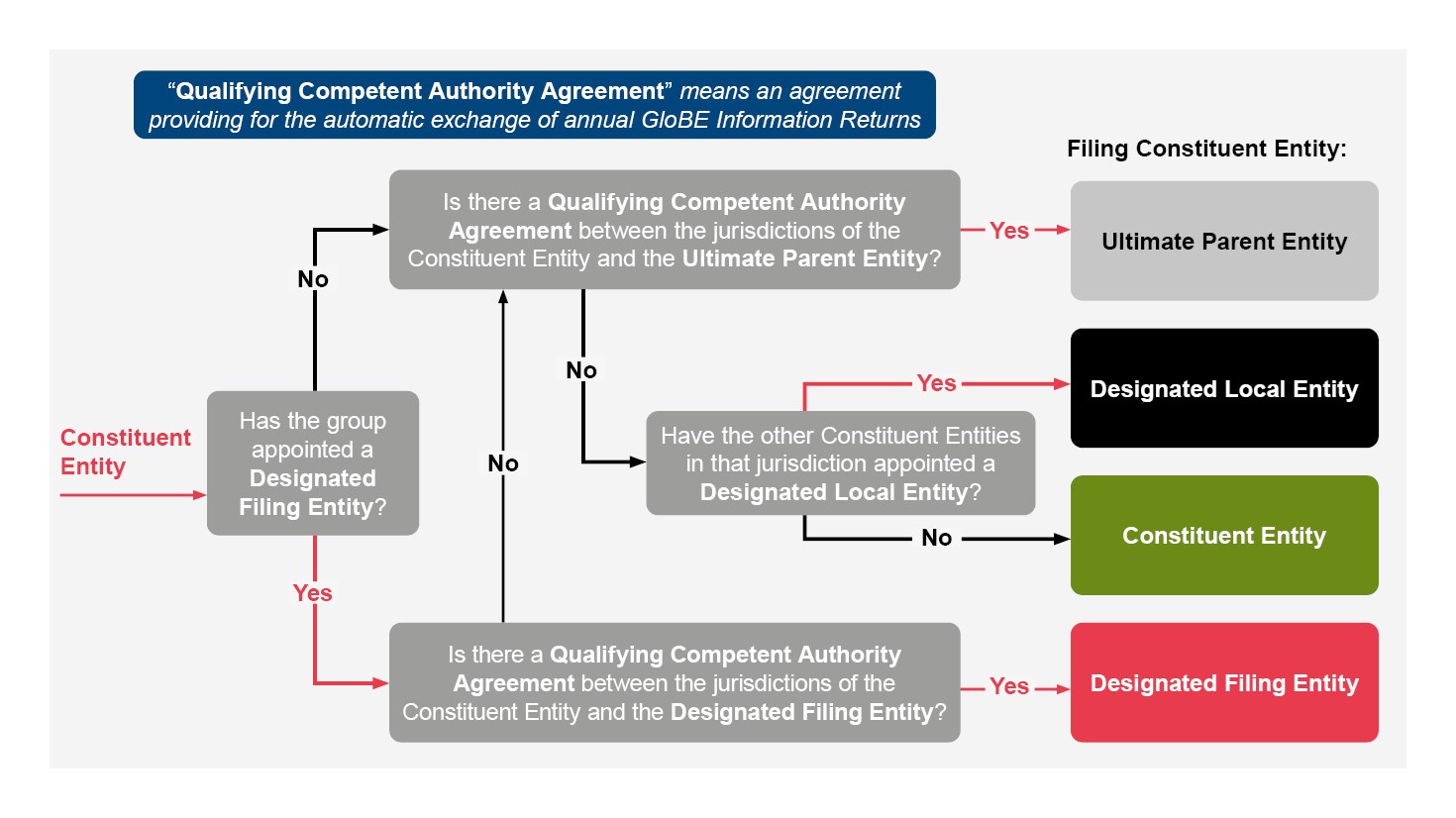

The starting point is that each Constituent Entity must file a Return, however this obligation is relaxed if the Return is filed by the Ultimate Parent Entity (UPE) or a Designated Filing Entity in a jurisdiction that has a Qualifying Competent Authority Agreement (QCAA) in effect. Ideally groups will want to minimise the number of Returns they need to make. For some groups this could be as simple as the UPE making a single return, which will often make most sense from a governance perspective, particularly for UPEs that already have much of the information from preparing their consolidated accounts. However, the challenge here will be for larger MNE groups operating across a wide variety of jurisdictions to identify as few entities as possible to make Returns if the jurisdiction of the UPE does not have QCAAs with the jurisdictions of all of its Constituent Entities.

The commentary suggests that existing arrangements such as double tax treaties and tax information exchange agreements that give legal authority for the automatic exchange of tax information between jurisdictions may be capable of being QCAAs if they enable the exchange of GloBE information. This allows MNE groups to start thinking about how they might collect the relevant information internally and which entities will report. In the absence of an existing agreement that qualifies, amendments may be necessary and new QCAAs may be developed as part of the “Implementation Framework”, due to be released later this year following a public consultation by the OECD that closed in April.

What must the Return contain?

A standard template for Returns is due to be developed, but it will include the following information:

- all Constituent Entities, including tax identification numbers, jurisdictions, and status under the GloBE Rules (e.g. a JV, Flow-through Entity, PE, etc.);

- details of the corporate structure of the MNE Group, showing Controlling Interests held by Constituent Entities in other Constituent Entities;

- information necessary to compute each jurisdiction’s effective tax rate (ETR), each Top-up Tax, the allocation of Top-Up Tax under the IIR, and the UTPR Top-Up Tax amount to each jurisdiction; and

- a record of any elections made under the GloBE Rules.

When must the Return be filed?

The deadline is 15 months after the last day of the relevant reporting year, which is the accounting period for which the UPE’s consolidated financial statements are prepared. It is very likely that this reporting deadline will be out of sync with domestic reporting obligations. This is recognised in the UK government’s consultation on implementation where they acknowledge reporting Pillar 2 liabilities could either be taken directly from the Return or from what is reported in the Corporation Tax return. The consultation says that, for the first year, the deadline will be increased to 18 months to allow additional time for groups setting up their compliance systems. The UK is also proposing a new registration process to alert HMRC that a group is within scope of the rules. This could fall as early as 6 months after the end of the financial reporting year.

What are the consequences of breaching these requirements? What confidentiality provisions apply to the Return?

Rules concerning filing and payment including penalties, sanctions, confidentiality, and time limits will be left to the determination of each implementing jurisdiction. However, the commentary does note that the Returns and the information contained in them will have at least the same level of protection as information obtained through domestic tax returns, and where subject to automatic exchange, will be subject to the confidentiality rules contained in the QCAA.

Safe Harbours

In recognition of the compliance burden that the GloBE rules present, safe harbours are being actively considered by the OECD for circumstances where the operations are likely to be taxable at or above the minimum rate. If a GloBE Safe Harbour is available it would deem the Top-up Tax for a jurisdiction to be zero for a particular year if the Constituent Entities in that jurisdiction meet certain eligibility criteria.

In anticipation of the safe harbour rules, Chapter 8 explains how the administration will operate. It states that whichever entity is responsible for filing the Return (see above) must make an annual election if the Safe Harbour is to apply.

A Safe Harbour election will not be effective where the Top-up Tax could have been allocated to the safe harbour jurisdiction if the ETR were below the Minimum Rate and the entity or entities that would have been liable to the Top-up Tax (the Liable Entity) are unable to demonstrate that eligibility for the Safe Harbour was not materially affected by certain facts and circumstances raised by the relevant tax authority.

The tax authority has 36 months from the date the Return was filed to notify the Liable Entity of the facts and circumstances it has identified, and the Liable Entity then has 6 months to respond successfully.

The conditions for any Safe Harbours are due to be developed and released this year in the Implementation Framework. In terms of how the Safe Harbours could be structured, common views expressed by stakeholders as part of the OECD’s public consultation on Pillar Two administration included:

- use of country-by-country reporting data to identify and exclude jurisdictions as those with an ETR higher than e.g.15% plus a margin; or

- exempting from the need to compute ETR jurisdictions that have introduced a qualifying Domestic Minimum Tax.

It remains to be seen what Safe Harbours might be acceptable to the Inclusive Framework countries.

Administrative Guidance

Tax authorities will be able to co-ordinate their application of the GloBE Rules by developing “Agreed Administrative Guidance”. None has been agreed or published to date.

Implementation Framework

Many of the administrative aspects of Pillar Two are due to be developed through consultation with businesses and stakeholders, with an Implementation Framework due to be published in 2022. The OECD’s public consultation closed in April this year, but no formal proposals were made and a formal release date for the Implementation Framework is yet to be announced. Until then, MNE groups will at least be able to start identifying their Filing Constituent Entity (or Entities) and preparing their internal processes accordingly ahead of implementation.

Keep up to date with the latest developments and other useful information on our OECD BEPS 2.0 hubpage.

Get in touch