Unpacking Pillar Two: the future of tax incentives

19 July 2022The OECD’s pillar two GloBE top-up tax proposals are aimed at ensuring large multinationals pay a minimum effective tax rate of 15% on all of their profits. While these rules will most obviously have an impact on groups operating in countries with low corporate income tax rates, they may also be engaged where a group’s tax liabilities are reduced because it benefits from tax reliefs.

Consequently, some governments have signalled their intention not only to implement a domestic minimum tax in order to collect any top-up tax in-country, but also to reconsider the design of their incentives which reduce GloBE ETR. Countries wishing to maintain their tax competitive standing may look to achieve this through means which do not affect GloBE ETR, such as by providing refundable tax credits or subsidies for specific types of expenditure.

How do the GloBE rules deal with reliefs and incentives?

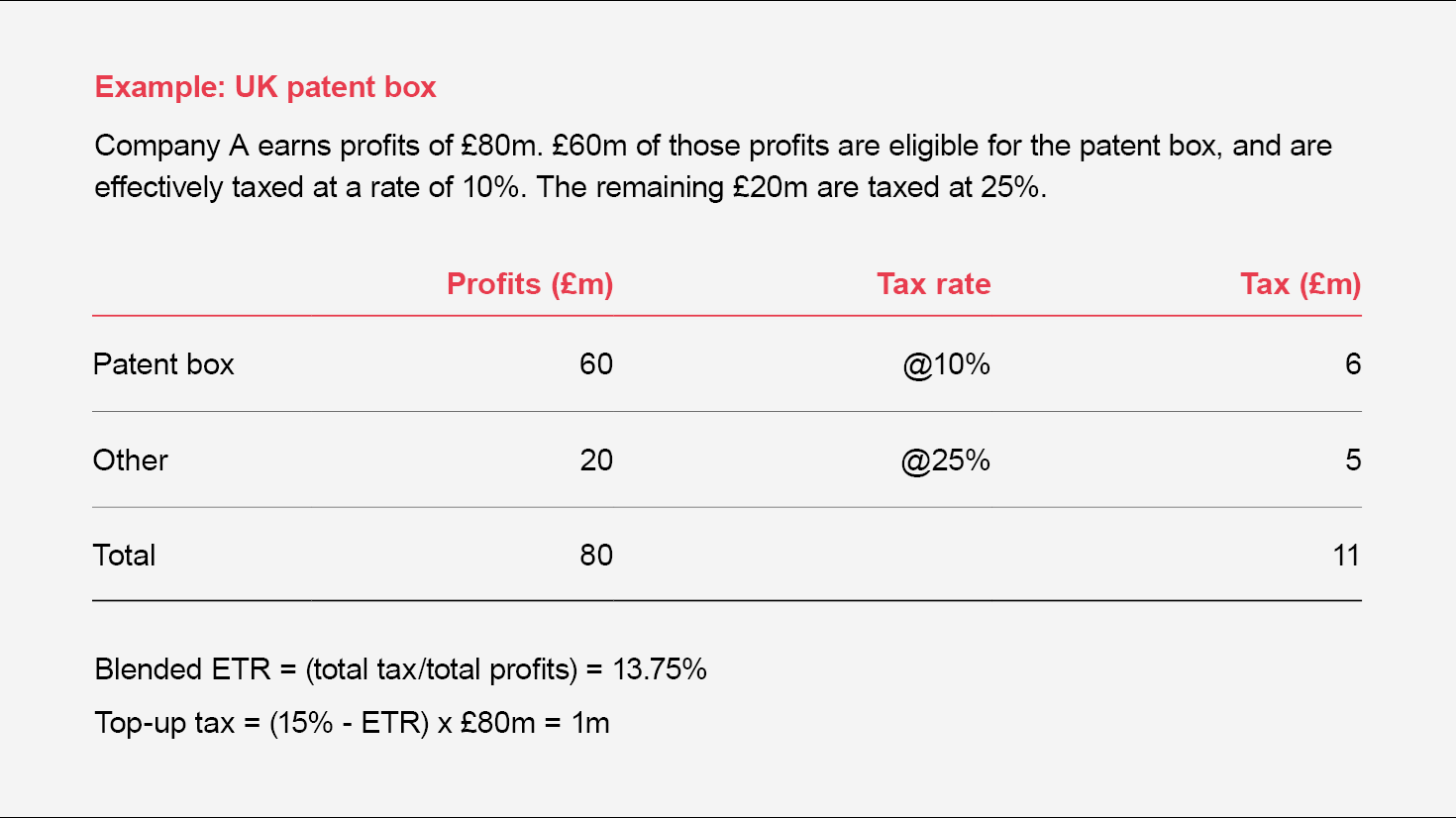

The GloBE rules measure a group’s ETR in each jurisdiction by comparing the income taxes and profits recorded in its accounts. While a small number of adjustments must be made to both figures these are largely technical in nature, and do not replicate the wide range of reliefs and incentives that countries offer through their domestic tax systems. Generally, therefore, reliefs will tend to reduce a group’s effective tax rate (ETR). Where that ETR falls below 15% top-up tax may be due and some of the benefit of the reliefs may effectively be lost (see the example below, which looks at the UK’s patent box). This is a deliberate policy choice: the GloBE rules are intended to apply to all low tax outcomes whether they arise from low nominal rates, how the tax base is defined, or credits that reduce tax liabilities.

Importantly, the rules do not distinguish between reliefs that are intended to encourage socially useful activity, such as investment in green energy, and those that are intended to be instruments of tax competition. This arguably surprising decision means that groups may lose the benefit of tax credits for investing in renewable energy, which has been a particular concern for groups investing in the US, which provides a variety of tax credits for renewables projects.

There are two exceptions to the general position that reliefs reduce ETR.

Firstly, tax reliefs that provide a timing advantage only will not depress a group’s GloBE ETR. That is because groups may include both current and deferred tax liabilities (DTLs) in their covered taxes when determining their ETR. For some specified items, including capital allowances on tangible assets, those DTLs are taken into account without restriction, meaning timing advantages up to a 100% first-year allowance will not reduce ETR. For other items ‘recapture’ rules apply, so that DTLs that have not unwound after five years are adjusted out of the ETR calculation, effectively limiting the duration of the permitted timing advantages.

Secondly, there are special rules that apply to ‘qualified refundable tax credits’ (QRTCs). A QRTC is a tax credit that, under the relevant domestic law, must be paid to the recipient as cash or cash equivalents within four years of the time that the recipient satisfies the conditions for receiving it. The UK’s R&D expenditure credit (RDEC) meets this definition: it is calculated as a fixed percentage of qualifying R&D expenditure and then either applied to satisfy the claimant’s tax liabilities or, if there is an excess, paid in cash.

The GloBE rules treat QRTCs received by a group as income in the ETR calculation, and not as a repayment of or reduction in taxes. This is a favourable outcome for claimant businesses. If, like the RDEC, a QRTC is subject to tax in the hands of the recipient at a rate above the METR then receiving it should not reduce the recipient’s ETR. Even in the case of a QRTC that is not taxable, treating the credit as an addition to income will lead to a much smaller reduction in ETR than if the credit was treated as a tax item.

This approach to QRTCs is based on the view that in substance they are akin to grants or subsidies. While the credits are delivered through the tax system and, to minimise the risk of abuse, the money is required to be applied in satisfaction of tax liabilities before it is paid in cash, fundamentally the credits are a subsidy for expenditure. The benefit that a business receives depends only on its qualifying expenditure, and not on whether it has taxable profits or any other tax attributes. The OECD Inclusive Framework therefore decided it was appropriate to treat QRTCs in the same way as grants, that is as additions to income rather than reductions to covered tax.

Given the favourable treatment of QRTCs, some governments have signalled that they are considering redesigning their incentives. Many businesses are keen for the US to take that approach: the renewable energy credits referred to above are generally non-refundable.

Will the GloBE rules lead governments to curb reliefs?

Tax reliefs are likely to remain a viable policy lever even after the GloBE rules are introduced, so it seems unlikely that governments will abandon them.

Most obviously, groups that are below the €750m revenue threshold will be out of scope of the GloBE rules. Small or medium sized businesses are often those that governments are most keen to support with incentives and some of the most generous reliefs – for example, the UK SME R&D scheme – are only available to SMEs. A significant sphere of relief-giving will therefore be unaffected.

Larger groups will also continue to benefit from reliefs in situations where they have otherwise highly taxed profits and the relief reduces the ETR to 15% (although, as shown by our example, that benefit will be limited if the ETR falls below 15%). Many large groups carry out a variety of activities in each jurisdiction, some of which will qualify for reliefs and some of which will not, so this sort of blending is likely to be common.

Given the constraints that the GloBE rules will put on CIT, it seems likely that countries that wish to maintain a competitive tax environment will look to achieve that through other means.

Governments will naturally be concerned not to provide reliefs that reduce a group’s ETR below 15% leading to a top-up tax being charged in another jurisdiction. That would mean the government providing the relief incurs a ‘deadweight’ cost which does not ultimately result in a benefit for the relief-receiving business. However, the precise effect of reliefs on an individual group’s ETR will be complicated and highly fact dependent. Rather than curbing specific reliefs, therefore, governments may prefer to avoid taxing groups below the minimum ETR by applying a domestic minimum tax (DMT) based on the GloBE model, effectively collecting any top-up tax in-country. Early indications are that governments find this logic compelling: the UK government mooted a DMT proposal in its pillar two consultation document that was published in January, highlighting revenue protection as one element of the policy rationale.

How will countries use tax to compete in the future?

The above is concerned with corporate income tax (CIT) reliefs. Given the constraints that the GloBE rules will put on CIT, it seems likely that countries that wish to maintain a competitive tax environment will look to achieve that through other means once the GloBE rules are in effect.

That could involve implementing a DMT and using their increased CIT receipts to fund:

- reductions in other taxes that are not taken into account in determining GloBE ETR, for example property or payroll taxes;

- new QRTCs for favoured categories of expenditure; or

- traditional grants or subsidies for expenditure.

The GloBE rules put some limits on this. Any measure that explicitly repaid the top-up tax collected under the rules would almost certainly be ineffective – either because it would reduce the tax expense recorded in the group’s accounts, or because it would be regarded as a tax refund requiring adjustment under the GloBE rules that define covered taxes.

Moreover, in order for a country’s implementation of the GloBE rules to be regarded as ‘qualified’ they must not be accompanied by related benefits. Countries will be keen to ensure their rules are qualified: this has the important advantage that other countries are then precluded from applying the back-up undertaxed profits rule to groups parented in that first country. The rules do not include a bright line definition of when a benefit would be regarded as ‘related’, however measures that are provided solely to groups within GloBE, or where the benefits relate directly to the group’s GloBE liability, or which are presented as a quid pro quo for taxation under GloBE are likely to be problematic. Conversely, the OECD commentary on the rules explains that favourable measures that are available to all taxpayers irrespective of whether they are impacted by GloBE are likely to be permissible.

Could a shift in incentives undermine the effectiveness of the GloBE rules?

New reliefs or subsidies of the kinds described above may, in some situations, undermine the effectiveness of the GloBE rules. For example, some countries currently apply low or no CIT regimes to manufacturing businesses. Those businesses are typically asset and payroll heavy. That means they will be sheltered from GloBE to an extent by the substance-based income exclusion, which reduces a group’s profits that are subject to top-up tax by a fixed percentage of its tangible assets and payroll costs. That percentage will reduce to 5% by 2032. It also means that the group has significant costs bases that could benefit from non-CIT reliefs. It is plausible that such countries could put businesses in the same financial position they would have been in through a combination of reductions to property and payroll taxes, and QRTCs or subsidies for investment in physical or human capital.

However, this approach will probably not be able to restore the pre-GloBE financial position of the sorts of classic BEPS arrangements that the GloBE rules are most obviously targeted at, namely low-substance intellectual property holding companies or group finance companies. These sorts of companies carry on activities that, under transfer pricing principles, can earn large profits based on relatively small asset and payroll bases, and while incurring relatively little expenditure. While that can make them effective instruments of tax planning, it also means that they will not derive much benefit from expenditure-based measures. Even extreme reductions in non-CIT liabilities or subsidies for expenditure are unlikely to produce savings that would equate to 15% of such companies’ profits.

Overall, then, while behavioural changes may undermine the rules at the margins, it seems likely that they will be effective in counteracting low-tax outcomes in many of the core situations they are intended to.

Keep up to date with the latest developments and other useful information on our OECD BEPS 2.0 hubpage.

This article was first published in the Tax Journal on 6 July 2022.

Get in touch