Latest QAHC changes in Spring Finance Bill 2023

29 March 2023Several changes to the qualifying asset holding company (QAHC) regime have been anticipated since the Government published draft legislation last summer. Since then, the measures have evolved following discussions with stakeholders with the results now published in the Spring Finance Bill 2023 (Finance (No.2) Bill), published on 23 March 2023.

These amendments - covering aggregator and parallel funds, corporate funds, and listed equities – demonstrate HMRC’s willingness to engage and fix issues as they arise to ensure the QAHC regime is as workable as possible. The main changes have been summarised below.

Aggregator and parallel funds

Teething problems with the QAHC regime have predominantly involved the ownership condition. One aspect has been the ability to utilise the GDO test when there are a number of entities in the structure and not all of them meet the GDO condition. Under the current rules the GDO condition operates on an entity-by-entity basis, however the new rules in the Spring Finance Bill 2023 make an exception to this for multi-vehicle arrangements. This new rule will provide a means for feeder and parallel funds to satisfy the GDO condition if they are party to a multi-vehicle arrangement and the arrangement meets the GDO condition.

Multi-vehicle arrangements are defined as arrangements to which two or more funds are party that result in investors in one of those funds reasonably regarding that investment as an investment in the arrangement as a whole, rather than in any particular fund.

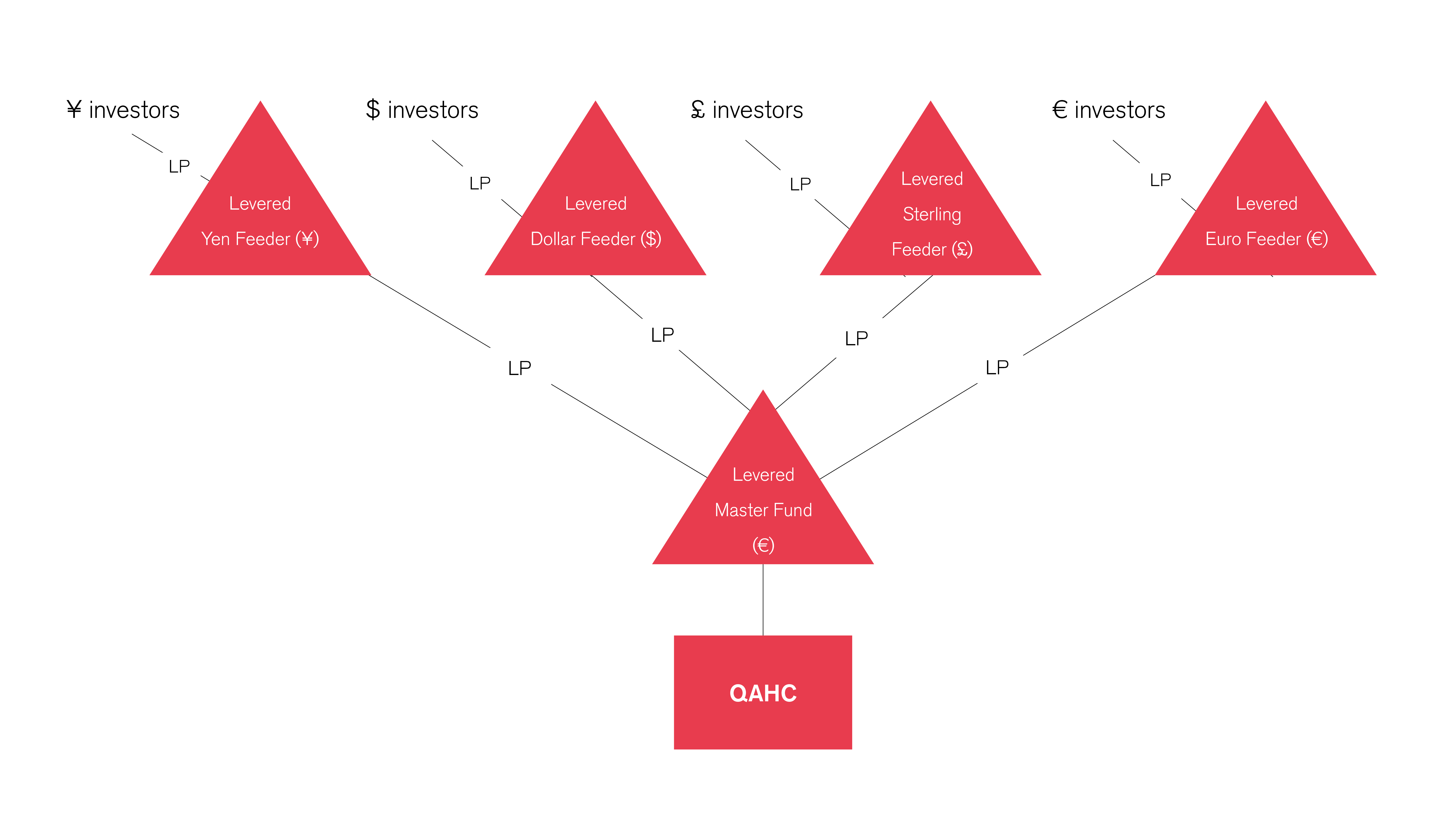

Taking the example below, all five funds (including the Master Fund) are a multi-vehicle arrangement as an investor regards the arrangement as one fund. However, it is still necessary for the arrangement to satisfy the GDO condition which should be possible if a non-fund specific marketing document is produced which markets the “arrangement” but not any particular fund. A PPM produced for the overall fund should adequately satisfy this.

The drafting of the legislation does not prevent other vehicles being added to the arrangement at a later date. Therefore, if a new feeder fund is added just before the final close to accommodate a particular investor’s requirement and is not itself widely marketed, it should qualify as long as the investor regards it as an investment in the arrangement as a whole. In these circumstances, any late additions to the structure should be seen to join the main arrangement and benefit from the GDO badge that those arrangements as a whole satisfy.

The new rules should allow for AIVs to qualify. In its simplest form, we anticipate an AIV set-up to make an investment via a parallel partnership in which all investors come in directly as opposed to via an existing feeder and master fund, will qualify. What’s important is to stand in the shoes of the investor and ask whether they would regard that investment in the arrangement as a whole, rather than exclusively in any particular fund. It will be important to make sure the PPM contemplates subsequent vehicles being added to the fund structure at a later date to support this.

Co-investment vehicles may prove more difficult to qualify under the muti-vehicle arrangement rule if the underlying economics and risk profile that the co-investors are exposed to are different to the main fund. In these circumstances it would be more difficult to argue that that the investment is made in the arrangement as a whole rather than an exclusive part of the fund.

The multi-vehicle arrangement rule will have effect from when the Spring Finance Bill 2023 receives Royal Assent which we expect will be in the summer of 2023.

Corporate funds

Another issue that the government has decided to fix relates to the ownership condition, with a significant and very welcome change that will mean corporate funds will be able to use the GDO condition. Under the existing rules only a CIS can satisfy the GDO condition, however the definition of a CIS under FSMA excludes a body corporate (other than an OEIC or a UK LLP). Up until now, this has meant certain non-UK entities that might be construed as a body corporate (for example a Delaware limited partnership) are excluded from the less onerous GDO qualification route.

The amendment in the Spring Finance Bill 2023 has expanded the type of entities that would be able to meet the GDO condition, as it now includes a CIS or an AIF that is not a CIS only by reason for it being a body corporate. Although HMRC had originally only intended to extend this route to certain partnership entities that have characteristics of a body corporate they have purposefully taken a more liberal approach.

This change of approach is very welcome as it will bring corporate funds more generally into the CIS definition.

This change is deemed to have retrospective effect from the introduction of the regime (1 April 2022).

Listed equities

The Spring Finance Bill 2023 also makes an amendment to the investment strategy condition. The investment strategy condition seeks to ensure that the QAHC does not have an investment strategy that includes the acquisition of listed securities, save for in public to private or IPO situations.

The Spring Finance Bill introduces an easement that would allow the QAHC to hold listed securities and meet the investment strategy condition, however the price of this relaxation is the denial of the distribution exemption. As currently drafted the legislation goes further than expected as it switches off the distribution exemption for all listed securities, disadvantaging holdings of listed securities that would otherwise qualify under the investment strategy condition.

This change will have effect from Royal Assent.

Get in touch