QAHCs: quantifying relevant interests

07 July 2023The UK now has a qualifying asset holding company (QAHC) regime which makes it easier for investment funds to base their investment holding structures in the UK. There are several eligibility conditions for the regime and one of the most complex of these is the ownership condition, which limits the relevant interests in a QAHC held by non-Category A investors to 30%.

To determine if more than 30% of relevant interests in a QAHC are held otherwise than by Category A investors, you need to identify and quantify the holders of relevant interests in the company. We look at a practical example below to demonstrate how the rules can catch out investment managers who route co-invest into their asset holding companies directly, rather than through the fund.

We have looked at relevant interests in detail in our guide on the QAHC regime, but as a reminder, a person will have a "relevant interest" if they have an interest in the company such that they:

- are beneficially entitled to a proportion of the profits available for distribution to equity holders;

- are beneficially entitled to a proportion of the assets for distribution to its equity holders on a winding up; or

- have a proportion of the voting power.

The extent of the interest is the greatest of those proportions, which can result in aggregate relevant interests in a QAHC adding up to more than 100%.

Also, an indirect interest in a QAHC can be taken into account where a person is beneficially entitled to profits or assets of the QAHC:

- through a partnership or other entity regarded as transparent for UK tax purposes, e.g. a bare trust (although note that this look-through is turned off where a partnership is a transparent "qualifying fund", subject to the rule below);

- partly directly, and partly indirectly, through another person or persons who are not QAHCs (known as the anti-fragmentation or "directly or indirectly" rule); or

- solely through one or more QAHCs.

Example

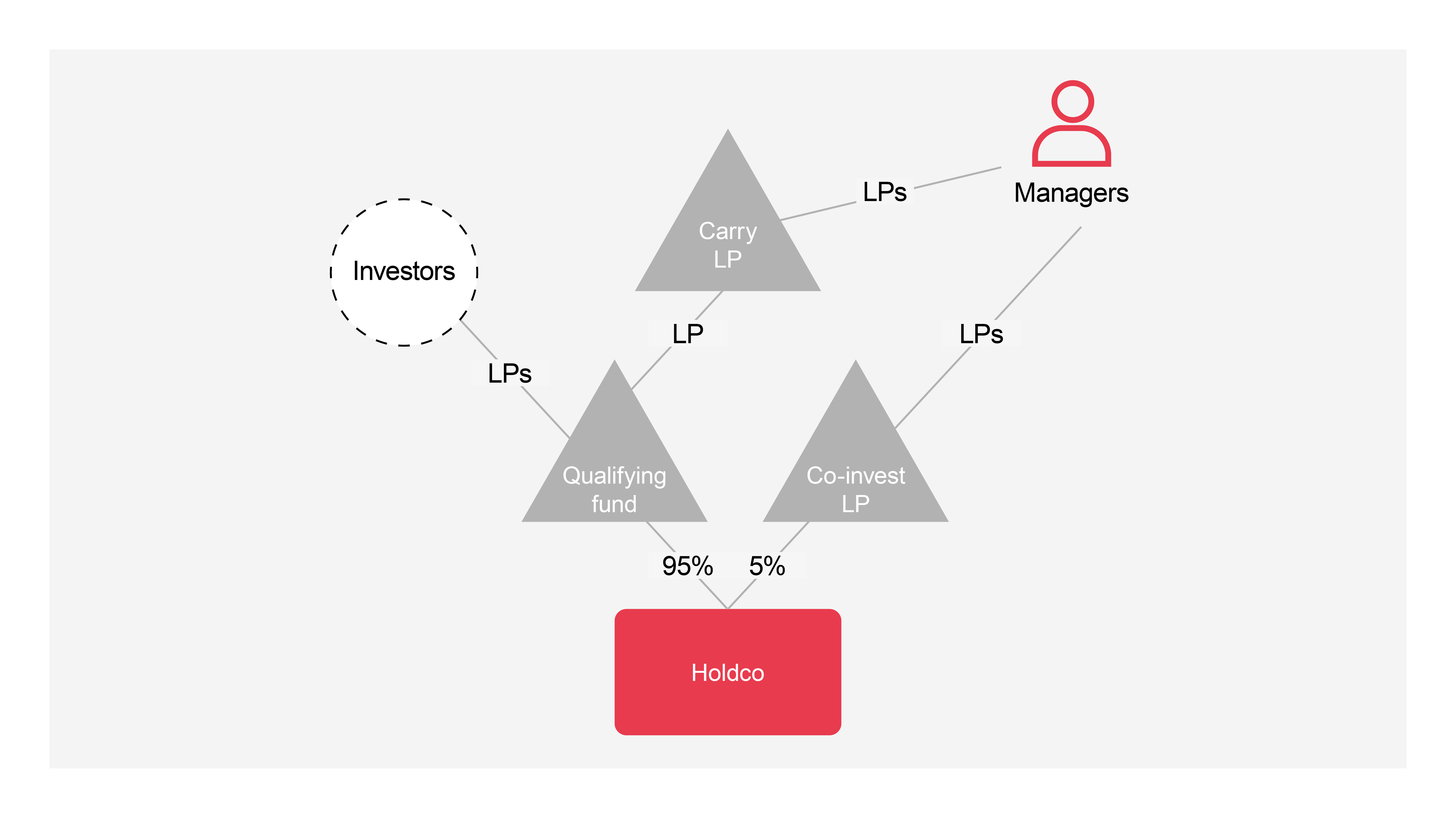

In this example:

- 95% of the shares in Holdco are held by a fund which meets the conditions to be a qualifying fund (the Qualifying Fund).

- The Managers of the fund have made a co-investment in the Fund via a parallel vehicle, Co-invest LP, and as a result hold 5% of the shares in Holdco via Co-invest LP.

- The Managers are also entitled to carried interest in the Fund via Carry LP.

- The Fund’s distribution waterfall says proceeds are distributed as follows:

- 100% to the Investors until they have received their drawn down commitments and a preferred return of 8%;

- thereafter, 20% to the Investors and 80% to Carry LP until Carry LP has received its "catch-up"; and

- thereafter, 80% to the Investors and 20% to Carry LP.

- Assume all Managers are individuals, are non-Category A investors and none are connected to any investors in the Fund. Also assume neither Co-invest LP nor Carry LP will meet the conditions to be a qualifying fund.

Determining the relevant interests

- The directly or indirectly rule is relevant here. This means that, while the general rule is that you do not need to trace through a qualifying fund, the Managers’ interest held in Holdco via the Qualifying Fund can still be a relevant interest for the purposes of the "directly or indirectly" rule since they also hold interests in Holdco via Co-invest LP.

- As regards the Managers’ carried interest entitlement, the legislation sets out that where a person has a beneficial entitlement to profits as a result of carried interest arrangements which carry a variable entitlement to profits, it is necessary to use the maximum entitlement over the life of the arrangements not the actual proportion at any one time (e.g. during the "catch-up"). Therefore, the maximum entitlement of Carry LP to profits from the Qualifying Fund as a result of the carried interest arrangements is 20%.

- Therefore, non-Category A investors in aggregate hold 24% relevant interests in Holdco, calculated as follows:

- 5% via Co-invest LP; and

- 19% indirectly (being 95% x 20%), via the Qualifying Fund/Carry LP.

- As this is less than the 30% threshold, Holdco should meet the ownership condition.

Now imagine if Co-invest LP held 10% directly, rather than 5%. This would result in non-Category A investors in aggregate now holding 28% (10% via Co-invest LP and 18% indirectly).

Increase Co-invest LP’s direct holding to 13% (with all other assumptions remaining the same) and you have failed the ownership condition – non-Category A investors in aggregate now hold just over 30% (13% via Co-invest LP and 17.4% indirectly).

In contrast, if the Managers made their co-investment through the Qualifying Fund (i.e. with Co-invest LP being a limited partner in the Qualifying Fund rather than holding a proportion of the shares in Holdco):

- the only shareholder of Holdco would be the Qualifying Fund;

- the directly or indirectly rule would no longer be relevant and you would not need to trace through the Qualifying Fund; and

- as a result, non-Category A investors would not hold any relevant interests in Holdco.

Even this high level example demonstrates that, due to the complexity of the rules (and in particular the need to identify the indirect interest of any person who holds directly), it is preferable if a QAHC only has Category A investors as direct shareholders.

Get in touch