SEC’s new Private Fund Adviser Rules: a three-minute guide for non-US investment advisers

26 September 2023Many readers will be aware that, on 23 August 2023, the SEC adopted its final Private Fund Adviser Rules (Rules), a significant update to the US’ regulation of private fund advisers. The legislative changes can be overwhelming and summary materials on the topic are vast. We therefore produced the following quick guide.

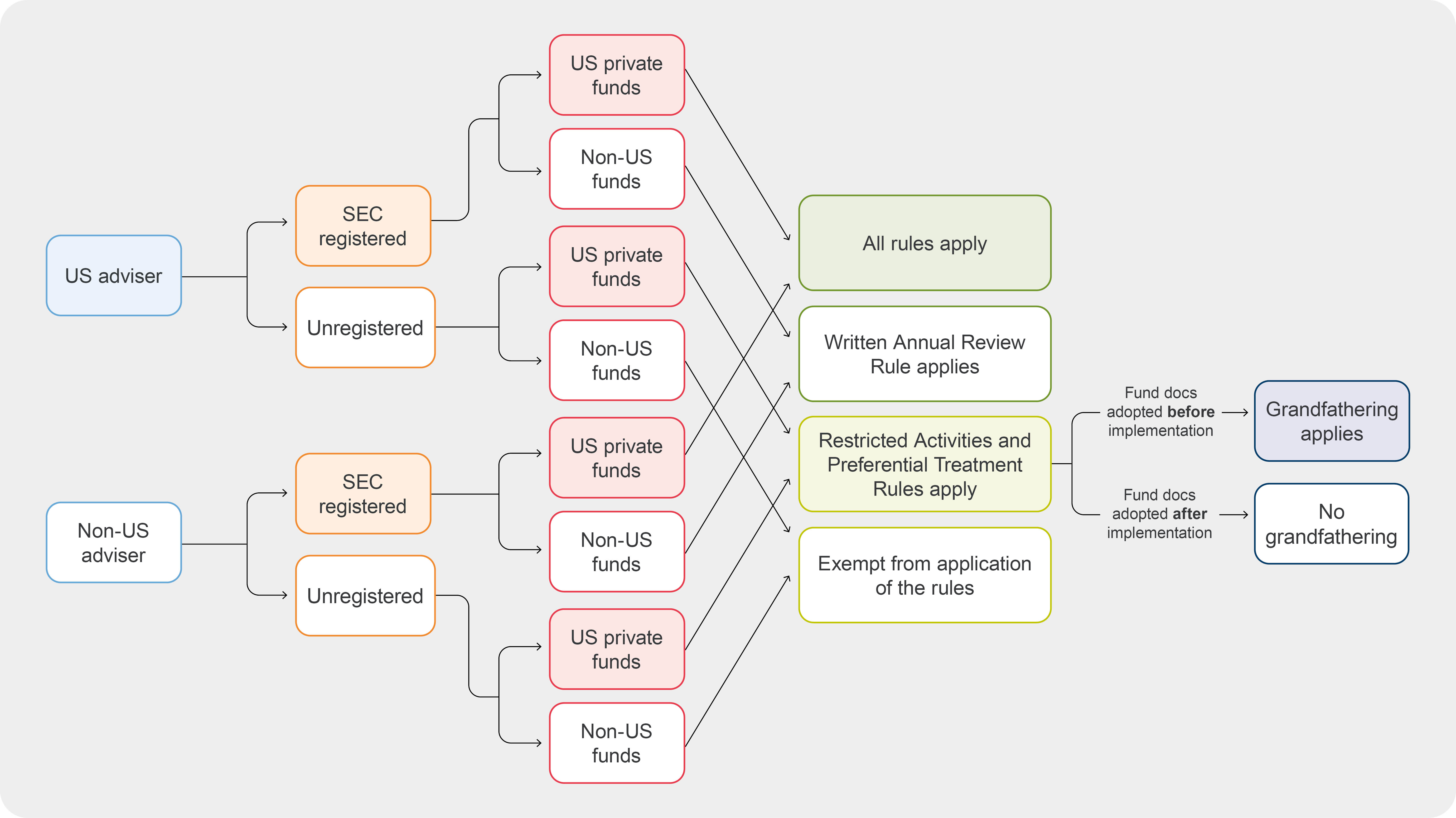

The Rules comprise five regulations and their application varies depending on whether an investment adviser is registered with the SEC, the adviser’s domicile, and the location of the private funds that it covers – as illustrated in the diagram below.

* A non-US adviser that is SEC-registered and which covers US funds will be subject to the Written Annual Review Rule unless registered to file with the SEC as an exempt reporting adviser.

** Elements of the Restricted Activities Rule and the Preferential Treatment Rule are subject to grandfathering provisions for documentation that pre-dates the introduction of the regulations in respect of a fund that began operations before the regulations were implemented (see the timelines below).

Lighter touch for non-US advisers with non-US domiciled funds

The publication clarifies that the Rules do not apply to non-US advisers with non-US private funds. This is defined as an adviser that has its principal office and place of business outside of the US and which has funds domiciled outside of the US, regardless of whether the fund has US investors.

The decision will be welcomed by exempt advisers because many firms raised their concerns with the SEC about the change to a more prescriptive form of regulation and the likely burden of compliance.

However, non-US advisers with non-US funds will be required to comply with the Written Annual Review Rule if the adviser is registered with the SEC and is not an exempt reporting adviser.

We also anticipate that investors will refer to the Rules as “market standard” regardless of whether strict application applies.

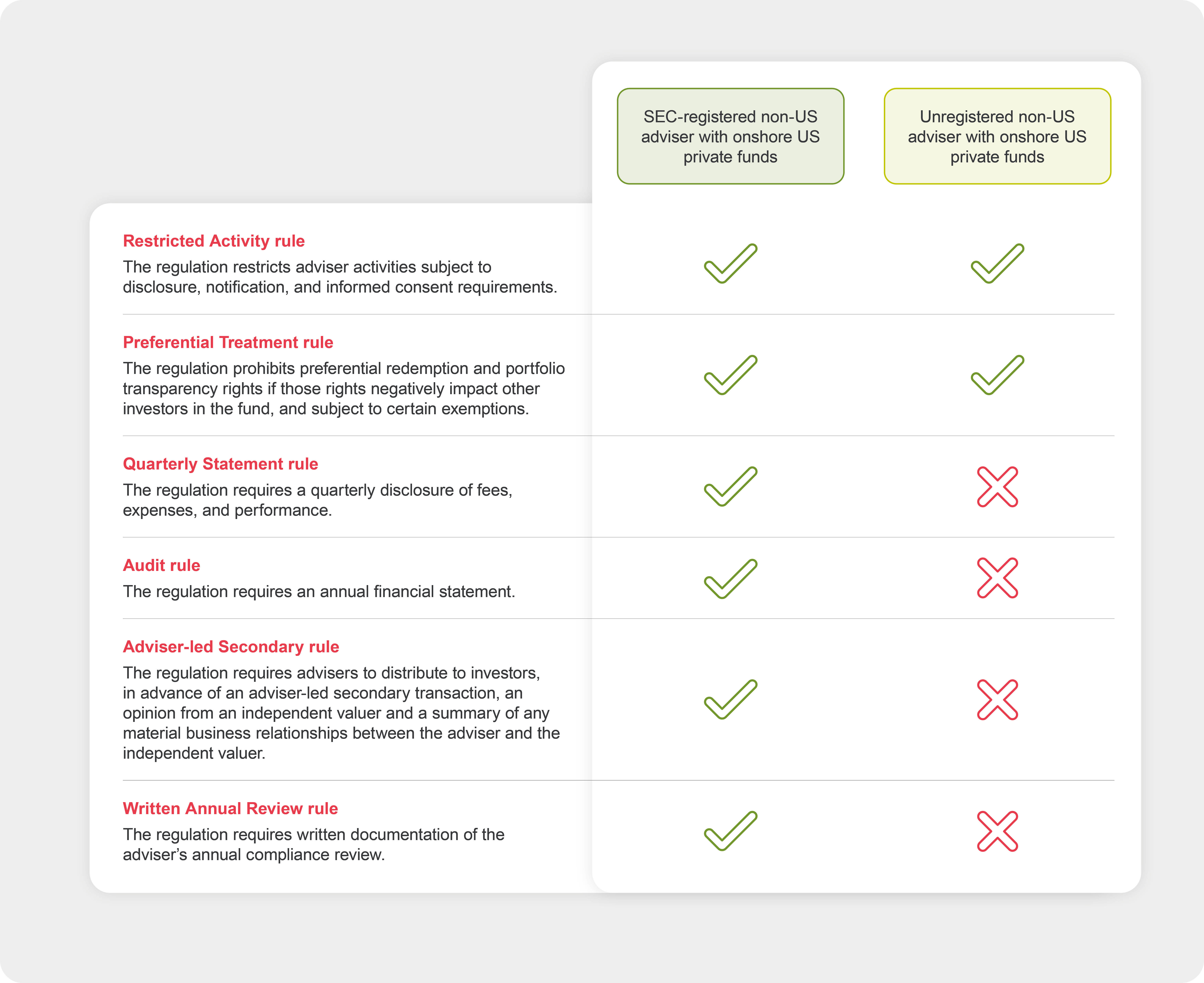

The implications for non-US advisers covering US private funds

The application of the regulations to non-US advisers with US-domiciled private funds is less straightforward and will depend on whether the adviser is registered with the SEC, as illustrated below.

The market impacts of the regulations

While certain non-US advisers will not be subject to some or all the Rules, the regulations will significantly change the private funds market in the US and the expectations of investors in private funds. Non-US advisers might find it beneficial or necessary to comply with the requirements to continue to fundraise in the US.

Timing

The Rules will apply 60 days after publication in the Federal Register (which is likely to happen in September or October 2023). There are transitional deadlines for compliance with the various elements of the regulations, of between 12 and 18 months, depending on the size of the adviser measured in respect of AUM. The SEC will monitor compliance via examinations. Contact us to understand how and when the Rules will apply to your business.

Get in touch