DAC6: Preparing for implementation under the new timetable

26 June 2020The Directive on Administrative Cooperation, or “DAC6” (the Directive), was introduced in May 2018 with first reports due by 31 July 2020. On 25 June 2020, HMRC confirmed that the reporting deadlines would be deferred by six months.

The Directive provides for two things: (i) a notification obligation on intermediaries (and in certain cases taxpayers) in relation to certain cross-border arrangements which represent “potentially aggressive tax planning”; and (ii) the exchange of that information between member states. The purpose is to allow tax authorities in member states to be aware, at an early stage, of arrangements that indicate potential tax avoidance.

The Directive places the principal reporting obligation on an intermediary defined as any person that designs, markets, organises or makes available for implementation or manages the implementation of a reportable cross border arrangement (RCBA). The definition also covers any person that provides aid, assistance or advice with respect to a RCBA. The intermediary must submit details of the transaction to its home tax authority within a certain timeframe. Failure to comply will lead to penalties.

This information will be shared with other member states on a quarterly basis. The expectation is that there will be legislative changes to counteract perceived abuse to enable a more targeted compliance approach. Although the UK’s negotiations with the EU continue, the likelihood is that the UK will participate in the information sharing process.

Despite more than two years in development, domestic legislation implementing the Directive and associated guidance has been slow. In the UK, the legislation responsible for adopting the Directive into law, The International Tax Enforcement (Disclosable Arrangements) Regulations 2020, was brought in on 9 January 2020 and the HMRC guidance remains in draft form. However, in light of the widespread disruption caused by the Covid-19 pandemic a number of calls were made to postpone the reporting deadlines, which the European Commission agreed (and which the UK will now follow). More details on the new reporting deadlines can be found below.

The regime

The DAC6 reporting requirements are triggered by an arrangement that contains at least one of several “hallmarks.”

A three stage process is used to determine whether a transaction is reportable for DAC6 purposes.

- Is there an arrangement? The meaning of “arrangement” is intentionally wide and can include any scheme, transaction or series of transactions.

- Is the arrangement a cross border arrangement (CBA)? An arrangement is cross border, broadly speaking, if it concerns at least two jurisdictions, of which at least one is an EU Member State (including the UK).

- Is the CBA an RCBA? If the CBA exhibits any of the hallmarks A-E (found at ANNEX IV of the Directive), it will be a reportable arrangement.

The Directive is clear that member states must respect legal professional privilege (LPP) under their domestic laws. Where there is no intermediary involved (or no intermediary with EU nexus), or the intermediary claims LPP and the client does not waive it, the obligation to file information on a RCBA lies with the taxpayer. Otherwise it will lie with the intermediary or intermediaries. Any such waiver of privilege by the client may be limited so as to allow the reporting without compromising LPP more widely.

Intermediaries will not need to submit a report if there are other intermediaries involved in the arrangement and one of those intermediaries has already submitted a report. However, the report must contain the information which the first intermediary would have been required to report. In addition, a valid reference number should be obtained by all intermediaries involved, as evidence.

Hallmarks

There are five broad hallmarks (A-E). These can be sub-divided into two categories. First, those which, where they exist, are sufficient to trigger a notification obligation and second, those which also need the main benefit test (MBT) to be met.

The MBT applies where it can be established that the main benefit or one of the main benefits which, having regard to all relevant facts and circumstances, a person may reasonably expect to derive from an arrangement is the obtaining of a tax advantage.

A “tax advantage” is defined to include:

- relief or increased relief from tax;

- repayment or increased repayment of tax;

- avoidance or reduction of a charge to tax or an assessment to tax;

- avoidance of a possible assessment to tax;

- deferral of a payment of tax or advancement of a repayment of tax; and

- avoidance of an obligation to deduct or account for tax,

where the obtaining of the tax advantage cannot reasonably be regarded as consistent with the principles on which the relevant provisions that are relevant to the cross-border arrangement are based and the policy objectives of those provisions.

Hallmark A – MBT to be met

A1 An arrangement where the relevant taxpayer or a participant in the arrangement undertakes to comply with a condition of confidentiality which may require them not to disclose how the arrangement could secure a tax advantage vis-a-vis other intermediaries or the tax authorities.

A2 An arrangement where the intermediary is entitled to a fee which is, broadly speaking, fixed by reference to the amount of the associated tax advantage.

A3 An arrangement that has substantially standardised documentation and/or structure and is available to more than one relevant taxpayer without a need to be substantially customised for implementation.

Hallmark B – MBT to be met

B1 An arrangement whereby a participant takes contrived steps, which consist in acquiring a loss-making company, discontinuing its main activity and using its losses to reduce its tax liability.

B2 Conversion of income into capital, gifts or other categories of revenue, which are taxed at a lower level or exempt from tax.

B3 Circular transactions resulting in the round-tripping of funds.

Hallmark C – Those in italics also require the MBT to be met

C1 Arrangements where there is a deductible cross-border payment made between two associated enterprises where any of the following conditions is met:

- the recipient is not resident for tax purposes in any tax jurisdiction;

- although the recipient is resident for tax purposes in a jurisdiction, that jurisdiction either:

- does not impose any corporate tax or imposes corporate tax at the rate of zero or almost zero; or

- is included in a list of ‘non-cooperative jurisdictions';

- the payment benefits from a full exemption from tax in the jurisdiction where the recipient is resident for tax purposes;

- the payment benefits from a preferential tax regime in the jurisdiction where the recipient is resident for tax purposes.

C2 Deductions for the same depreciation on an asset are claimed in more than one jurisdiction.

C3 Relief from double taxation in respect of the same item of income or capital is claimed in more than one jurisdiction.

C4 An arrangement which includes transfers of assets where there is a material difference in the amount being treated as payable in consideration for the assets in those jurisdictions involved.

Hallmark D

D1 Arrangements that have the effect of undermining or circumventing reporting obligations under DAC2 or equivalent agreements on the automatic exchange of financial information, or which take advantage of the absence of AEOI.

D2 Arrangements, broadly speaking, involving a non-transparent legal or beneficial ownership chain where the beneficial owners are made unidentifiable.

Hallmark E

Arrangements which involve

E1 the use of unilateral safe harbour rules;

E2 the transfer of hard-to-value intangibles meeting certain conditions; or

E3 an intragroup cross-border transfer of functions and/or risks and/or assets, if the projected annual EBIT during the three-year period after the transfer, of the transferor or transferors, are less than 50% of the projected annual EBIT of such transferor or transferors if the transfer had not been made.

Timeline

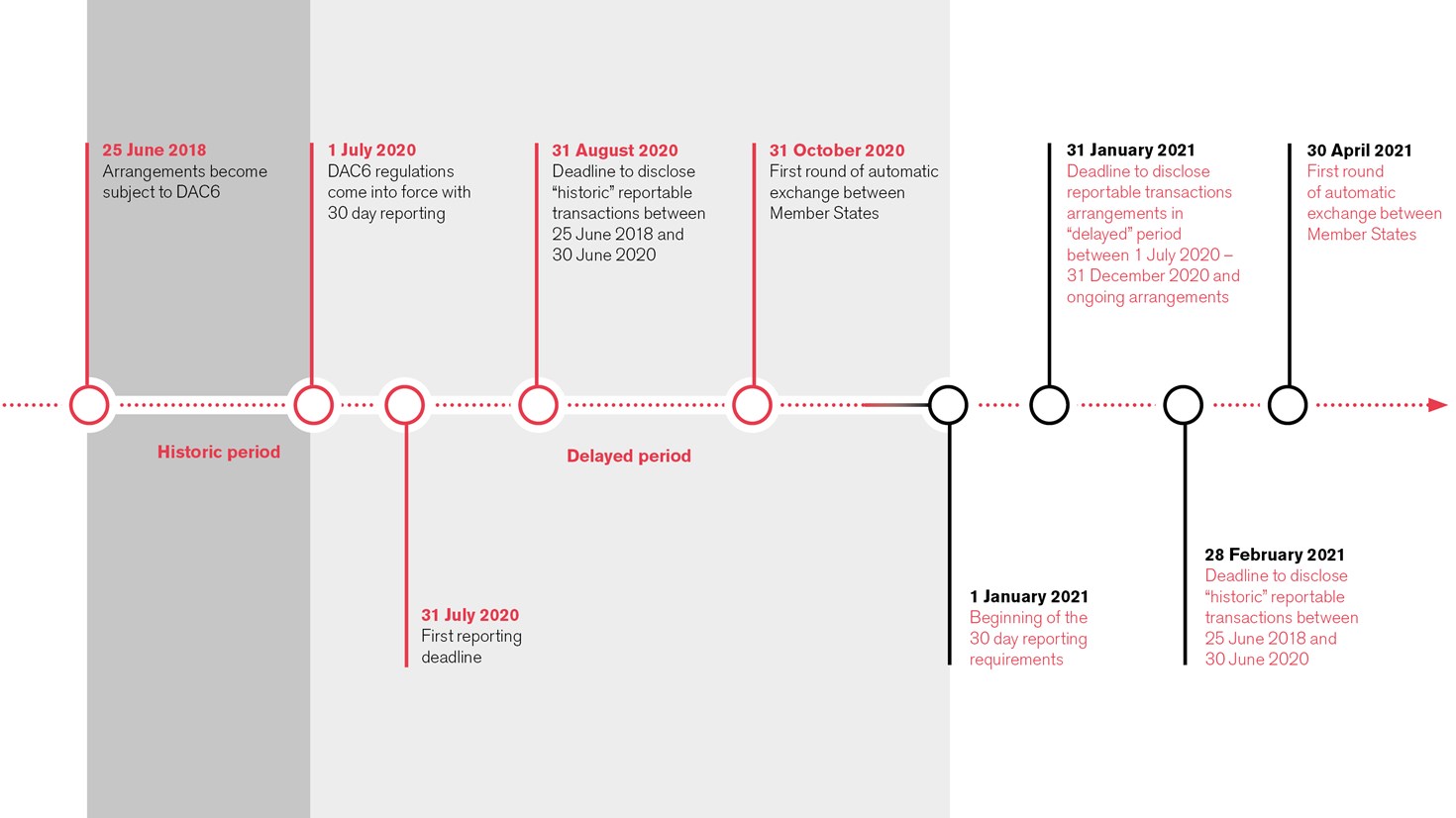

The European Commission recently agreed to postpone reporting deadlines due to the disruption tax authorities, intermediaries and taxpayers are facing as a result of the Covid-19 pandemic. The amendment allows for member states to introduce a six month delay to the reporting deadlines, on an optional basis. The optionality means that some member states may choose to action the delayed deadlines, and some may not.

HMRC have confirmed that the UK will defer the regime, as have other member states, as follows:

- historical reporting: the deadline for reporting “historical” CBAs that became reportable between 25 June 2018 and 30 June 2020 is deferred from 31 August 2020 to 28 February 2021;

- delayed post-1 July 2020 reporting: the beginning of the 30-day period for reporting cross-border arrangements that become reportable after 30 June 2020 is deferred from 1 July 2020 to 1 January 2021 (meaning that the earliest deadline for reporting such arrangements is 31 January 2021); and

- exchange of information: the deadline for the first exchange of information between member states on reportable cross-border arrangements is deferred from 31 October 2020 to 30 April 2021.

Please see the table below for the original (red) and deferred (black) timeline reporting deadlines.

The amendment to the Directive allows for the possibility of a further deferral, for a maximum of three additional months, if the ongoing pandemic continues to hamper the ability of tax authorities, intermediaries and taxpayers to comply with the regime.

Key challenges

Multiple intermediaries

There may be more than one intermediary involved in the RCBA. Where there are multiple intermediaries, particularly when they are located in different countries, there needs to be effective and timely communication to determine exactly what needs to be reported, and where.

Multiple jurisdictions and regime complexity

The rules themselves are complex. At the same time, different Member States are likely to have different interpretations on how the Directive should apply. For example, the UK MBT considers the policy intent of the underlying tax provisions, but the Directive itself does not. The combination of multiple jurisdictions, differing tax regimes and DAC 6 implementation language, and differences in interpretation makes for an especially complicated regime. The optionality in terms of deferral adds another layer of potential complication.

Retaining a degree of control

Taxpayers may wish to have a say in the reporting process, but as the reporting obligation ultimately rests with the intermediary this may create some difficulty, and possibly some tension. This dialogue will need careful management, with timely communication, especially once the tight 30 day reporting deadline kicks in. Now is the time to start thinking about operating protocols to allow for this.

Historic look back period

The historic look back period covers two years’ worth of transactions. This poses some obvious difficulties in terms of data mining, DAC6 analysis and the supporting audit trail. The complexity of the regime and the number of transactions that may need to be reviewed adds further complication and challenge.

How we can help

As the reporting deadlines edge closer, we can help you in a number of ways including:

- Providing assistance with a DAC6 impact assessment to help you identify where reporting risks exist within the business, developing a business as usual operating model, and supporting with training and implementation.

- Reviewing legacy transactions to identify DAC 6 reporting requirements for the look back period.

- Providing ad hoc DAC6 advice as necessary.

Please contact Jeremy McCallum or Arfan Iqbal for more information.

Get in touch