Impact of amendments to the Specified Supplies Order for PE firms and credit fund managers

17 December 2020On 9 November the Chancellor of the Exchequer confirmed that the Value Added Tax (Input Tax) (Specified Supplies) Order 1999 (the SSO) will be amended with effect from 1 January 2021.

The amendments, which will permit the recovery of input VAT incurred in making supplies of certain financial services to EU counterparties, will have a significant impact on the input VAT recovery position of some UK-based private equity (PE) firms and managers of credit funds.

This note summarises the impact of the changes in relation to common PE and credit fund structures.

The Amendments

In its current form the SSO permits input VAT to be recovered to the extent to which it is attributable to certain supplies of financial services made to non-EU counterparties. Such supplies include (among others) the granting of credit and disposals of securities (both fixed income and equity). Services of intermediating in such supplies also give the right to VAT recovery where the recipient of either the intermediation service or the underlying supply belongs outside the EU.

In 2019 the Treasury published regulations amending the SSO to take effect from a date to be determined. Those regulations amended the SSO so that supplies of specified financial services to any non-UK counterparty would give rise to a right to input VAT recovery.

At the time of their publication the Treasury appeared to take the view that the proposed amendments were a fall-back provision which would come into force dependent on the outcome of withdrawal negotiations with the EU, and the amendments were seemingly shelved following the withdrawal agreement reached in 2019. In light of the impending end to the transition period the Chancellor has now confirmed that the amendments to the SSO will take effect from 1 January 2021.

From 1 January 2021 the amended SSO will ensure that the supply of most financial services to any non-UK counterparty will give rise to a right to UK VAT recovery. This mirrors the EU position whereby specified supplies of financial services from European service providers to the UK will (again, from 1 January 2021) give rise to a right to European input VAT recovery. The changes therefore prevent UK financial services firms from being placed at a competitive disadvantage to their European counterparts.

Impact and Actions

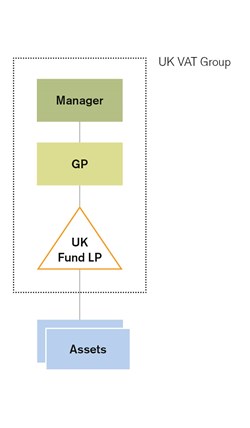

The impact of the changes will depend on the type and location of the funds in question, as well as the nature and quantum of fees charged in relation to the funds and their assets. We set out below some common structures and consider the impact of the changes to the SSO in respect of each of them.

| Supply | Current VAT treatment |

| Disposal of an investment | VAT exempt, with the right to input VAT recovery only where the buyer is non-EU |

| Provision of monitoring services to portfolio companies | Taxable, with the right to input VAT recovery |

| Loans | VAT exempt, with the right to input VAT recovery only where the borrower is non-EU |

| Arranging an acquisition (in return for an arrangement fee on closing) |

VAT exempt, with the right to input VAT recovery only where either the supply recipient or Bidco (if they are different) is outside the EU |

From 1 January 2021 the supplies that are identified above as only giving the right to VAT recovery where the recipient is non-EU should give the right to VAT recovery where the recipient is non-UK, and the manager/fund VAT group should therefore benefit from increased VAT recovery.

The ability to benefit from improved VAT recovery will, however, depend in part on the partial exemption method operated by the VAT group. It is quite common for the VAT group to operate a partial exemption special method (a PESM) that apportions input VAT simply between "investment activities" resulting in the disposal of investments and "monitoring activities" which result in the charging of taxable monitoring fees.

In some cases, but not all, the PESM includes a mechanism for further apportioning VAT allocated to investment activities between disposals to EU counterparties and disposals to non-EU counterparties. Where this is the case the PESM should be read from 1 January 2021 as apportioning between disposals to UK counterparties and disposals to non-UK counterparties, so that no change is required to the method (as discussed in more detail at the end of this note).

In many cases the PESM will not take account of loans or arrangement fees and the relevant changes to the SSO may not therefore result in increased VAT recovery. When considering whether a change should be made to the existing partial exemption method, PE fund managers should consider:

- what the full implications would be of reflecting loans and arrangement fees in the calculation - loans granted and arrangement fees charged to UK counterparties will still not give the right to VAT recovery; and

- the risk of prompting HMRC to challenge the VAT group’s partial exemption method; we are aware of a number of cases in which HMRC are asserting that time-spent methods of apportionment should be replaced with income-based methods.

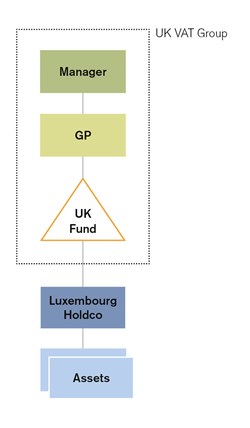

UK PE fund that holds assets under an EU Holdco

The updated SSO may significantly improve the input VAT recovery position of the manager and the fund.

At present the manager/fund VAT group (viewed as a single person) will typically make some or all of the following supplies:

| Supply | Current VAT treatment |

| Provision of monitoring services to portfolio companies | Taxable, with the right to input VAT recovery |

| Loans | VAT-exempt, with the right to input VAT recovery only where the borrower is non-EU |

| Arranging acquisitions (in return for an arrangement fee on closing) | VAT-exempt, with the right to input VAT recovery only where the borrower is non-EU |

From 1 January 2021 the supplies that are identified above as only giving the right to VAT recovery where the recipient is non-EU should give the right to VAT recovery where the recipient is non-UK. The manager/fund VAT group should therefore benefit from increased VAT recovery.

In accordance with the December 2019 decision in Melford Capital, where investments are held under a holding company outside the VAT group (so that disposals are not made directly from the VAT group) the manager and fund should in principle be entitled to full VAT recovery if; (a) supplies are made by VAT group members in relation to all of the investments; and (b) those supplies give the right to VAT recovery. See more information on the Melford decision.

From 1 January 2021 the fund/manager VAT group should therefore have a strong argument for full VAT recovery if it grants loans and/or provides services in respect of all of the fund’s investments and the recipients of the loans and/or services are outside the UK.

In many cases, however, the fund will hold UK investments directly and will hold non-UK investments under an EU Holdco. In such circumstances:

- VAT incurred on costs that are wholly attributable to the non-UK investments may be recoverable in full. Most significantly this might include reverse-charge VAT accounted for on services received from overseas sub-advisors; and

- VAT on costs that are attributable both to investments held directly by the fund and others that are held under a Holdco outside the VAT group will still need to be apportioned. Many firms’ partial exemption methods will have been designed on the understanding that investment holding activity (whether directly or via a holding company) must be quantified and input VAT restricted accordingly. That understanding is somewhat outdated, particularly in light of the Melford Capital decision, and there is merit in revisiting such methods with both Melford Capital and the changes to the SSO in mind. It is important to note in this regard that altering the VAT recovery method operated by the manager/fund VAT group does not always require engagement with HMRC.

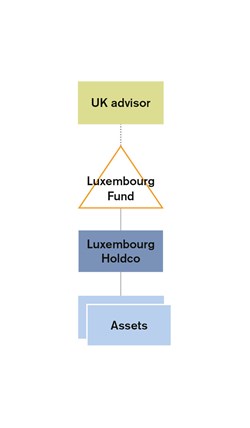

EU PE fund

At present the manager/fund VAT group (viewed as a single person) will typically make some or all of the following supplies:

| Supply | Current VAT treatment |

| Provision of investment advisory or portfolio management services in relation to the fund |

Outside the scope of UK VAT with the right to input VAT recovery |

| Provision of monitoring services to portfolio companies | Taxable, with the right to input VAT recovery |

| Arranging acquisitions (in return for an arrangement fee on closing) | VAT exempt, with the right to input VAT recovery only where either the supply recipient or Bidco (if they are different) is outside the EU |

Many PE firms managing EU funds will already be entitled to full VAT recovery on their costs and the changes to the SSO should not affect that.

However, firms that currently suffer an input VAT restriction as a result of receiving VAT exempt arrangement fees from EU Targets or Bidcos should not suffer that restriction from 1 January 2021.

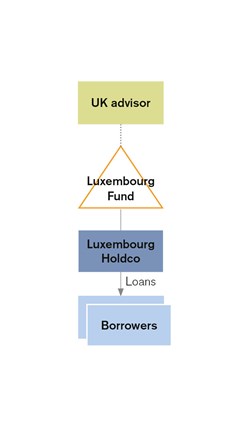

EU credit fund

The great majority of managers of EU credit funds will already be entitled to full VAT recovery on their costs and the changes to the SSO should not change that. However, firms that currently suffer an input VAT restriction as a result of making any VAT-exempt supplies to EU recipients of the type covered by the SSO should not suffer that restriction from 1 January 2021.

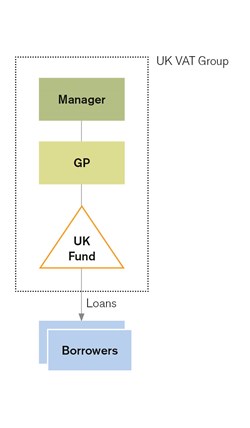

UK credit fund

In many cases the only supplies made from the manager/fund VAT group will consist of the granting of credit and the disposal of fixed income securities. The VAT group should benefit from increased VAT recovery to the extent to which such transactions are entered into with EU counterparties.

Where the VAT group includes other entities that are engaged in activities unrelated to the UK credit fund the VAT group is likely to operate a partial exemption method and that method may have been designed on the understanding that supplies made by the UK credit fund would not give entitlement to any input VAT recovery. In such cases input VAT will be treated as irrecoverable to the extent to which it is attributable to the activities of the UK credit fund. It may be beneficial to alter the partial exemption method, which may require engagement with HMRC.

Other matters

Services spanning the 1 January 2021 amendment date

The nature of the amendments to the SSO is such that the date of the payment of any fees or interest for financial services provided to EU counterparties may well be critical in determining the supplier’s input VAT recovery position.

Ordinarily, Section 88 Value Added Tax Act 1994 provides that a supplier of services with a billing period spanning a change in VAT treatment can choose whether to apply the pre- or post-change treatment for that billing period. However, this provision only applies where there is a change in the “description” of the treatment of supplies (for example, an amendment to an exemption with effect from a certain date).

As such it appears that Section 88 will not apply to the amendments to the SSO; whether or not a supply gives the right to corresponding input VAT recovery is likely therefore to be governed solely by the date of payment.

Application to existing PESMs

The amendment to the SSO includes an amendment to Regulation 102 of the VAT Regulations 1995, the secondary legislation which provides the basis for agreeing a PESM with HMRC. The amendment is such that any PESM under which input VAT recovery is determined by explicit reference to EU or non-EU supplies should have effect as though it was agreed by reference to UK and non-UK supplies.

Notwithstanding this provision, the amended SSO will lead to a significant change to the recovery profile of many PE firms and credit fund managers which, as discussed above, may not be fully captured by existing PESMs. Taxpayers should consider whether their existing PESM is appropriate in light of these amendments.

Get in touch